Ethereum Price Prediction: ETH/USD readies for the ultimate lift-off to $340 – Confluence Detector

- Ethereum seeks support below $320 after sellers gained traction from the new 2020 high around $320.

- Ether could easily ascend to another new yearly high if bulls purpose on overcoming the falling triangle resistance.

Ethereum price hit a wall at the new 2020 high around $334. Bulls had a plan keep to keep the price above the support at $320, however, this dream was shattered when bearish pressure increased during the trading sessions on Tuesday. The second-largest cryptocurrency was then forced to seek refuge under $320. An intraday low of $312 has been traded on Wednesday (Asian session) but Ether has adjusted slightly upwards to $315 (prevailing market value).

Declines are likely to increase in the current and upcoming sessions based on the strong bearish grip coupled with high volatility. On the other hand, lower, price movements could bounce off support at $310 which is aided by the 100 SMA ($309.71). Consequently, a breakout is anticipated on overcoming the falling triangle resistance. Such a move would have the potential to clear the hurdle at $334 and trade a new yearly high past $340.

ETH/USD 1-hour chart

%20(70)-637315869416886160.png&w=1536&q=95)

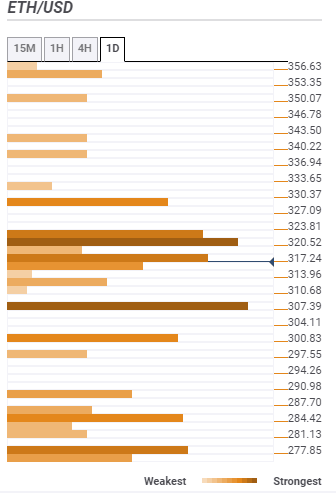

Ethereum resistance and support levels

Resistance one: $320 – Highlighted by the Fibo 61.8% one-day, the SMA ten 4-hour, the Bollinger Band one-day upper, the SMA 50 1-hour and the SMA 200 15-minutes.

Resistance two: $323 – Home to the BB 15-minutes upper curve, the pivot point one-week resistance two, the previous high 4-hour and the BB 1-hour upper curve.

Resistance three: $330 – Highlighted by the previous high one-day and the pivot point one-day resistance one.

Support one: $313 – This a subtle support that hosts the previous low 1-hour and the BB 15-minutes lower curve.

Support two: $307 – This is the strongest support area and home to the previous low one-day, the pivot point one-day support one and the SMA five one day.

Support three: $300.83 – This would be the last resort in keeping the price above $300. It is home to the BB 4-hour lower curve and the pivot point one-week resistance one.

More ETH/USD levels

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren