EOS Price Analysis: EOS/USD recovery capped by SMA100

- Binance revealed the key issues of EOS network structure.

- EOS/USD needs to break above $4.55 for the recovery to gain traction.

EOS, now the 8th largest digital asset with the current market value of $4.2 billion, has gained 1.5% in recent 24 hours to trade at $4.51 at the time of writing. EOS/USD topped at $5.38 on February 13 and retreated to the recent low of $4.2 by February 17. The coin has been moving in sync with the market, vulnerable to speculative trading.

Binance research sheds some light on EOS decentralization issues

EOS network is often accused of low decentralization and inefficient governance model, which allows EOS holders further consolidate their position and gain power. Binance Research explored the issue and came up with several takeaways. The experts assessed the decentralization based on three parameters - collision resistance, fault tolerance and attack resistance - and revealed the weak points that may affect the network decentralization and make it vulnerable to faults and attacks.

Specifically, the researches noted that EOS has no mechanisms to prevent vote trading. On the contrary, the existing incentive structure promotes vote trading and selfish acts, thus reinforcing consolidation.

In general, EOS problems seem to be enabled and aggravated by a number of issues such as low voter turnouts, little resistance to Sybil attacks, and coherently little transparency, the 1-token-30-votes system, as well as the changed block rewards.

EOS/USD: Technical picture

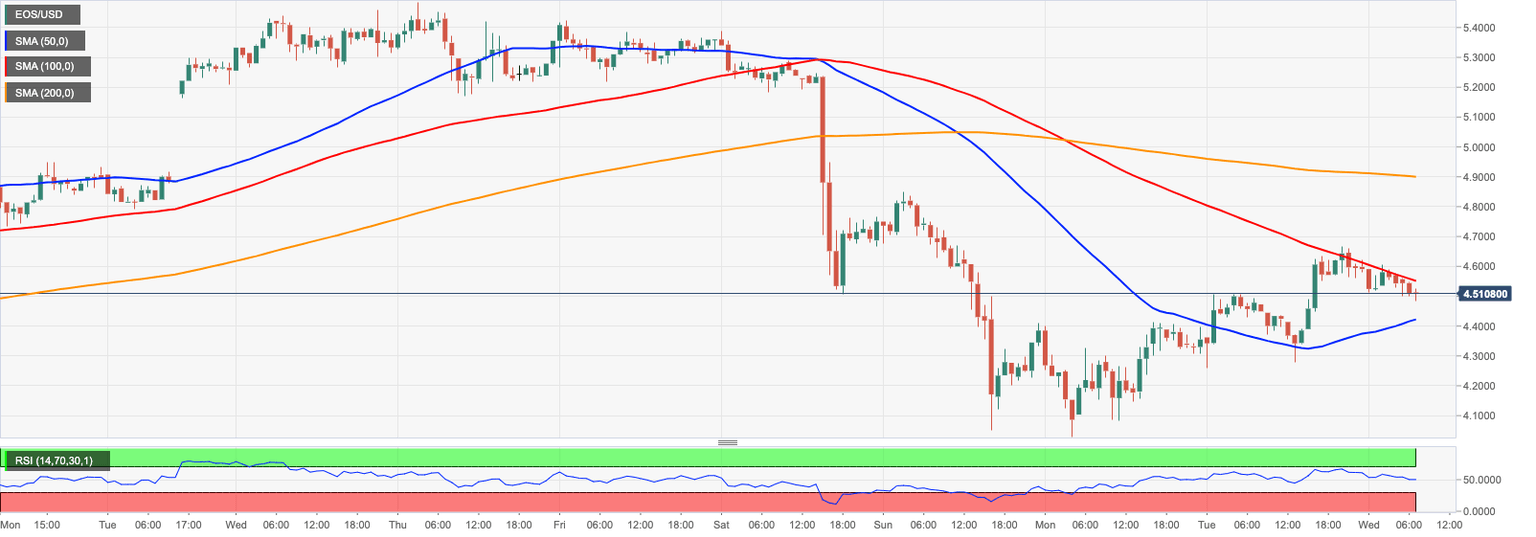

On the intraday chart, EOS/USD has been effectively capped by the sloping SMA100 1-hour (currently at $4.55). A sustainable move above this area will help to improve the short-term technical picture and allow for an extended recovery towards $4.70 (SMA100 4-hour) and psychological $5.00.

On the downside, the initial support is created by $4.30 (SMA200 4-hour) and $4.00 reinforced by the recent low. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $3.88 (SMA50 daily).

EOS/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst