Enjin Coin price rally fades quickly despite Coinbase listing

- Enjin Coin price hits new high after being catapulted by a bullish outside day.

- Coinbase Pro platform listing cements awareness and interest in ENJ.

- Enjin JumpNet capturing the attention of NFT fans and crypto miners.

Enjin Coin was drifting until the bullish outside day on April 7, encapsulating the previous 11 days on well above-average volume. The following breakout into a new high was decisive, but it has since retraced back into the base. The next couple of days will be vital to ascertaining whether ENJ can restart the rally.

Enjin Coin price breakout may have been a bull trap

The new ENJ listing on Coinbase has shone the light on the token as a new alternative for cryptocurrency fans. Enjin Coin is the child of Enjin, a blockchain-based game and app developer that envisioned helping transactions between players with a currency of value.

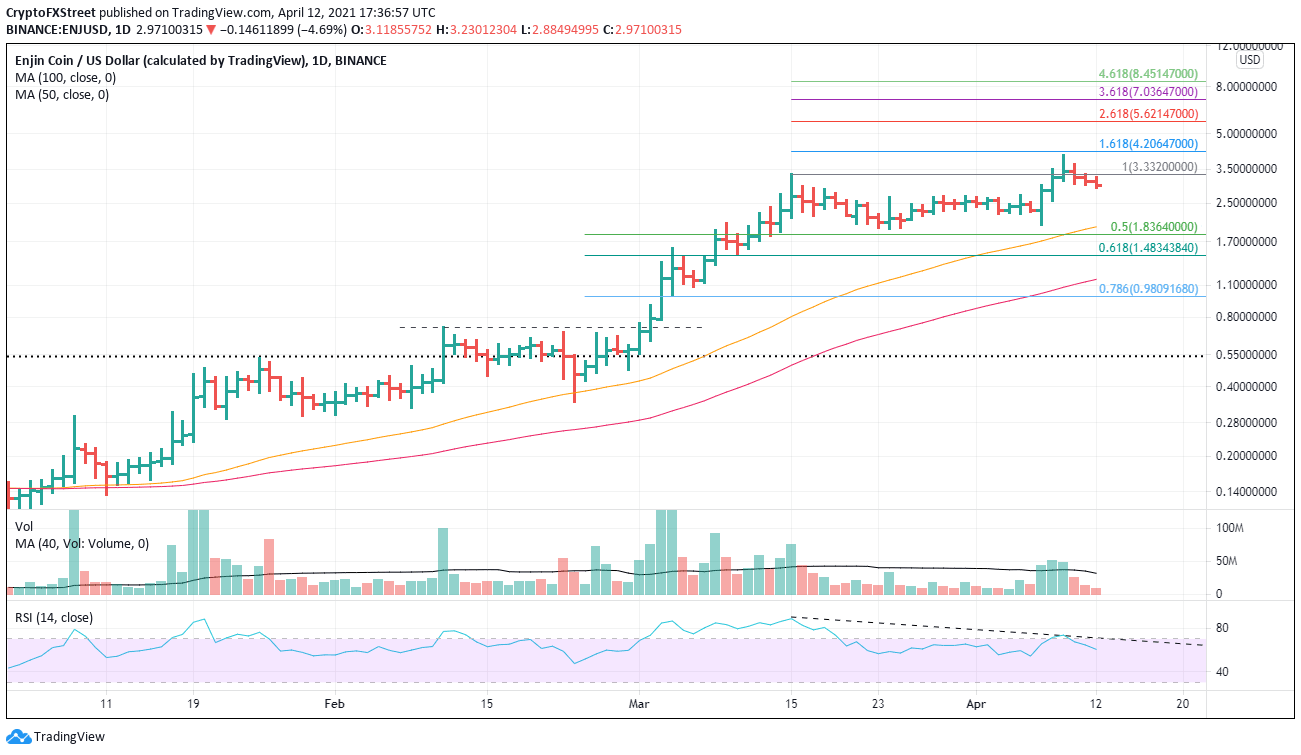

Over the last three days, the ENJ rally has faded, and it has returned to the base, albeit on lighter than average volume. However, the sharp reversal on April 9 near the 161.8% Fibonacci extension of the March correction emphatically shows resistance. Ideally, the token should retake the high at $4.03 within the next two to three days, or it raises the odds that the breakout was a bull trap.

A continuation of the reversal will not discover meaningful support until the low of the April 7 bullish outside day at $2.00. The 50-day simple moving average (SMA) at $1.97 will provide additional support, followed closely by the 50% retracement of the rally from the February 23 low at $0.341.

ENJ/USD daily chart

A renewal of the breakout would target the 161.8% extension at $4.20 and then the 261.8% extension at $5.62.

Speculators need to give ENJ a couple of days to see if the pullback is a shakeout or a bull trap. Moreover, they should note the daily Relative Strength Index (RSI) showed a bearish momentum divergence at the new high, making the rally less sustainable.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.