Ethereum price screams 'sell,' but fundamentals have never been stronger

- Ethereum price hints at a correction due to the TD Sequential indicator's recent sell signal.

- While a downswing could push ETH near its previous ATH at $1,440, it is unlikely due to increasingly bullish fundamentals.

- Declining ETH supply on exchanges and other fundamentals hint that ETH might be headed to $3,000 shortly.

Ethereum price notes a slow down in its 150% year-to-date return. Although the recent sell-off may have played a role in reducing its momentum, the Tom DeMark (TD) Sequential indicator a halt in the smart contracts platform token's rally.

Ethereum price at crossroads as bullish momentum wanes

Ethereum price has seen a drastic reduction in momentum as the last three 3-day candles have grown increasingly small.

The TD Sequential indicator's most recent sell signal presented in the form of a green nine candlestick affirms the lack of buyers and the mounting selling pressure.

Technically, this setup stipulates that a one to four candlestick correction must follow.

If this were to occur, then ETH could head down to the 78.6% Fibonacci retracement level at $1,490.

On the off chance, the price slices through the barrier mentioned above, then ETH could correct up to its previous ATH at $1,440.

ETH/USDT 3-day chart

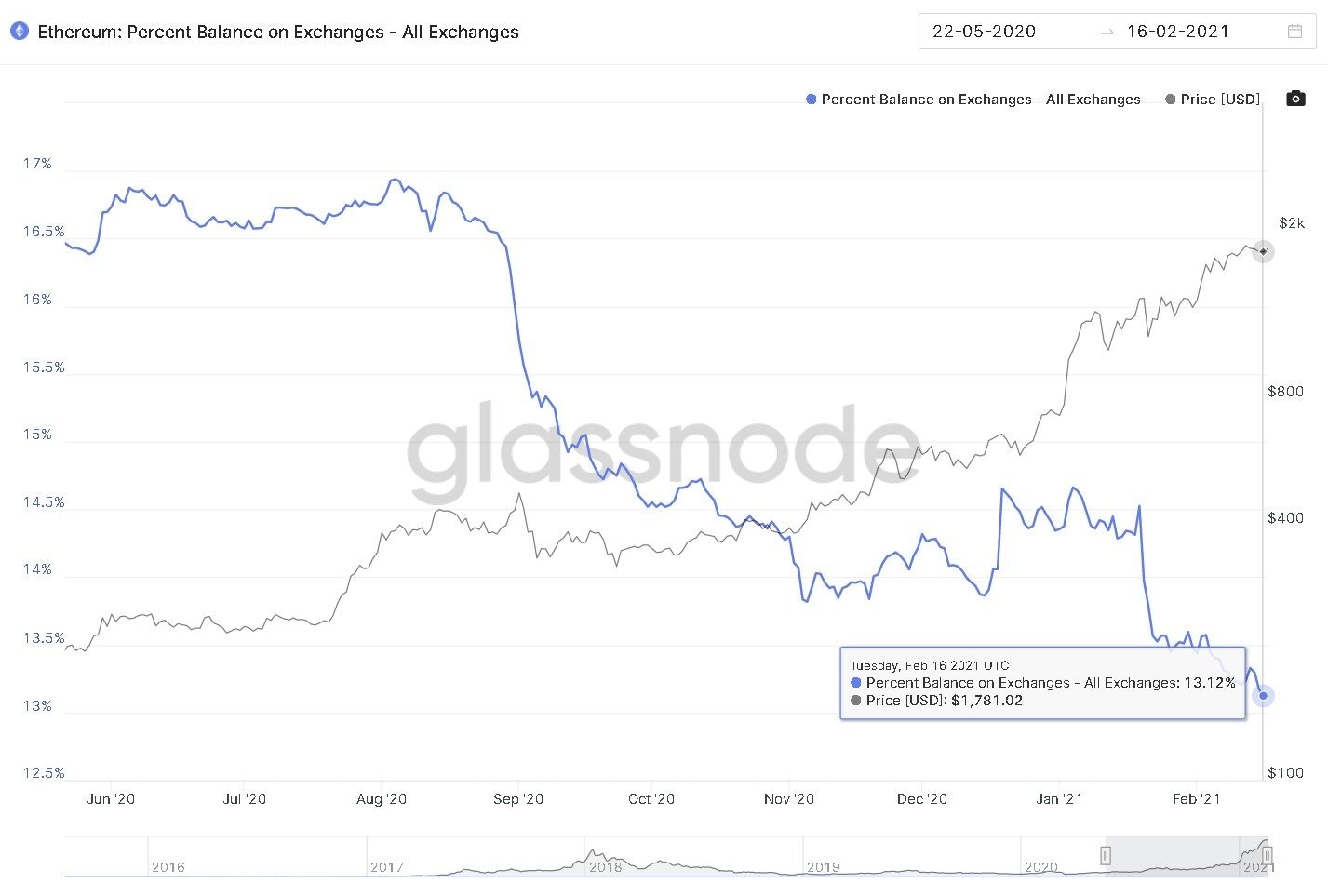

While the technical aspects indeed point towards a correction, on-chain fundamentals suggest that this correction might either be small or never come.

Exchange addresses holding ETH has dropped nearly 9% since January 9. Correspondingly, Ethereum price has seen a 30%.

Exchange addresses holding ETH chart

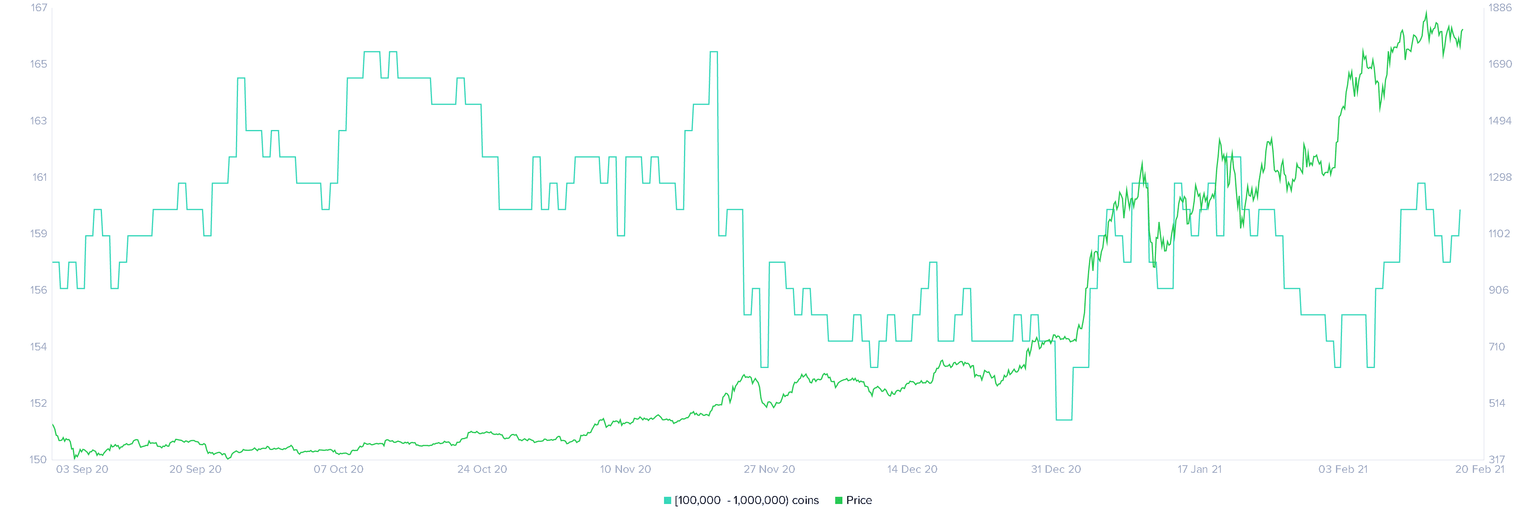

Whales holding 100,000 to 1 million ETH have increased their holdings by 3.25% from February 2 and 4.6% from January 2. Within the same periods, ETH price has seen a 140% and 16.5% increase.

Ethereum holder distribution chart

Glassnode's on-chain metric shows that about 97% of all the coins in circulation are in profit, further supporting the bullish thesis.

Coinbase, America's most popular exchange, announced a waitlist for ETH staking, which signals that more ETH supply will be taken out of circulation and placed in staking, effectively reducing the coins available for selling.

All-in-all, ETH's prospects, in the long run, seems quite bullish. Hence, a decisive one-day or perhaps even a 3-day close above the new all-time high at $1,871 will invalidate the short-term bearish outlook and rally the coin to new highs around the 161.8% Fibonacci retracement level at $3,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.