Ethereum loses key support level as ETH price falls to two-month lows against Bitcoin

Ethereum’s native token, Ether (ETH), rallied by more than 15% in the first 12 days of October. But, compared to Bitcoin’s (BTC) 30% gains in the same period, the second-largest cryptocurrency is currently in a downtrend when priced in BTC.

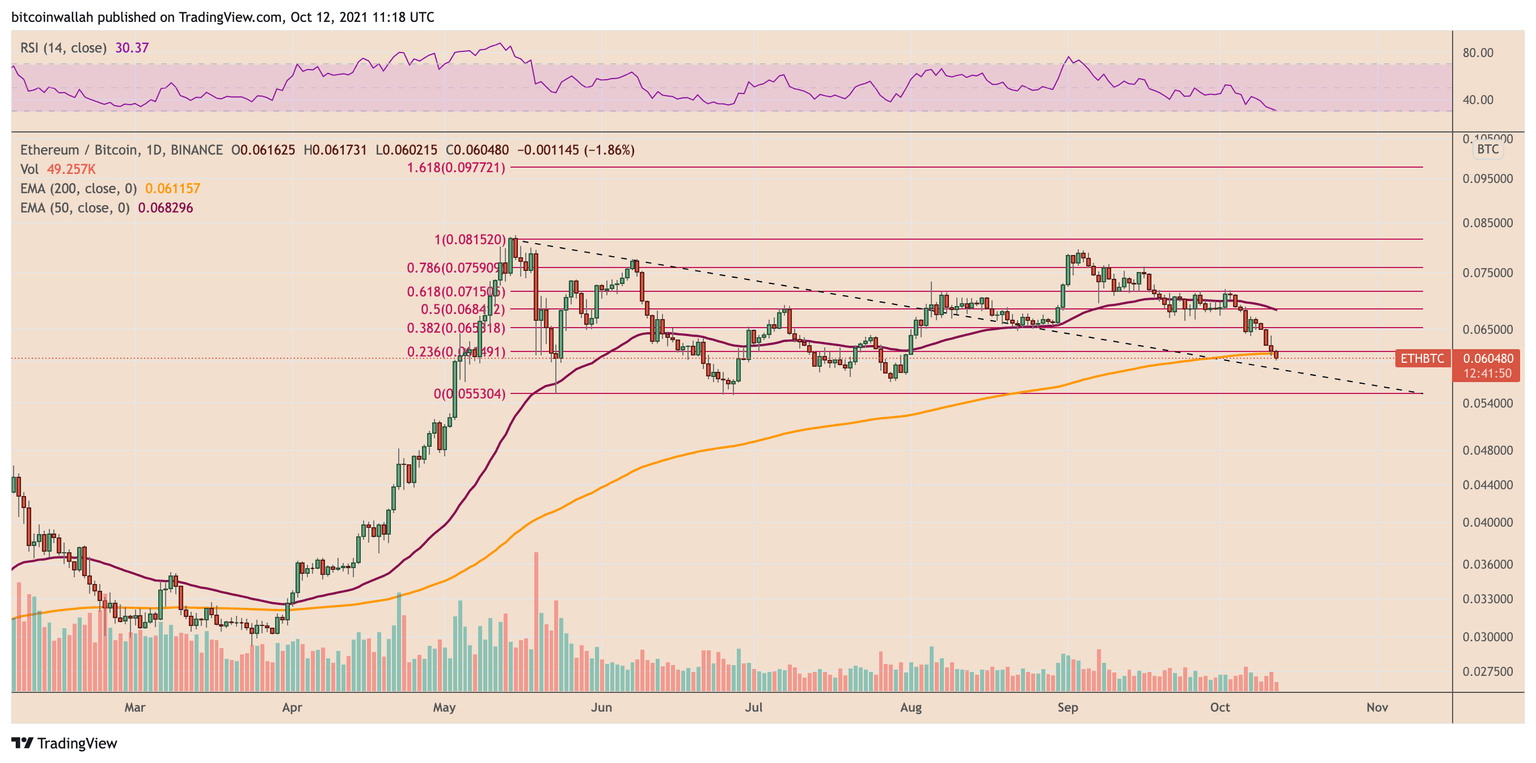

So far into October (and the fourth quarter of 2021), the ETH/BTC exchange rate has plunged by over 12%, reaching 0.060215 BTC for the first time in more than two months on Oct. 12.

ETH/BTC daily price chart. Source: TradingView

The drop also pushed ETH/BTC below one of its longest-standing support zones, the 200-day exponential moving average (200-day EMA; the orange wave), as shown in the chart above. This raises the risk of more downside with 0.055304 BTC serving as the next possible target.

Bitcoin dominance rises on ETF hopes

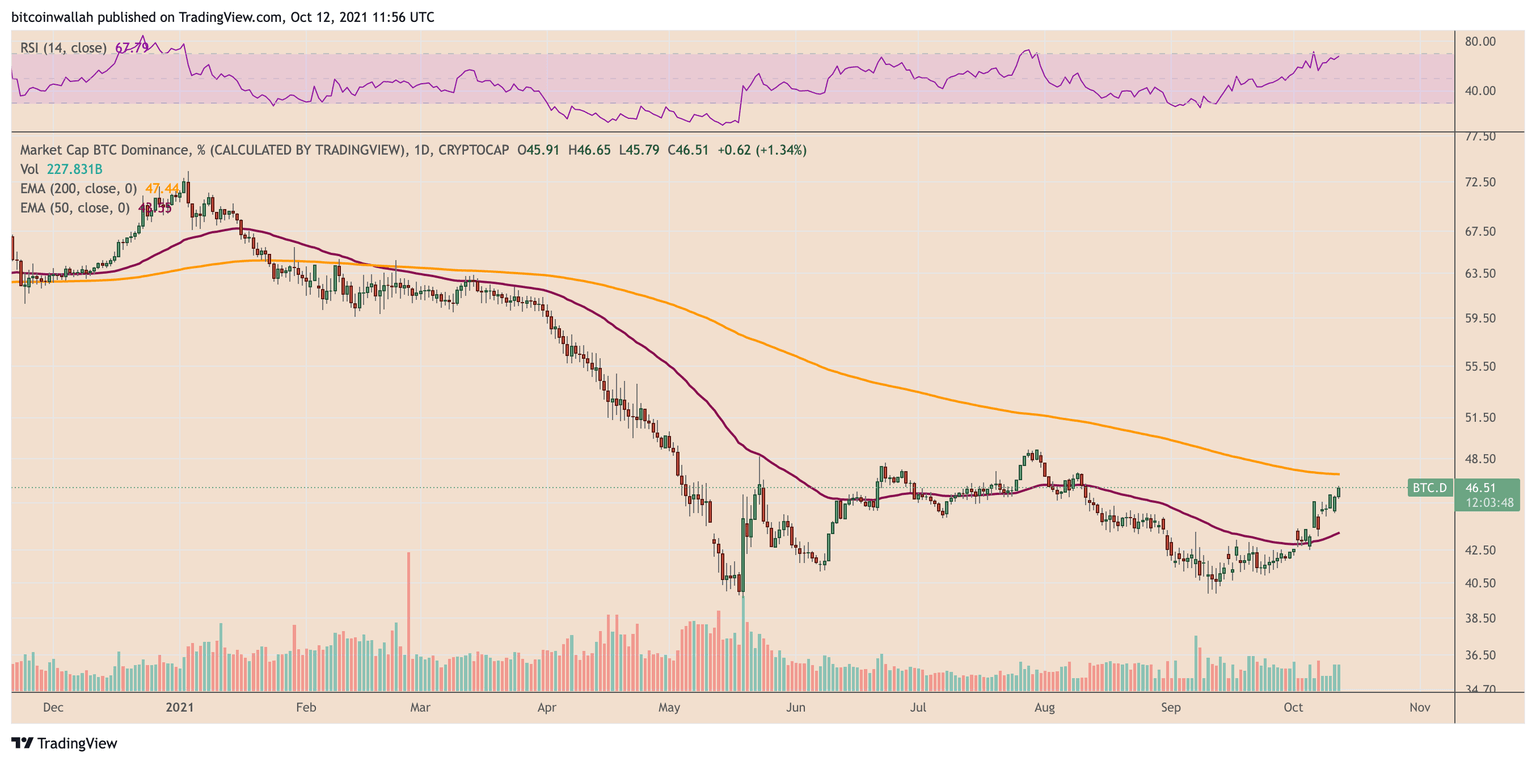

More evidence for ETH/BTC’s weakness came from Bitcoin’s rising dominance in the crypto market.

In detail, the Bitcoin Dominance Index, which measures the flagship cryptocurrency’s capitalization against the rest of the crypto market, surged from 42.39% on Oct. 1 to 46.64% on Oct. 12. On the other hand, Ether’s dominance dropped from 18.15% to 17.57% in the same period.

Bitcoin dominance index daily chart. Source: TradingView

That shows that more capital rotated into the Bitcoin market than altcoins so far into October.

Related: Institutional crypto products eye record AUM as investors pile into Bitcoin The rising Bitcoin dominance coincided with expectations that the United States Securities and Exchange Commission could approve four Bitcoin-based exchange-traded funds (ETF) in a matter of weeks. The applicants are Global X Bitcoin Trust, Valkyrie XBTO Bitcoin Futures Fund, WisdomTree Bitcoin Trust, and Kryptoin Bitcoin ETF.

SEC Chair Gary Gensler hinted at an optimistic outcome for Bitcoin ETFs despite the SEC rejecting similar applications for eight years in a row. Gensler noted that this time, however, the Bitcoin ETF applicants filed under the Investment Company Act of 1940, which offers higher investor protection.

