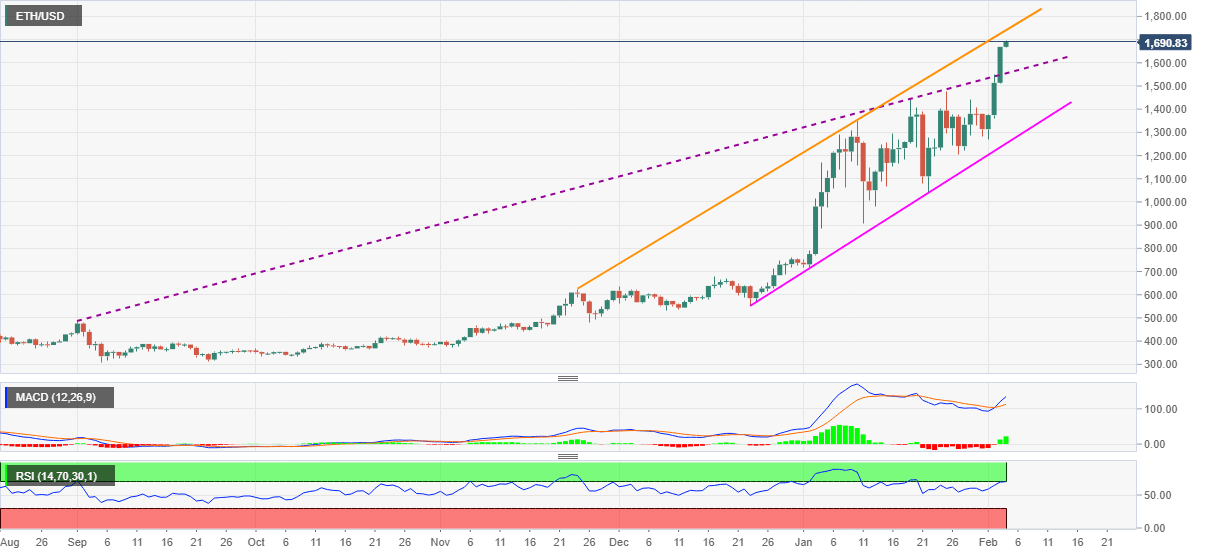

Ethereum Price Prediction: ETH records new all-time high as FOMO kicks in

- Ethereum bulls ignore overbought RSI amid fears of mission out the rally.

- 10-week-old resistance line guards immediate upside ahead of the $2,000 threshold.

- Ascending trend line from September stops ETH sellers, for now.

ETH/USD bulls are unstoppable while refreshing the record top around $1,700 during early Thursday. The altcoin is on a four-day uptrend after the previous day’s rally that crossed a key resistance line.

Although overbought RSI conditions may probe the ETH/USD bulls around a short-term trend line resistance near $1,750, the bulls are en route to the $2,000 psychological magnet before catching a breather.

It should also be noted that chatters of the cryptocurrency pair’s rally towards the $5,000 level, with the $3,000 acting as an intermediate halt, are also famous in the market.

Meanwhile, the counter-trend traders are looking for a downside break of the $1,600 to retest the previous resistance line from September, at $1,550.

Though, ascending trend line from December 23, at $1,251 now, will be the ultimate test for the ETH/USD sellers.

To sum up, Ethereum buyers are in full mood to flash the $2,000 despite multiple challenges.

ETH/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.