Ethereum Price Prediction: ETH bulls gather strength for a sustained break above $4000

- Ethereum bulls take a breather after Saturday’s $500 rally to record highs.

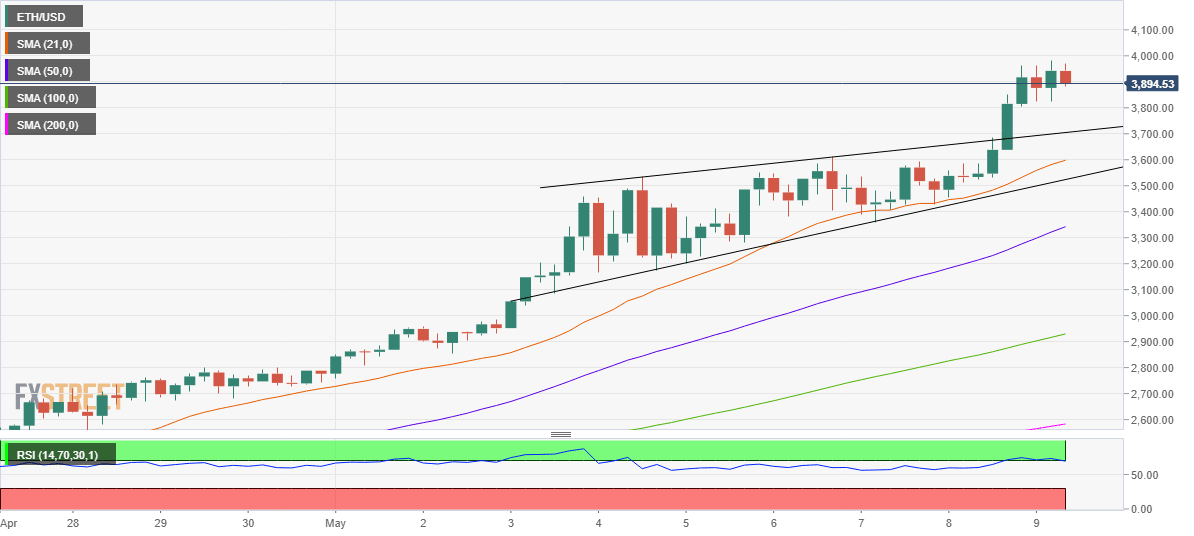

- The No. 2 coin eyes additional upside after rising wedge breakout on the 4H chart.

- RSI is in the overbought region, dip buying to keep the uptrend intact.

ETH/USD is off the fresh all-time highs of $3,984, holding on to the record run, as the bulls take a breather before the next push higher.

The renewed bearish sentiment across the crypto board seemingly checks the upside in the ETH price just as Bitcoin faces rejection once again near $60,000.

ETH/USD: In consolidation before the next upswing restarts

Ethereum’s four-hour chart shows that the price is holding the higher ground, consolidating the massive $500 increase seen on Saturday.

ETH/USD: Four-hour chart

The ETH bulls went onto clinch fresh record highs earlier on, although lacked additional vigor, as the relative strength index (RSI) peeped into the overbought territory.

The overbought conditions, however, are not overstretched, suggesting that there is likely more room to rally for the ETH price.

Therefore, the price could race past the $4000 barrier on a sustained basis, in order to reach the rising wedge pattern target at $4220.

Note that Ethereum confirmed a rising wedge upside break on the said time frame during American mid-morning on Saturday.

Despite the technical setup offering an upbeat outlook, the buyers could be wary of creating fresh positions after the recent upsurge, which could trigger a fresh pullback in the rates towards the pattern resistance now support at $3705.

A failure to defend that level could expose the bullish 21-simple moving average (SMA) at $3,598.

If the downside pressure intensifies and the initial pattern support at $3517 caves in, it could invalidate the rising wedge breakout, calling for a reversal of the uptrend in the near term.

ETH/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.