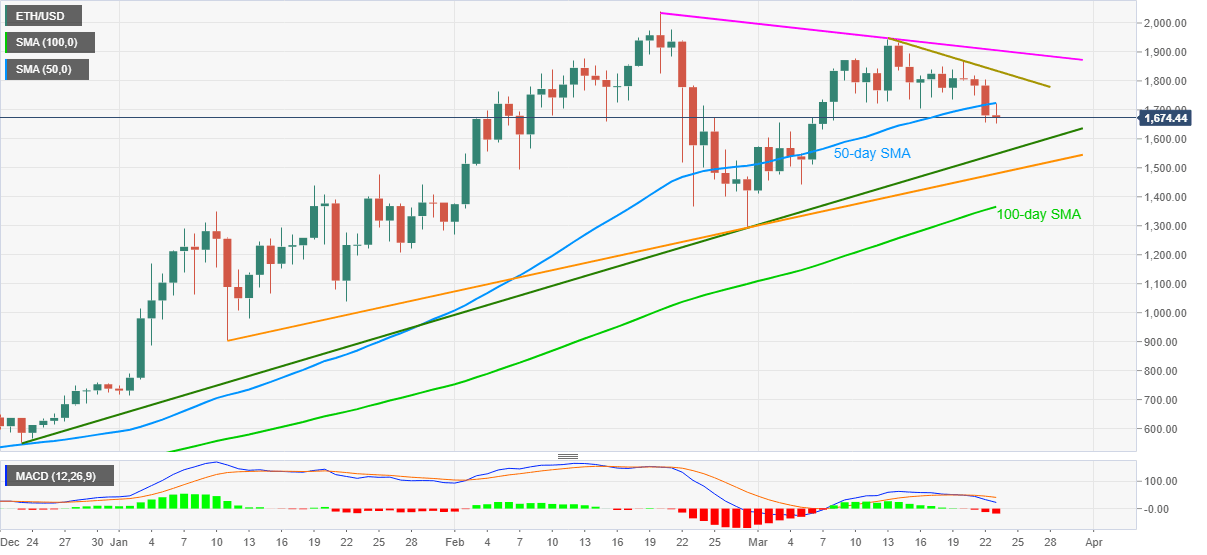

Ethereum Price Prediction: ETH bears eye mid-$1,500s on break of key SMA

- Ethereum stays depressed near 17-day low, keeps 50-day SMA breakdown.

- Bearish MACD, sustained break of the key SMA direct sellers towards the yearly support line.

- Buyers and sellers both have multiple barriers but trips for bears seem less bumpy ahead of immediate support line.

ETH/USD remains on the back foot around $1,670 during late Tuesday’s trading. In doing so, the altcoin keeps the downside break of 50-day SMA, amid bearish MACD, near the lowest levels last seen on March 07.

Given the clear break of the short-term key Simple Moving Average (SMA), coupled with downbeat MACD, Ethereum sellers look set to attack an upward sloping trend line from December 23, 2020, currently around $1,550.

However, any further downside will be questioned by an ascending support line from January 11 and 100-day SMA, respectively near $1,480 and $1,365.

Meanwhile, an upside clearance of 50-day SMA, at $1,723 now, will not be able to invite ETH/USD bulls as a 12-day-old resistance line and a falling hurdle, established since February 20, close to $1,835 and $1,905 in that order, will challenge the recovery moves.

If at all the Ethereum buyers cross the $1,905 resistance, the record top marked in February around $2,040 will be in the spotlight.

ETH/USD daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.