Ethereum Price Forecast: ETH extends rally following lingering effect of SEC Chair Atkins' DeFi vision

Ethereum price today: $2,780

- Ethereum briefly surged above $2,820 following SEC Chair Atkins' bullish vision for DeFi regulation.

- Ethereum funding rates, staking balances, and ETF flows have spiked, reflecting strong buying pressure from investors.

- ETH could smash the $2,850 resistance and rally to $3,250 if it holds the 200-day SMA as support.

Ethereum (ETH) is up 3% in the early Asian session on Wednesday, as bullish sentiments from Securities and Exchange Commission (SEC) Chair Paul Atkins' statement on decentralized finance (DeFi) regulation continue to push the top altcoin's price higher.

Ethereum on-chain metrics and derivatives receive boost from Atkins' DeFi statement

Ethereum has rallied over 10% from a low of $2,490 on Monday, briefly reaching $2,820 for the first time since February 24, after SEC Chair Paul Atkins' statement in the final Crypto Task Force roundtable for 2025, where he outlined his 'bullish' vision for the DeFi landscape.

Atkins highlighted his delight at the SEC's Division of Corporation Finance for clarifying that staking, staking-as-a-service, and proof-of-work do not fall under securities laws. He also discussed the resilience of smart contracts in DeFi protocols.

Furthermore, he stressed the importance of establishing regulatory frameworks to guide on-chain services. Atkins outlined three key areas that the SEC is considering for regulating the DeFi sector, including the possibility of further guidance or rulemaking, amendments to existing SEC rules and regulations, and "innovation by exemption."

The statement comes at a time when Ethereum is also receiving attention from the buzz around stablecoins, following Circle's impressive performance on the NYSE and the GENIUS stablecoin bill advancing in the Senate.

"Looking ahead, macro tailwinds are aligning for ETH," wrote QCP analysts in a note to investors on Tuesday. "Ethereum's native role in tokenization and settlement rails may be primed for outsized structural upside."

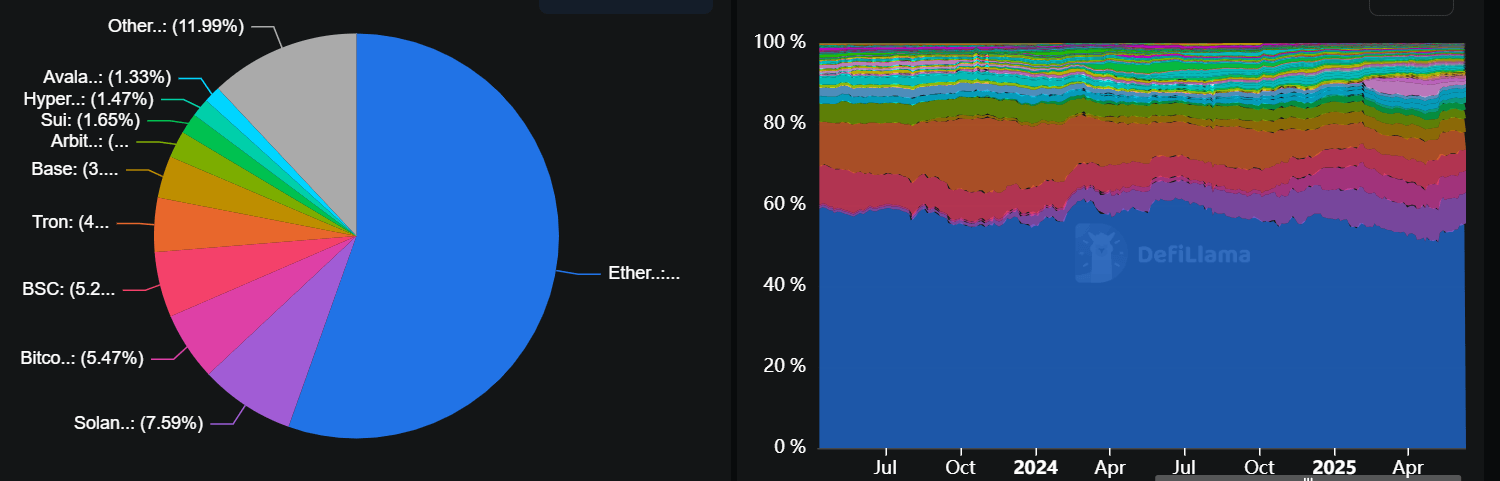

Ethereum hosts a majority of the global DeFi and stablecoin markets — over 55% of the total value locked (TVL) and 50% of the global stablecoin supply, according to DefiLlama data.

Ethereum TVL. Source: DefiLlama

The development has sparked strong bullish sentiment in Ethereum derivatives, with futures funding rates spiking to their highest level since May 23, per Coinglass data. The rise sparked $128.38 million in futures liquidations, with long and short liquidations accounting for $48.07 million and $80.31 million, respectively, in the past 24 hours.

ETH futures and options volume have also been on the rise, increasing by 46% and 51% during the period.

"Implied volatility on Ethereum has climbed, with front-end at-the-money vols pushing into the low 70s, while options skew flipped sharply in favour of calls, rising by 5 to 6 points. Elevated perpetual funding rates reinforce the bullish tone," added QCP analysts.

A similar movement is evident in ETH staking protocols, where their collective balance reached an all-time high of 34.59 million ETH, according to data from Beacon.ch.

Total ETH Staked. Source: Validatorqueue (Beacon.ch)

Meanwhile, US spot Ethereum ETFs continued their positive run, recording 18 consecutive days of net inflows, while flows in spot Bitcoin ETFs have been mixed.

"This rotation suggests a broadening thesis, from Bitcoin as digital gold to Ethereum as the infrastructure layer for real-world assets," the analysts concluded.

Ethereum Price Forecast: ETH eyes $3,250 as it tests key resistance range

Ethereum has surged above a rising trendline resistance and the 200-day Simple Moving Average (SMA) — a key hurdle that has prevented an uptrend since May 13.

Following the move, the top altcoin is testing the upper level of the $2,750 to $2,850 resistance range. If ETH holds the 200-day SMA as support, it could surge past $2,850, reclaim the $3,000 psychological level, and rally to test the $3,250 resistance.

ETH/USDT daily chart

On the downside, ETH could find support at the rising trendline if it fails to bounce off the 200-day SMA. A further decline will bring the $2,400 to $2,500 support range into focus.

The Relative Strength Index (RSI) has crossed above its moving average line and is testing its overbought region, signaling rising bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) is testing its moving average line as its histogram bars are on the verge of flipping positive. A successful crossover will strengthen the bullish outlook.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi