Ethereum price aiming for $800 as institutional investors buy the dip

- Ethereum price tries to recover after several metrics turn bullish.

- Grayscale Trust Fund has bought over 130,000 ETH.

The largest cryptocurrency trust fund, Grayscale, has recently purchased around 131,254 Ethereum pushing its total to $1.66 billion at current prices. Ethereum has managed to defend a critical support level on the daily chart and it’s aiming for higher highs.

Ethereum price faces a major resistance level ahead of $800

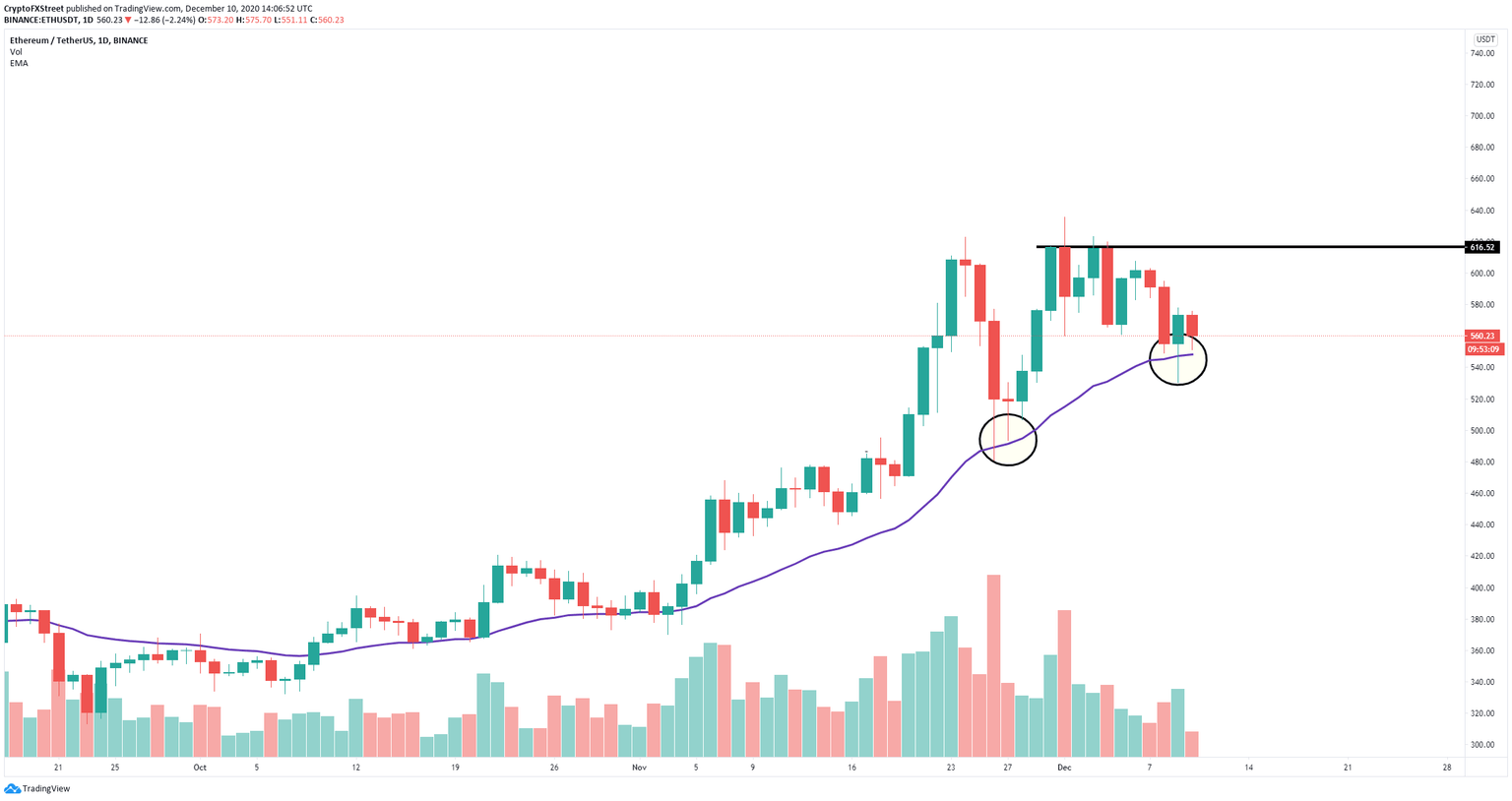

On the daily chart, the digital asset has managed to stay above the 26-EMA for several months and just defended the support level again in the past three days. The next significant resistance level is the 2020-high at $635.