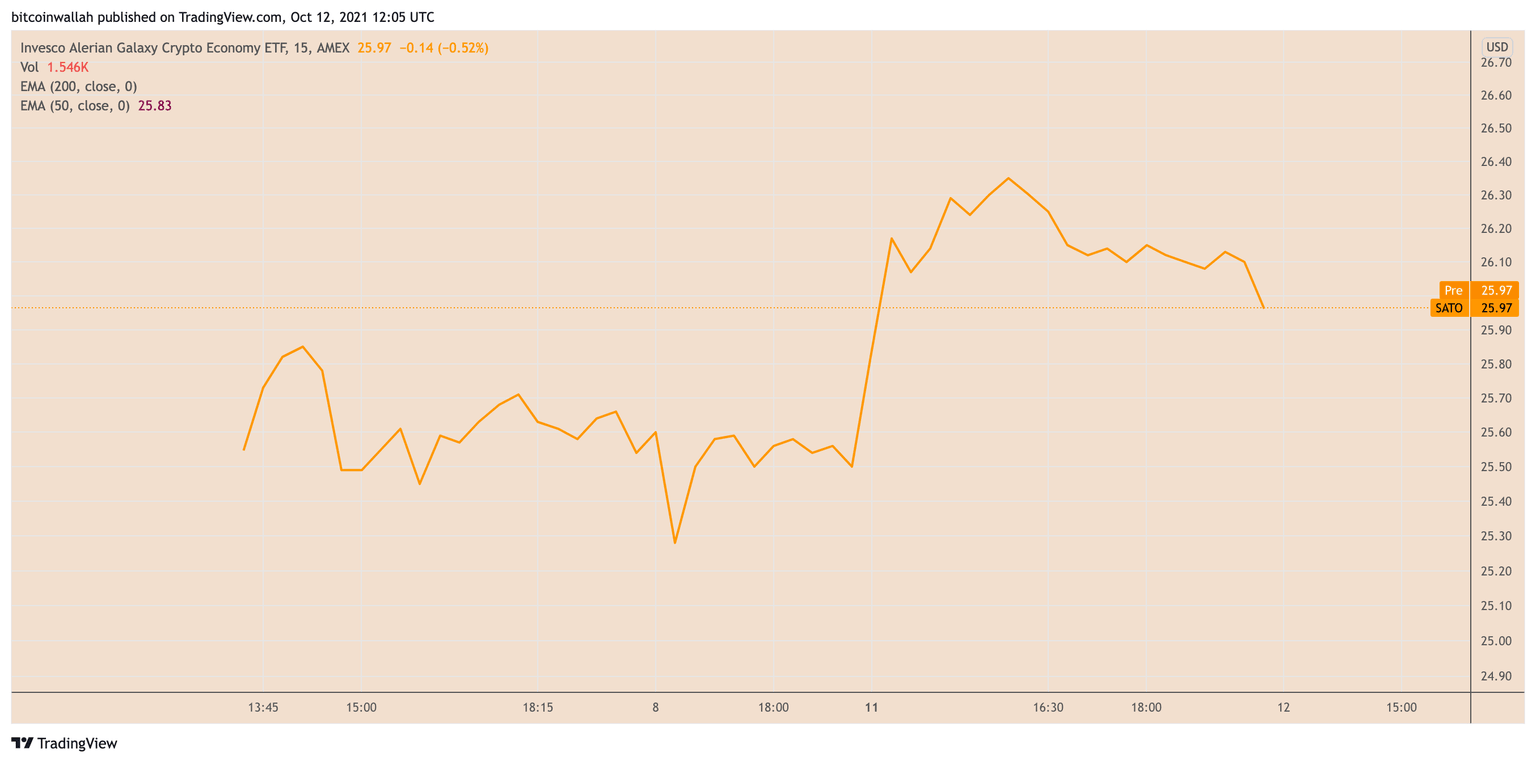

Earlier this week, two “light” Bitcoin ETFs started trading in the U.S., named Invesco Alerian Galaxy Crypto Economy ETF (SATO) and Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC). However, the funds invest 80% of their assets in crypto-related companies, not Bitcoin itself.

SATO ETF 15-minute price chart. Source: TradingView

The SEC also approved a third crypto equity ETF. Dubbed the Volt Crypto Industry Revolution and Tech ETF (BTCR), the fund will gain exposure “in entities that hold a majority of their net assets in bitcoin or derive a majority of their earnings from bitcoin mining, lending or transacting.”

Bitcoin to go “insane?”

James Seyffart, an ETF analyst with Bloomberg Intelligence, said the news would be “very bullish” for Bitcoin. Similarly, independent market analyst Lark Davis also predicts “insane” market reactions should the SEC approve a Bitcoin ETF having exposure to actual BTC.

So, it appears the speculation over Bitcoin ETF approvals raised traders’ appetite for the top cryptocurrency in recent days, with BTC outperforming its top rivals, including Ether.

Nonetheless, Ethereum boasts a strong decentralized application ecosystem and remains the key force behind the booming decentralized finance and nonfungible token sectors.

David Gokhshtein, founder of Gokhshtein Media and PAC Global, noted that Ethereum’s healthy network effect could send Ether to $10,000 by the end of this year. Meanwhile, as Cointelegraph covered, an ongoing supply crunch in the Ether market should remain a major talking point for bulls moving forward.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.