Ethereum Price Prediction: The break of these two key trendlines shows ETH/USD is gearing up for a move towards $250

- ETH/USD is up 3% in the last 24 hours setting a daily uptrend and climbing above EMAs.

- Two major trendlines have been broken which indicates Ethereum has strong bullish momentum.

Ethereum is currently trading at $235 after a significant bull move climbing above the daily 12-EMA at $229.63 and the 26-EMA at $229.8. ETH/USD also cracked the $232.80 resistance established on July 1 as the last daily high which means the digital asset is now inside a daily uptrend.

Two major trendlines were broken, Ethereum is free to run towards $250

The first trendline was formed on the ETH/BTC chart all the way back in February 2020. Ethereum tried to crack this resistance line two times in the past but was rejected heavily on the same day. The current breakout is robust but the bulls still need to close above the trendline.

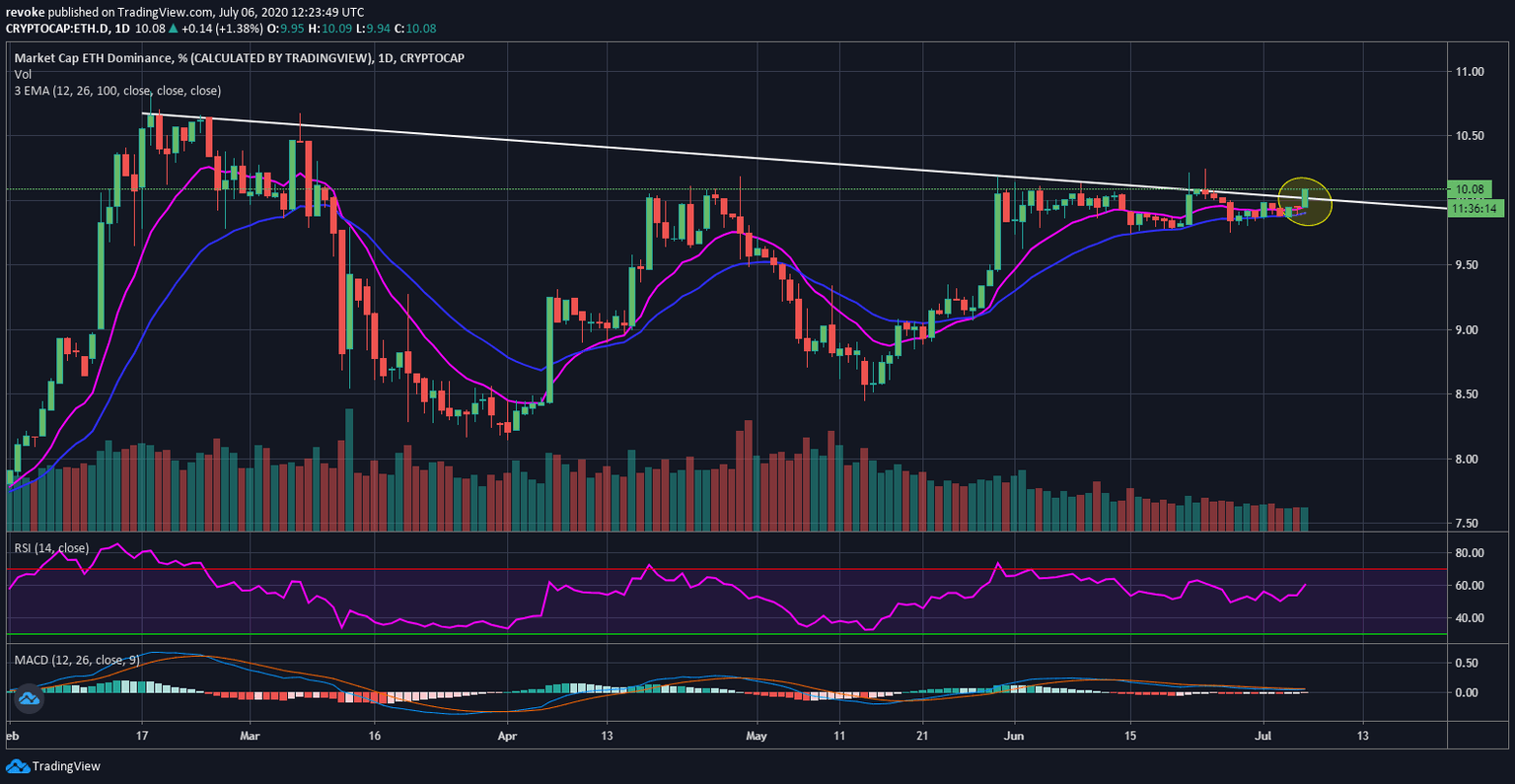

The second trendline was painted inside the Ethereum dominance chart. Similarly, Ethereum tried to break free from the trendline on June 24 but got rejected. ETH is currently trading above the trendline and 10% dominance.

A clear close above both of these trendlines will indicate a powerful bullish reversal. At the same time, ETH/USD is now inside a daily uptrend and facing very little resistance until $250. The daily MACD is also turning positive and both daily EMAs are on the verge of a bull cross.

ETH/USD daily chart

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637296356482698298.png&w=1536&q=95)

-637296357180112564.png&w=1536&q=95)