Ethereum derivatives data points at bullish start for ETH in 2024

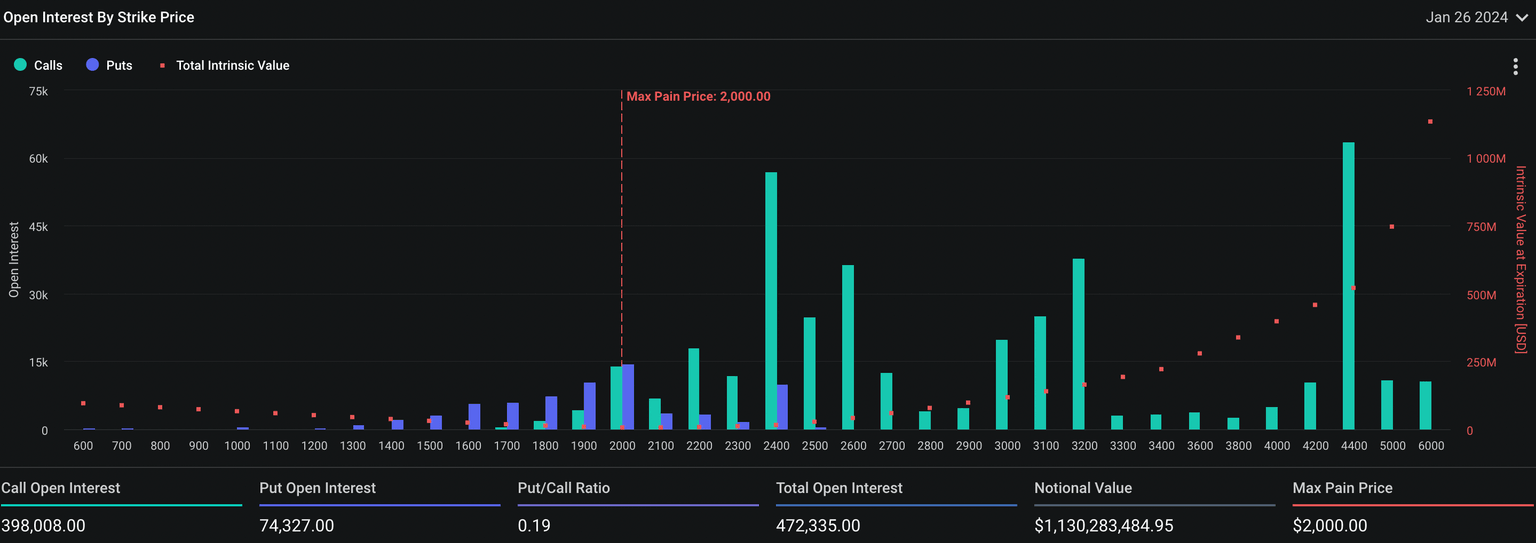

- Ethereum put/call ratio for options expiring on January 26, 2024 is 0.19.

- ETH put/call ratio is 0.38, as on December 8, according to Deribit data.

- Ethereum price sustained above the $2,300 level on Binance, as the altcoin printed nearly 13% weekly gains.

Ethereum, the second largest asset by market capitalization is on track to rally towards its $2,500 target in the ongoing cycle. Evaluating derivatives data reveals a bullish bias among market participants in January 2024.

Also read: Solana price breaches key weekly resistance, SOL gains are likely sustainable

Ethereum derivatives traders are bullish on ETH in 2024

Data from Deribit reveals an underlying bullish bias among derivatives traders, on Ethereum. The put/call ratio is considered an indicator of the mood among market participants. It is a contrarian indicator and it looks at options buildup. Put/call ratio helps traders understand whether it is time to make a contrarian call on an asset.

For Ether, the put/call ratio is 0.38 on December 8, as seen on Deribit. For options contracts with January 26, 2024 expiry, the put/call ratio is 0.19. This rounds off to nearly 2 puts every 10 calls, a bullish bias among derivatives traders.

Ethereum open interest by strike price

For December 29 expiry, there are twice as many calls as puts and this implies Ethereum’s derivatives traders are bullish on ETH price rally by the end of December. The altcoin is currently trading at $2,359 on Binance. The altcoin has sustained above the $2,300 level while Ethereum is in its uptrend. The altcoin has yielded nearly 13% weekly gains and upwards of 25% monthly gains for traders in the past month. The altcoin’s trade volume has surged to $12.36 billion in the past 24 hours.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.