ETH/USD daily chart

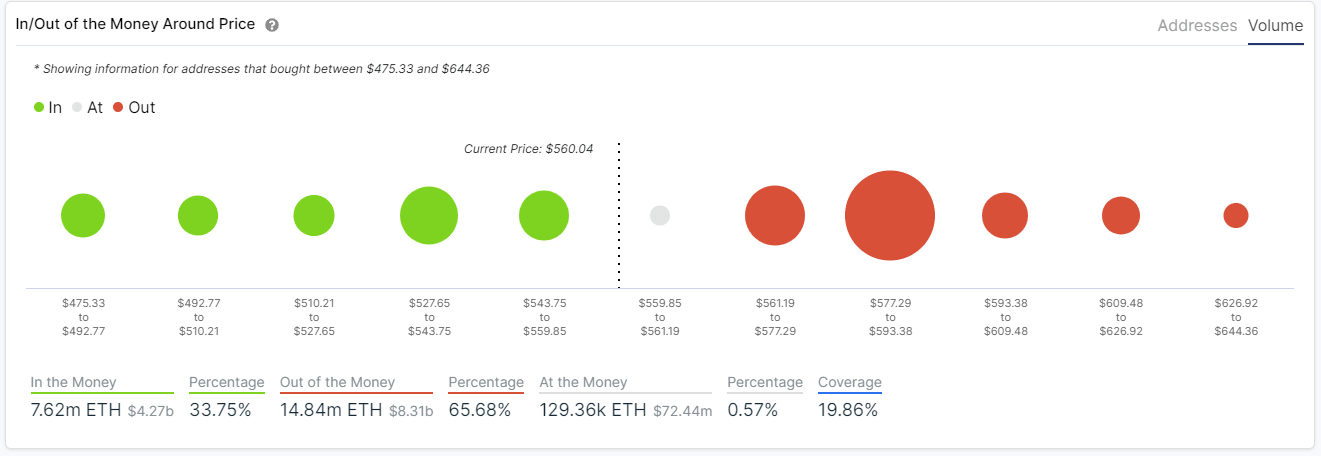

However, the In/Out of the Money Around Price (IOMAP) chart shows that there is a cluster of resistance between $577 and $593, which means that a breakout above this point can quickly drive Ethereum price towards $635. A further break of this level would push the digital asset to the next weekly resistance level at $800.

ETH IOMAP chart

Considering the recent acquisition of 131,254 Ethereum by Grayscale and the increase in buying pressure, it seems that cracking the resistance at $593 will not be hard for the bulls. Furthermore, Messari, a research crypto platform, has just released a new report stating that Ethereum is bound to process more than $1 trillion in real value transfers this year, eclipsing giants like PayPal, which also supports cryptocurrencies now.

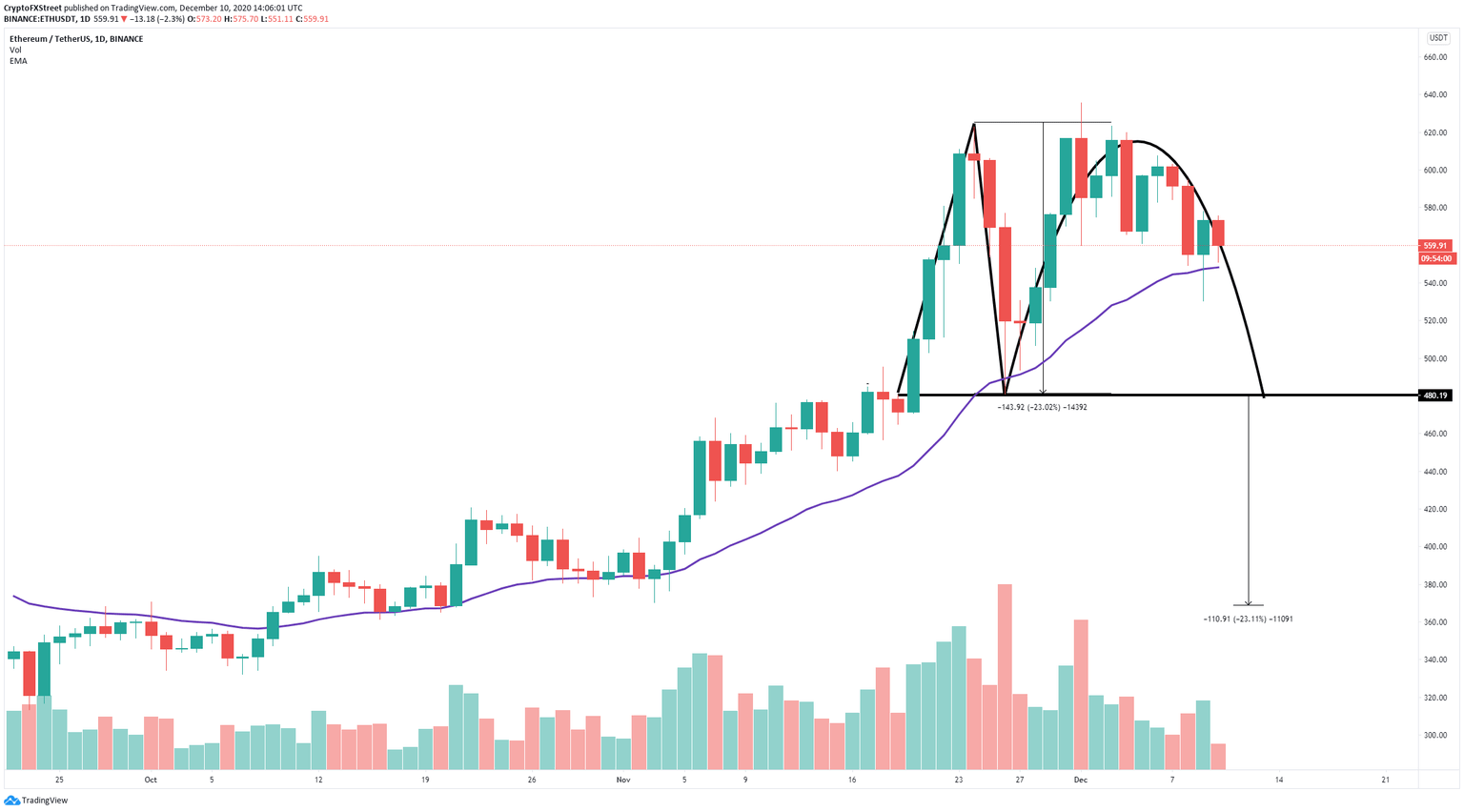

ETH/USD daily chart

On the other hand, a concerning pattern known as Adam and Even could be forming on the daily chart. The most significant support level of the pattern is $480, which means that a breakdown below this point would drive Ethereum price towards $370. The loss of the 26-EMA would be the first bearish indicator.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.