Ethereum price action gets boring as wETH insolvency concerns spike

- Ethereum price continues to trade between $1,000 and $1,300 since the November 9 crash.

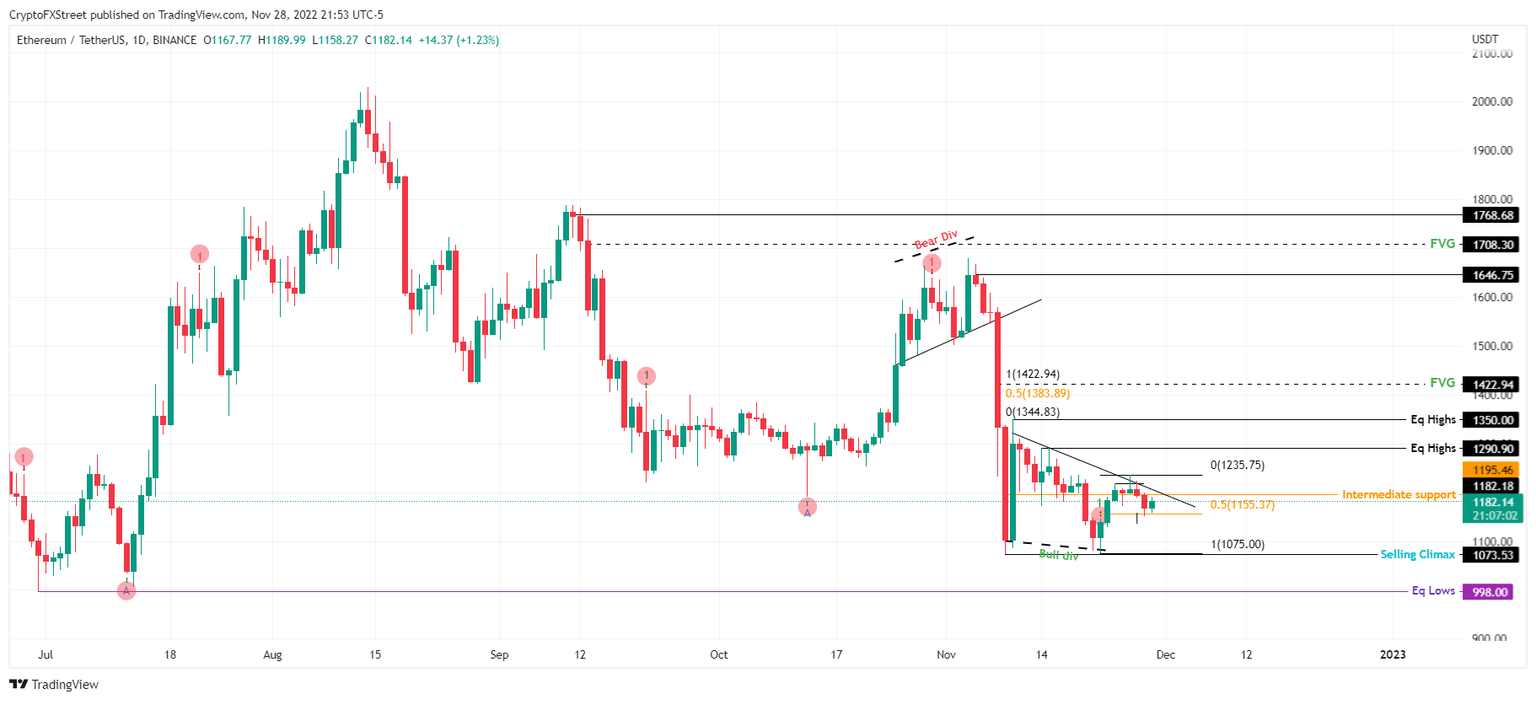

- A breakout above the declining trend line connecting swing highs formed since November 10 could trigger a run-up to $1,400.

- Wrapped Ether (wETH) insolvency rumors that started as a joke continue to make rounds on Twitter.

Ethereum (ETH) price shows a lack of volatility as it hovers above a crucial support level. A move to the upside is unlikely until it overcomes another significant hurdle. Therefore, ETH continues to consolidate, awaiting a signal from BTC.

Wrapped Ethereum (wETH) depeg and insolvency rumor

The Wrapped Ethereum (wETH) insolvency/depeg rumor was started as a joke by Twitter user Cygar on November 27. What’s ironic about this is that the Twitter user had explained on November 26 how wETH can never be insolvent.

Cygar further explained that it was a test to see who was reading his content.

This is really a test to see who’s been reading my content.

— cygaar (@0xCygaar) November 26, 2022

Since many prominent members of the Ethereum community added to the joke, it blew up on Twitter, causing mainstream media like Bloomberg to cover this rumor. While a major part of the community knows about this, there are still many who are still unaware.

Ethereum price in a tight spot

Ethereum price rallied 8.4% after the Momentum Reversal Indicator (MRI) flashed a buy signal on November 22. This move was anticipated and pointed out in a previous article. However, the minor upswing that pushed ETH to $1,235 failed to continue its ascent. The main reason is that Bitcoin lacks volatility.

Due to this sideways movement, Ethereum price is stuck trading above $1,155 and the declining trend line connecting the swing highs formed since November 10. A successful breakout above this resistance level will signal that the bulls are ready.

In such a case, Ethereum price could climb higher and sweep the equal highs at $1,290 and $1,350. However, if the buying pressure continues to build up, ETH might tag the $1,400 psychological level.

ETH/USDT 1-day chart

While things are looking up for Ethereum price, a breakdown of the $1,075 support level will create a lower low. This shift in narrative would invalidate the bullish thesis and skew the odds in the bears’ favor. In such a case, ETH could revisit the $998 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.