Ethereum price moves out of no-trade zone but faces massive supply barrier ahead

- ETH/USD is positioned to retest the $680-$700 area once $620 is cleared.

- On the downside, Ethereum's critical support comes at $550.

ETH/USD has settled above $600 and extended the recovery towards $611 on Thursday after a period of range-bound trading. The second-largest digital asset has hit the intraday high at $615 and gained over 2% in the past 24 hours. On a week-to-week basis, the coin has gained over 18%.

ETH leaves a no-trade zone as bulls have the upper hand

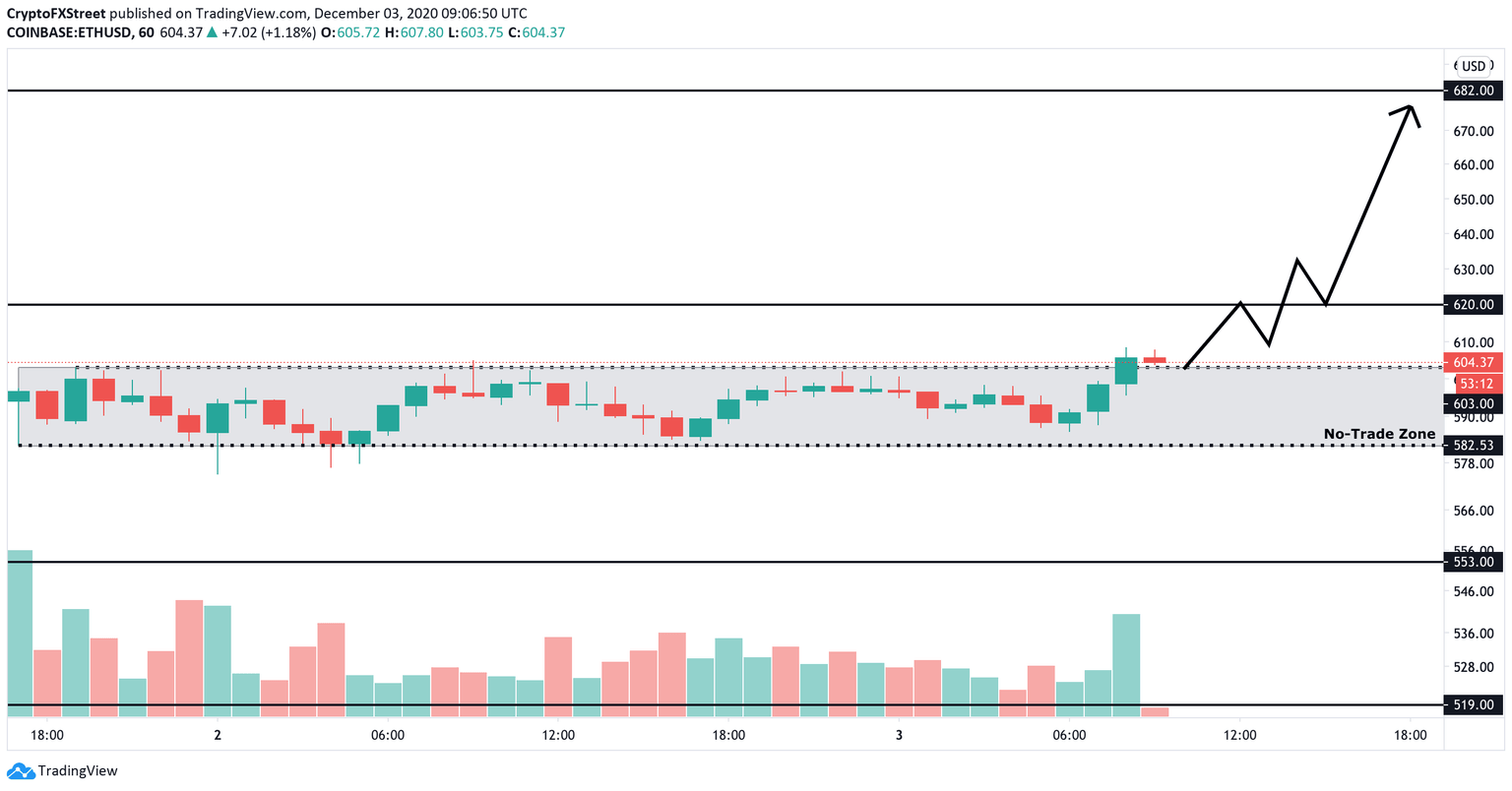

On the hourly chart, ETH has broken out of a no-trade zone. If the upside momentum is sustained, Ethereum's price may continue the recovery towards the next primary bullish target of $680 and the psychological $700. A sustainable move above $620 is needed to confirm the bullish scenario.

