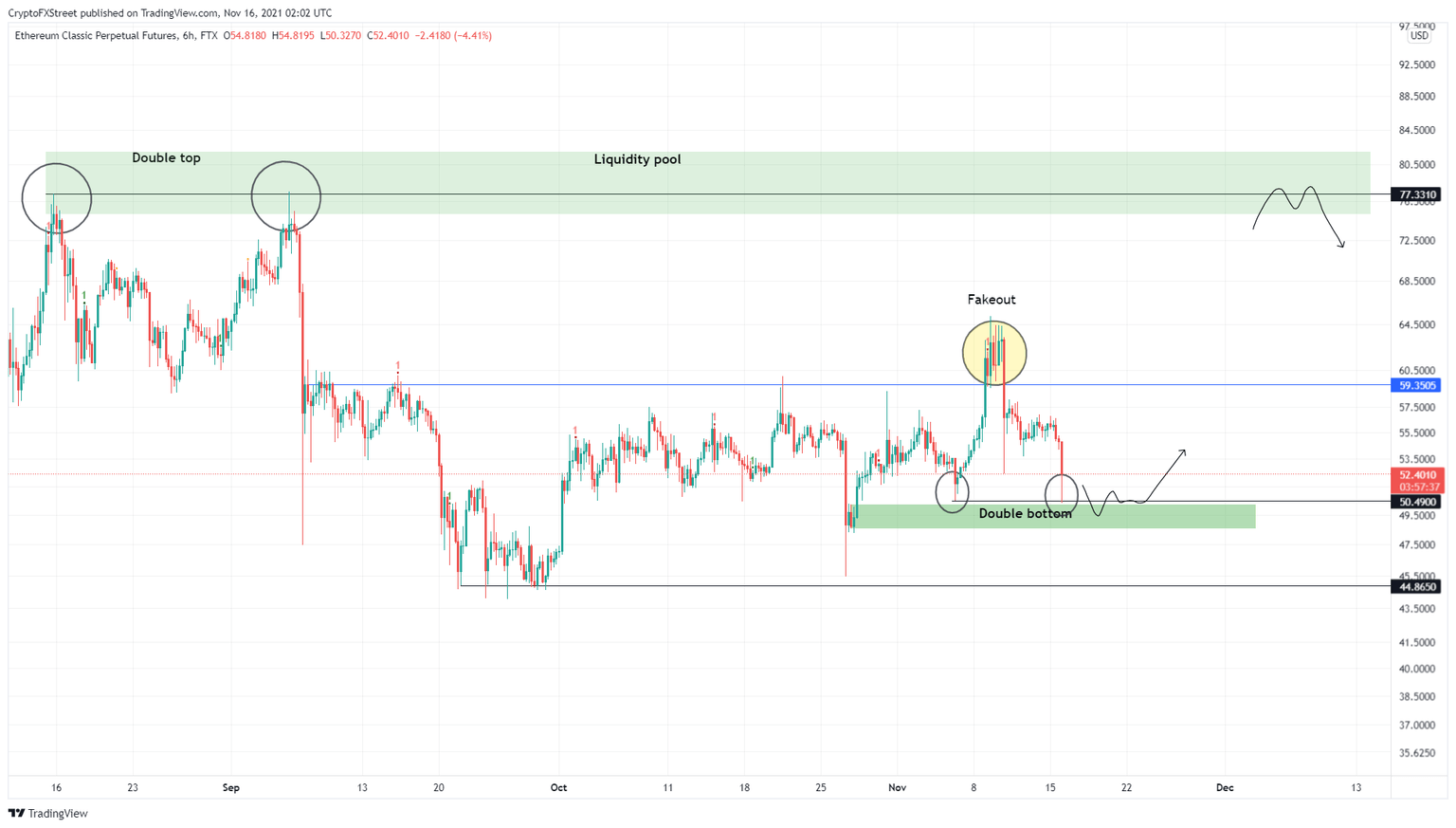

Ethereum Classic price signals 'buy the dip' before ETC rallies 50%

- Ethereum Classic price has formed a double bottom at $50.49, signaling a potential reversal in play.

- A retest of the $48.55 to $50.21 demand zone could also be seen before ETC embarks on a 50% rally to $77.33.

- A lower low below $44.86 will invalidate the bullish thesis.

Ethereum Classic price looks ready for a reversal as it comes close to retesting a crucial support floor. A dip into this area is likely to trigger a reversal in the downtrend and a move into a particular liquidity area.

Ethereum Classic price to pull a 180 from current downleg

Ethereum Classic price set up double top at $77.31 on September 6 and dropped roughly 35% to where it currently stands. While this downswing reached a low of $45.46 on October 27, ETC has recovered nicely. However, the recent downswing seems to have created a double bottom at $50.49, suggesting a potential reversal rally around the corner.

Investors can expect Ethereum Classic price to briefly venture into the 6-hour demand zone, ranging from $48.55 to $50.21, before kick-starting an uptrend.

The bull rally will face one resistance barrier at $59.35. Clearing this will open the path for ETC to capture the “buy stop” liquidity resting above the double top at $77.33. This run-up would constitute a 53% upswing from the $50.49 support level.

ETC/USDT 6-hour chart

Regardless of the bullish outlook from a short-to-mid term outlook, things could head south if Ethereum Classic price fails to hold above the $48.55 to $50.21 demand zone. A lower low below $48.55 will signal that a move to the $44.86 support floor is likely. Market participants can expect ETC to restart the uptrend here.

However, a swing low below $44.86 will invalidate the short-term bullish narrative.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.