Ethereum price risks 20% correction amid SEC’s crackdown on crypto staking

Ethereum’s native token, Ether (ETH $1,548), saw its worst daily performance of the year as the United States Securities and Exchange Commission (SEC) stopped Kraken, a cryptocurrency exchange, from offering crypto staking services.

On Feb. 9, Kraken agreed to pay $30 million to settle the SEC’s allegation that it broke securities rules by offering crypto staking services to U.S. retail investors.

In particular, the news pushed down the prices of many proof-of-stake (PoS) blockchain project tokens. Ethereum, which switched to a staking-based protocol in September 2022, also suffered.

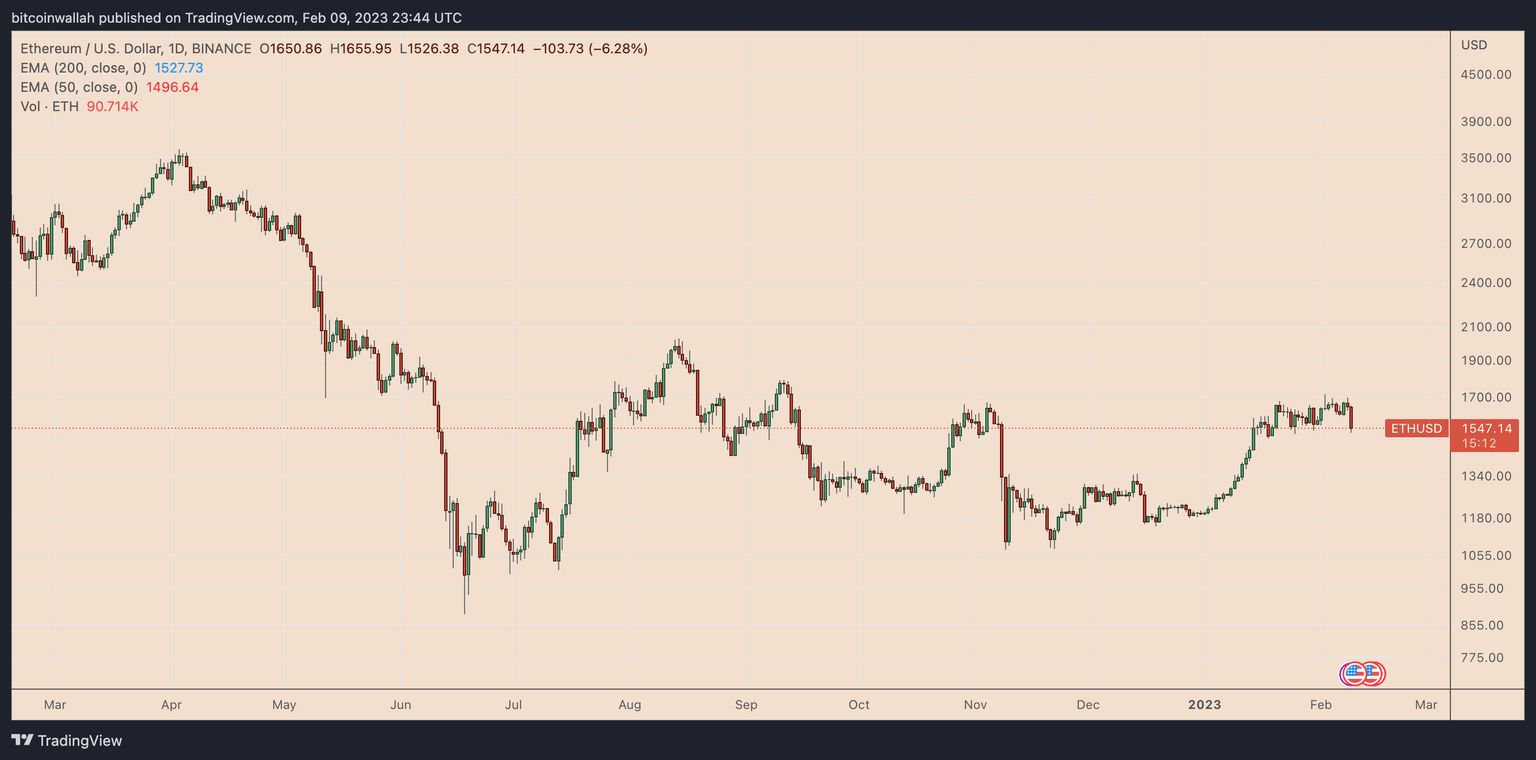

On Feb. 9, ETH’s price plunged nearly 6.5% to around $1,525, the largest single-day decline since Dec. 16 of last year.

ETH/USD daily price chart. Source: TradingView.com

Will Ethereum staking survive the SEC crackdown?

The SEC's crackdown on crypto staking begins as Ethereum awaits the release of its key network upgrade, dubbed Shanghai, in March.

The update will finally allow Ether validators — entities that have locked approximately $25.6 billion worth of ETH tokens in Ethereum’s PoS smart contract — to withdraw their assets alongside yield rewards.

As a result, multiple analysts, including Bitwise Asset Management’s chief investment officer, Matt Hougan, consider Shanghai a bullish event for Ether.

“Today, many investors who would like to stake ETH and earn yield are sitting on the sidelines. After all, most investment strategies can’t tolerate an indefinite lock-up,” wrote Hougan in his letter to investors in January, adding:

So, most investors stay out of the market. But once that indefinite lock-up is removed, the percentage of investors willing to stake their ETH will explode.

But doubts have been emerging about the future of crypto staking in the U.S., with Brian Armstrong, the CEO of Coinbase crypto exchange, fearing that the SEC would ban staking for retail investors in the future.

Moreover, some analysts argue that banning Ether-staking services will force users to move away from Ethereum.

Notably, Ethereum requires stakers to deposit 32 ETH (~$50,000) into its PoS smart contract to be a validator. As a result, retail investors often use third-party staking services that pool smaller amounts of ETH to enable validator status.

“If the SEC bans crypto staking for the public, then a majority of Ethereum validators will have to come down,” argues independent analyst Ripple Van Winkle, adding:

Because you need 32 ETH to stake. Which means the ETH network is going to experience issues.

ETH price sees bearish rejection

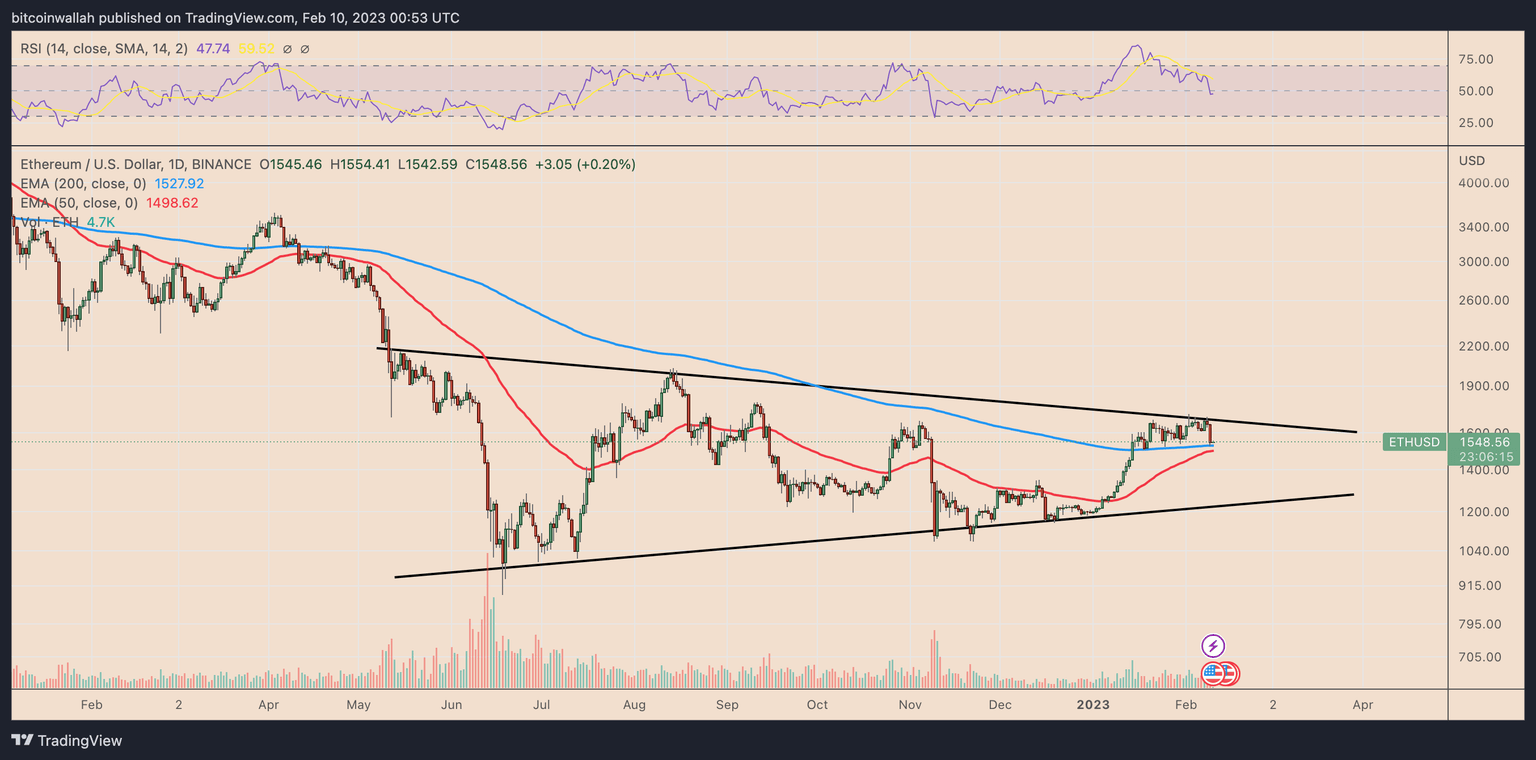

From a technical perspective, Ether price is positioned for a potential 20% price correction in February.

Notably, on the daily chart, ETH price has been undergoing a pullback move after testing its multimonth descending trendline as resistance. It now holds the 200-day exponential moving average (200-day EMA; the blue wave) near $1,525 as support.

ETH/USD daily price chart. Source: TradingView

Ether risks dropping below the 200-day EMA support wave owing to its negative market fundamentals. Such a scenario includes the next downside target at $1,200, which coincides with a multimonth ascending trendline support.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.