Ethereum Price Forecast: BitMine continues accumulation as ETH flips 50-day EMA

Ethereum price today: $3,220

- Ethereum treasury firm BitMine Immersion acquired 32,977 ETH last week, pushing its total holdings to 4.14 million ETH.

- The move follows a rebound in ETH ETFs, which posted net inflows of $174 million on their first trading day of 2026 last week.

- ETH is testing the resistance near $3,260 after flipping the 50-day EMA.

Ethereum (ETH) treasury firm BitMine Immersion (BMNR) continued to accumulate the top altcoin, purchasing 32,977 ETH over the past week.

Despite the amount representing the firm's lowest weekly purchase in months, Chairman Thomas Lee noted that BitMine has outpaced other Ethereum treasuries in ETH accumulation. "We remain the largest 'fresh money' buyer of ETH in the world," said Lee in a Monday statement.

BitMine now holds a 4.14 million ETH stash, which is 3.43% of the global ETH circulating supply. The company has also staked 659,219 ETH from that balance across three staking providers ahead of the unveiling of its Made in America Validator Network (MAVAN).

BitMine's other holdings comprise 192 Bitcoin (BTC), a $25 million stake in Worldcoin (WLD) treasury, Eightco Holdings and a cash balance of $915 million.

In its chairman's message last week, Thomas Lee urged shareholders to increase the firm's authorized shares from 500 million to 50 billion, arguing that it's required to accommodate future share splits and support capital market activities.

Meanwhile, ETH began the year on a positive note as US spot Ethereum exchange-traded funds (ETFs) recorded $174.4 million in net inflows on their first trading day of 2026 last Friday, according to SoSoValue data.

The newly found momentum follows months of underperformance relative to commodities Gold and Silver. "The surge in commodity and precious metals in 2025 bodes well for crypto prices in 2026, which tend to follow metal price moves," Lee added.

BMNR trades at $32.3, up 3% at the time of publication on Monday.

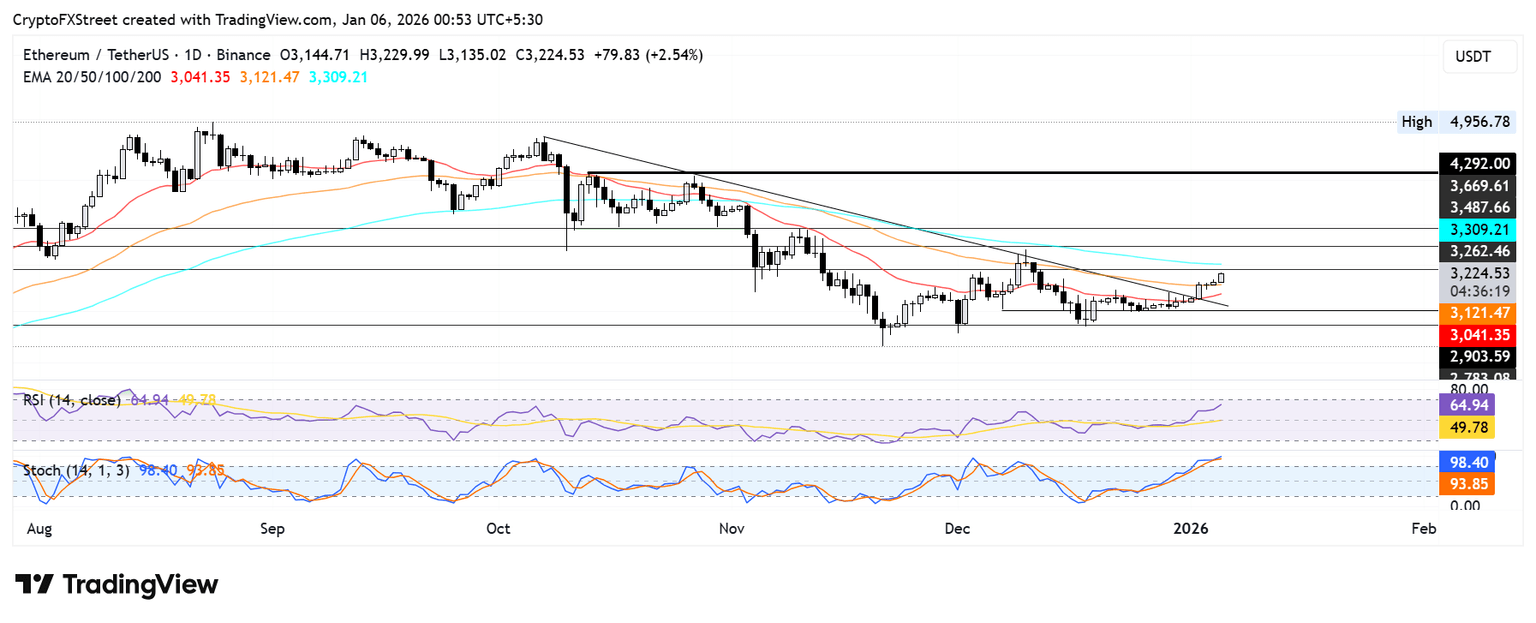

Ethereum Price Forecast: ETH flips 50-day EMA, faces $3,260 resistance

Ethereum saw $72 million in futures liquidations over the past 24 hours, driven by $54.5 million in short liquidations, per Coinglass data.

ETH has risen above the 50-day Exponential Moving Average (EMA) and is testing the $3,260 resistance level. A firm rise above the resistance alongside the 100-day EMA could see ETH tackle the $3,480 hurdle.

On the downside, ETH could bounce at the $2,900 support — which has held for the past two weeks — if it breaches the 20-day EMA.

The Relative Strength Index (RSI) is above its neutral level while the Stochastic Oscillator (Stoch) is in overbought territory, signalling a dominant bullish momentum. However, sustained oversold conditions in the Stoch often lead to a short-term pullback.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi