Enjin partnership with Uniqly catalyzes ENJ price to 20% bull rally

- Enjin recently revealed their collaboration with Uniqly to further develop the NFT space.

- Uniqly plans to launch its ecosystem on Enjin’s upcoming Efinity blockchain.

- Enjin Coin price shows a solid bounce from a demand level, hinting at a 20% upswing.

Enjin, an NFT-related blockchain, has announced integration with Uniqly, a bridge between NFT and physical products. ENJ price revealed a quick bounce from a support area as users reacted to this news.

NFT adoption soars

Enjin has been one of the significant NFT-focussed blockchains before the mania took over the main street.

Uniqly is a marketplace that allows trading NFT tokens backed by real-world items and is also an escrow that simplifies the exchange of physical products like clothing, works of art, collectibles, etc.

The recent collaboration will allow Uniqly to onboard its ecosystem on Enjin’s Efinity blockchain, which brings the cross-chain NFT markets one step closer to reality.

The blog details:

Working with Enjin will allow us to take the first step toward a global, decentralized market that blurs the lines between the physical and digital world.

Although not definitive as of this writing, the partnership has plans to launch the first planned release of a limited-edition collection of designer NFT shirts, all redeemable via the token burn process.

Enjin Coin price primed to test swing high

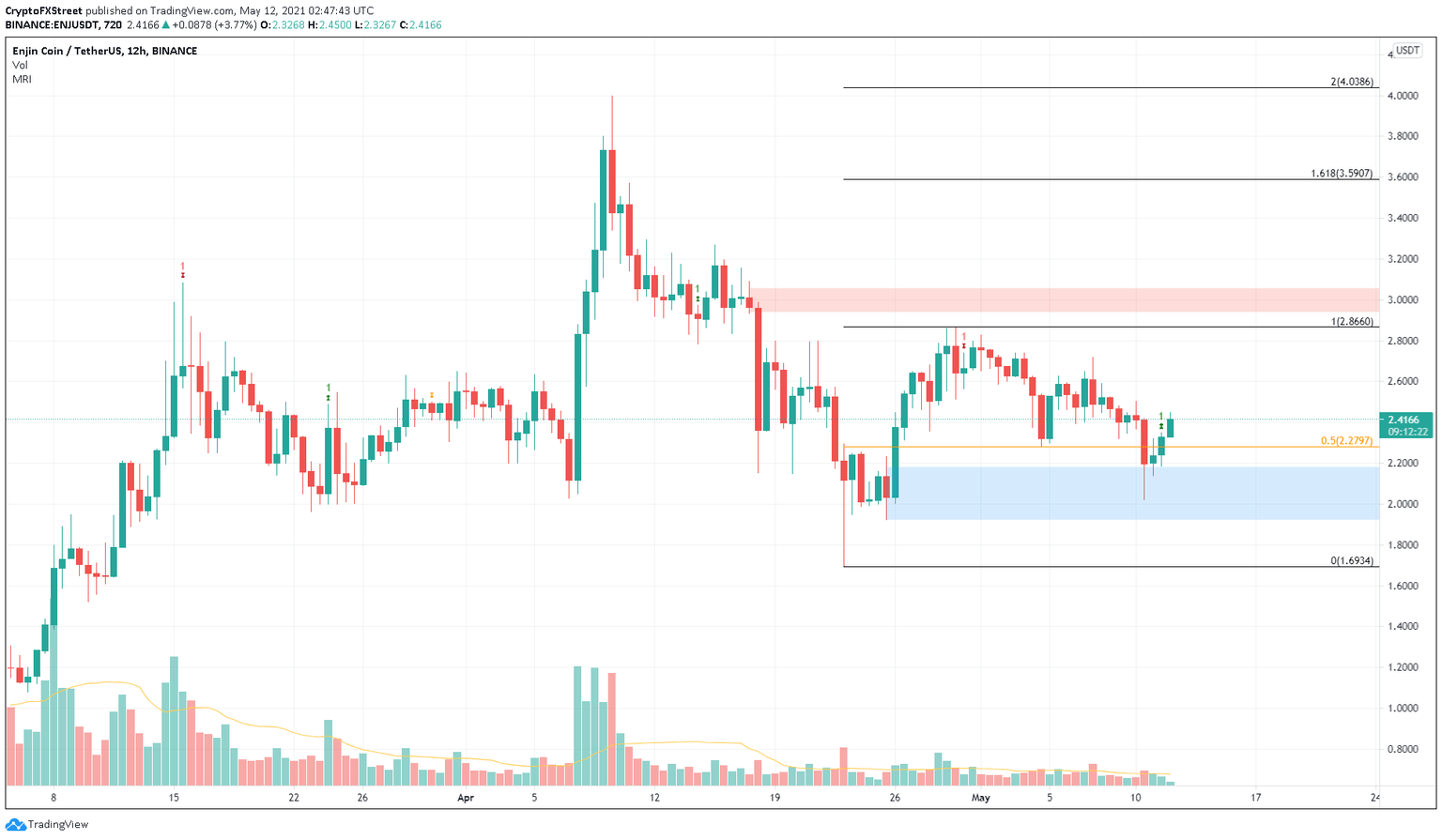

Enjin Coin price dipped into a demand zone that stretches from $1.92 to $2.18 on May 10. Since then, ENJ has surged 21% to move above this support area successfully. This move suggests a resurgence of buyers, indicating that a bull rally awaits Enjin Coin price.

The Momentum Reversal Indicator (MRI) has flashed a buy signal in the form of a green ‘one’ candlestick on the 6-hour chart, further confirming the bullish outlook mentioned above.

This setup forecasts a one-to-four candlestick upswing for ENJ.

Hence, investors can expect ENJ to rally toward the $2.86 level, the swing high created on April 29. However, the resistance level at $2.65 may slow down this ascent or even stop it in its tracks. Therefore, market participants should keep a close eye on this barrier.

ENJ/USDT 12-hour chart

On the flip side, a potential spike in selling pressure that produces a 12-hour candlestick close below $1.92 will invalidate the bullish thesis and kickstart an 11% downswing to $1.69.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.