Ethereum price could kick-start Uptober after revisiting $1,050

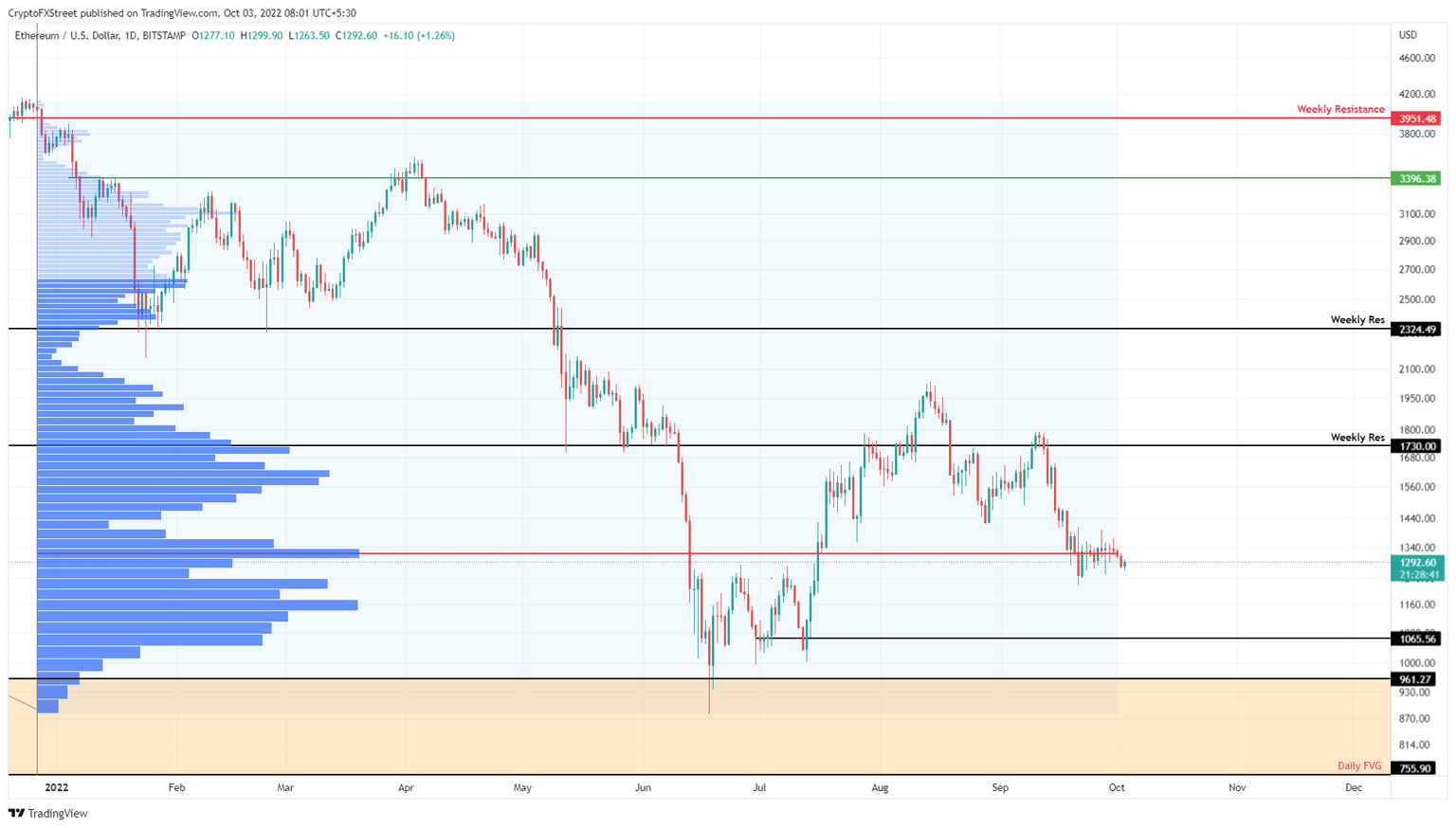

- Ethereum price has sliced through the 2022 volume POC at $1,326, denoting a weak bullish momentum.

- This development could see ETH crash to $1,050 if the $1,200 support level fails to hold.

- After this initial downturn, market participants can expect ETH to kick-start a run-up to $2,000.

Ethereum price shows an interesting development over the two days that has caused bears to rejoice. Bulls, on the other hand, seem to be weak and unresponsive, which could lead to steep correction for ETH holders.

Ethereum price at a crucial junction

Ethereum price has been hovering below the 2022 Point of Control (POC) at $1,326, which is the highest traded volume level for this year. This barrier is a support level, but a breakdown could flip it into a hurdle.

Between September 19 and 21, Ethereum price slid below the POC and produced a three-day candlestick close below it, flipping it into a resistance level. Since then, ETH has been trying to conquer it but has failed or lacked the momentum to do so.

With the start of a new month and a new quarter, investors can expect a manipulative move that first pushes Ethereum price lower, luring impatient bears, followed by a quick surge in bullish momentum that pushes ETH higher, trapping the short-sellers.

So market participants should expect a move that retests the immediate support level at $1,200 or the subsequent level at $1,050. Ideally, this level would be perfect for long-term investors to accumulate ETH, which could create a trend reversal, pushing Ethereum price back to $1,730.

In a highly bullish case, however, this run-up could extend well beyond $1,730 and revisit the $2,000 psychological level.

ETH/USDT 3-day chart

On the other hand, if Ethereum price prematurely recovers above the 2022 POC at $1,326, it will denote a resurgence of buyers. This development could see ETH struggle to overcome the $1,450 hurdle.

However, a flip of the $1,730 barrier could indicate that the initial bearish thesis is unlikely to unfold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.