EOS Price Analysis: EOS/USD soars over 10% targeting $3.00

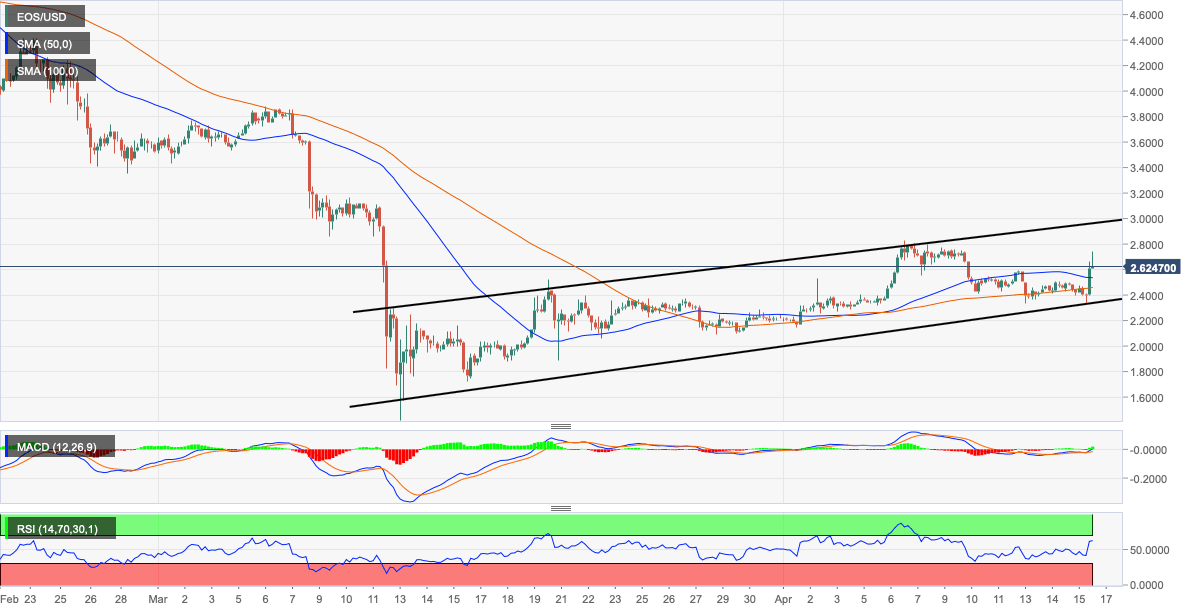

- EOS breaks out above the 50 SMA in the 4-hour chart as bulls target $3.00.

- EOS/USD continues to trend upwards within a gradually ascending channel started after the March 12 crash.

The cryptocurrency market has faced volatility during the European session on Thursday. The Asian session earlier in the day was mostly bearish as sellers extended their action from the American session on Wednesday. EOS, after being rejected from $2.80 failed to find support at $2.40. However, a weekly low formed at $2.30 kept the selling pressure at bay in readiness for the ongoing bullish momentum.

At the time of writing, EOS/USD is trading at $2.61 following over 10% growth on the day. Interestingly, EOS remains bullish in spite of the stalling across the board. For instance, Bitcoin price has slipped under $7,000 after testing $7,145 while Ethereum is trading at $167 from intraday highs of $174.

Looking at the 4-hour chart, EOS continues to nurture an uptrend within an ascending channel that started after the crash in the cryptocurrency market on March 12. Moreover, the price is above the moving averages where the 50 SMA has been turned into a support line at $2.55. The 100 SMA in the same 1-hour time frame is the next support target at $2.46.

From a technical point of view, the RSI shows that EOS is prime for more action towards the psychological $3.00. Its sharp motion corresponds to the price action recorded on the day. Moreover, with the RSI not yet oversold, it means that EOS still has plenty of room for growth.

EOS/USD 4-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren