Ethena Price Forecast: ENA steadies as Arthur Hayes boosts holdings to over 5 million tokens

- Ethena price steadies around $0.780 on Thursday after rallying more than 6% so far this week.

- The Data Nerd shows that BitMEX co-founder Arthur Hayes added 579K ENA, bringing total holdings to over 5 million tokens.

- On-chain data highlights accumulation, with large wallets increasing ENA exposure.

Ethena (ENA) price holds above $0.780 at the time of writing on Thursday, having rallied more than 6% so far this week. BitMEX co-founder Arthur Hayes expanded his ENA position by 578,956 tokens, bringing his total holdings above 5 million. On-chain flows further suggest growing confidence from large wallets, even as some traders realize profits and absorb short-term selling pressure.

BitMEX co-founder boosts ENA holdings

According to The Data Nerd, BitMEX co-founder Arthur Hayes purchased 578,956 ENA worth $473,350 on Binance on Wednesday. Hayes currently holds over 5 million ENA tokens.

A closer examination of the supply distribution metric reveals that large wallets are accumulating ENA tokens. Santiment’s Supply Distribution metric shows that whales holding between 100,000 and 1 million (red line), 1 million to 10 million (yellow line) and 10 million and 100 million ENA tokens (blue line) have accumulated a total of 277.77 million tokens from September 3 to Thursday, highlighting growing confidence among investors.

%20%5B12-1757577481412-1757577481414.01.13%2C%2011%20Sep%2C%202025%5D.png&w=1536&q=95)

ENA supply distribution metric chart. Source: Santiment

These accumulations come even as some traders lock in gains, with Santiment’s Network Realized Profit/Loss (NPL) metric showing significant profit-taking spikes on September 3 and again on Wednesday, suggesting that whales are absorbing the selling pressure.

%20%5B13-1757577502793-1757577502794.03.40%2C%2011%20Sep%2C%202025%5D.png&w=1536&q=95)

ENA NPL chart. Source: Santiment

Some other bullish metrics for ENA

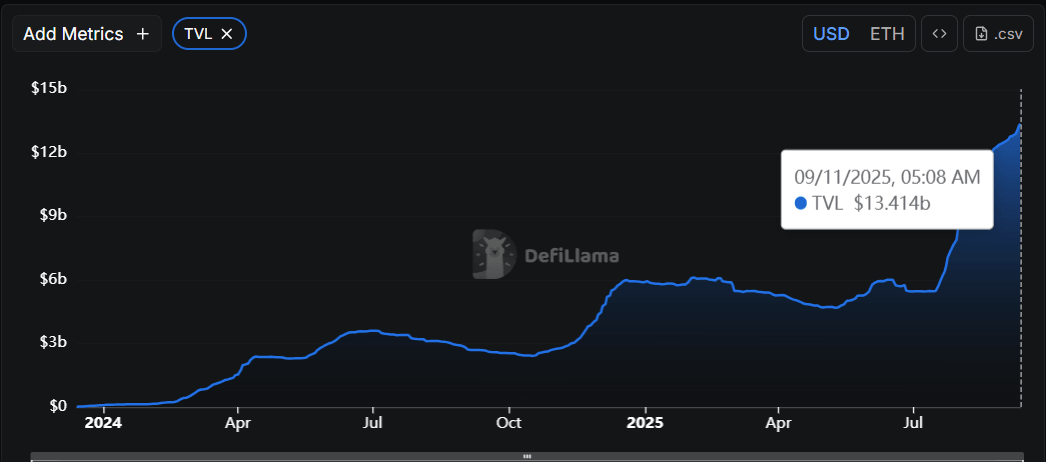

Data from crypto intelligence tracker DefiLlama shows that ENA’s Total Value Locked (TVL) reached a new all-time high (ATH) of $13.41 billion on Thursday. This increase in TVL indicates growing activity and interest within the Ethena ecosystem, suggesting that more users are depositing or utilizing assets within ENA-based protocols.

ENA TVL chart. Source: DefiLlama

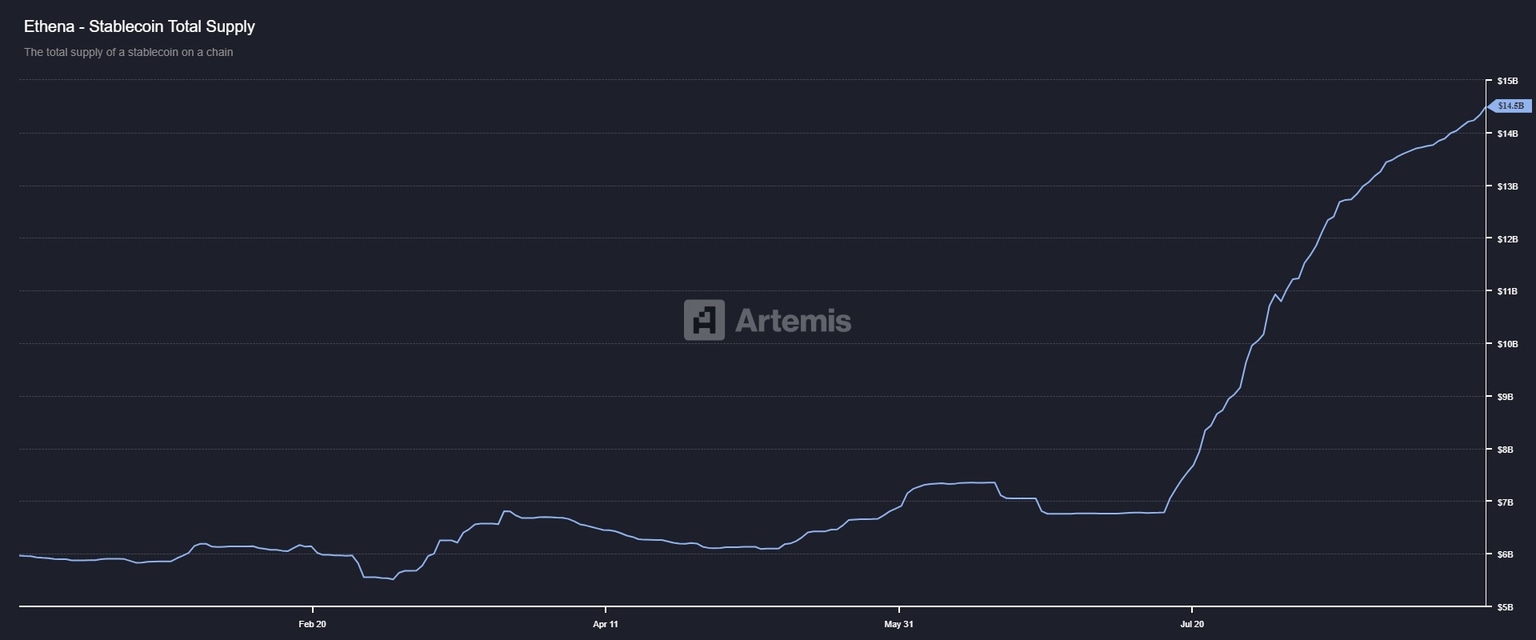

Additionally, ENA stablecoin supply and market capitalization also reach a record high of $14.5 billion, further supporting the bullish view.

ENA stablecoin total supply chart. Source: Artemis terminal

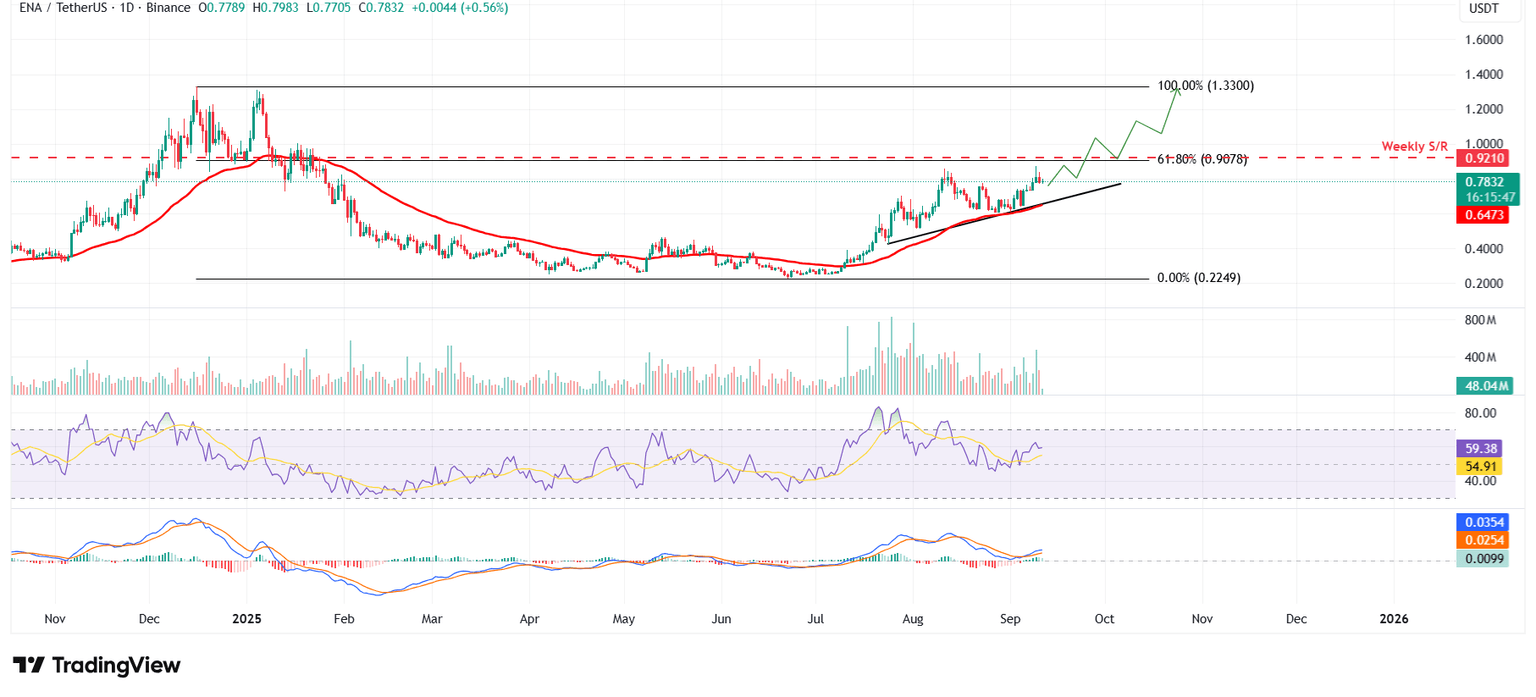

Ethena Price Forecast: ENA rebounds following test of key support

Ethena price found support around the ascending trendline (drawn by connecting multiple lows since July 24) on September 1 and rallied more than 15% until Wednesday. This trendline roughly coincides with the 50-day Exponential Moving Average EMA at $0.647, making this a key support zone. At the time of writing on Thursday, it steadies at around $0.783.

If ENA continues its upward momentum, it could extend the rally toward its weekly resistance at $0.921. A successful close above this level could extend gains toward its December 16 high at $1.330.

The Relative Strength Index (RSI) on the daily chart reads 59, which is above its neutral level of 50, indicating that bullish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) indicator displayed a bullish crossover last week, which remains in effect, indicating sustained bullish momentum and an upward trend ahead.

ENA/USDT daily chart

However, if ENA faces a correction, it could extend the decline toward its 50-day EMA at $0.647.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.