EOS delisted from Binance P2P, recovery stalls on approach to $3

- Binance removes the 14th largest coin from its P2P platform.

- EOS/USD recovers from the strong support area, but the upside is limited.

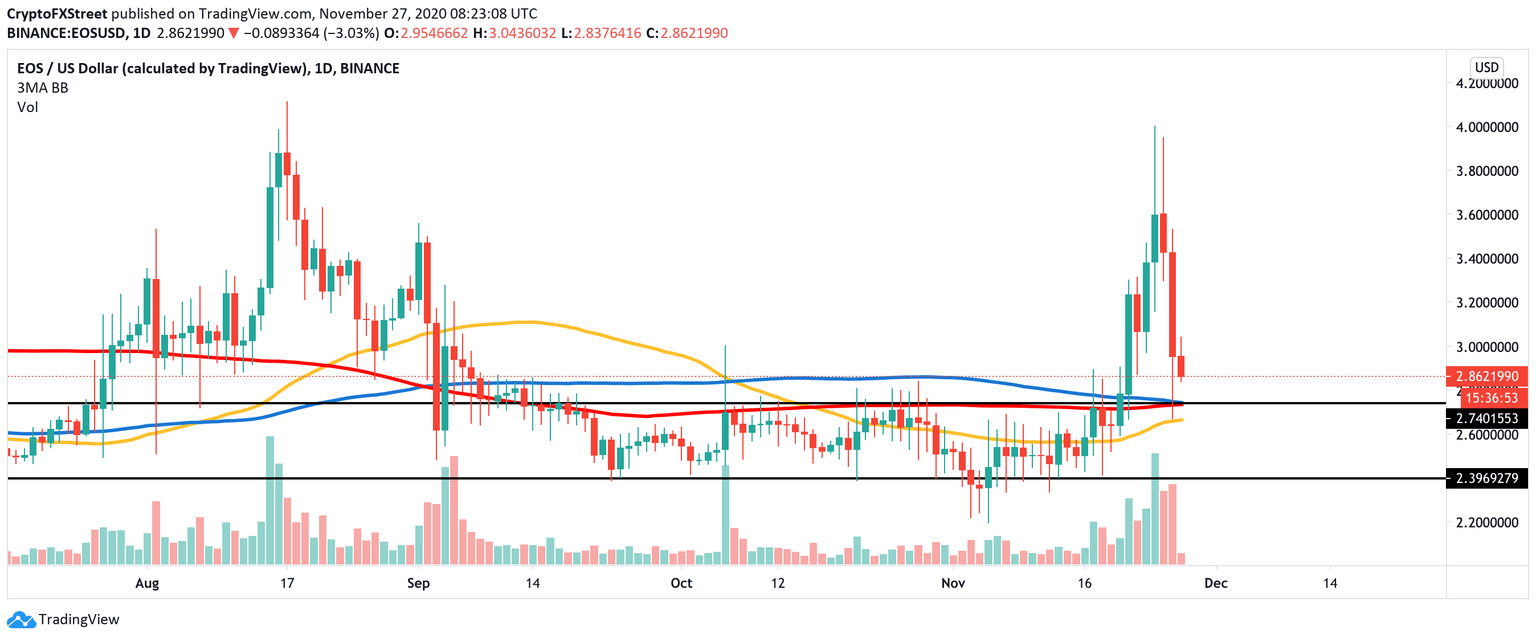

EOS hit the top at $3.89 on November 25, only to collapse to $2.66 on the next day amid the sell-off across the cryptocurrency market. By the time of writing, the token has recovered from the low to trade at $2.9; however, it is still nearly 7% down on a day-to-day basis.

EOS sits in 14th place in the global cryptocurrency rating with the current market capitalization of $2.7 billion and an average daily trading volume of $5.6 billion. Currently, the token is most actively traded on Binance and Huobi Global.

Binance delists EOS from P2P platform

The world's largest cryptocurrency exchange announced today that EOS is no longer supported on its peer-to-peer platform. All users were asked to complete the related transactions and delete the EOS advertisements by 4:00 AM (UTC) on November 27. Also, all EOS tokens should be transferred from the P2P wallet to the spot wallet.

Notably, the exchange did not provide any explanations and gave users short notice of the decision. The community is bewildered by the Binance move as EOS is considered a popular token.

According to the Chinese blockchain reporter Collin Wu, EOS was hugely popular in China in 2018.

Binance announced that P2P trading zone (fiat currency trading) will list the stable coin Dai (DAI) on November 27, 2020, and delist EOS (EOS) at the same time. EOS was very popular in China in 2018. Dai, the largest decentralized stablecoin on Ethereum, was developed by MakerDAO pic.twitter.com/LL6UvHQtHR

— Wu Blockchain(Chinese Crypto Reporter) (@WuBlockchain) November 27, 2020

EOS found support, but recovery momentum is weak

The market reaction to this Binance delisting news has been muted so far. From the technical point of view, EOS/USD is well-supported by the broken consolidation channel's upper line at $2.7. This barrier is reinforced by a combination of daily 100 and 200 EMA. If this support level is cleared, the sell-off may be extended to the channel's lower line at $2.4.

EOS/USD, daily chart

On the upside, EOS may struggle to approach the psychological $3 and $3.3 as this level served as a strong resistance during the August rally. A sustainable move above will allow the bullish momentum to gain traction and retest $3.7, followed by the psychological $4.

Author

Tanya Abrosimova

Independent Analyst