ETH/USD 1-hour chart

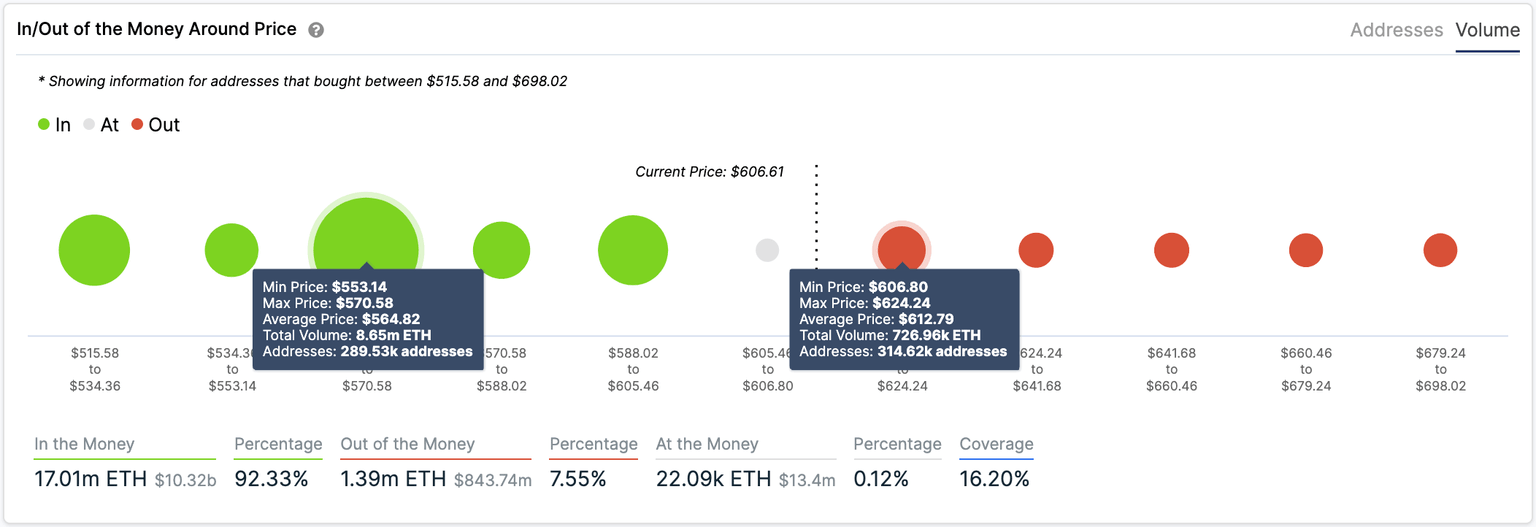

Intotheblock's data on In/Out of the Money Around Price signals a local hurdle on approach to $620 as nearly 315,00 addresses holding over 726,00 coins there. Once it is cleared, the upside momentum will gain traction with little-to-no resistance on the way.

Ethereum: IOMP data

On the other hand, failing to settle above this barrier will attract more sellers to the market and push the channel support price below $580. If this is the case, the sell-off may be extended to $550, where the IOMAP shows stable support with nearly 290,000 addresses holding 8.6 million coins. If this level gives way, $520 will come into focus.

ETH/USD 1-hour chart

On December 1, Ethereum developers successfully produced the Beacon Chain's genesis block and thus launched the transition to Ethereum 2.0. ETH/USD has been rallying ahead of the event and hit the recent top at $636. The downside correction triggered by the "sell the fact" scenario, pushed the price to $563.

Author

Tanya Abrosimova

Independent Analyst