Elrond Price Prediction: EGLD in search of platform, eyes 25% ascent

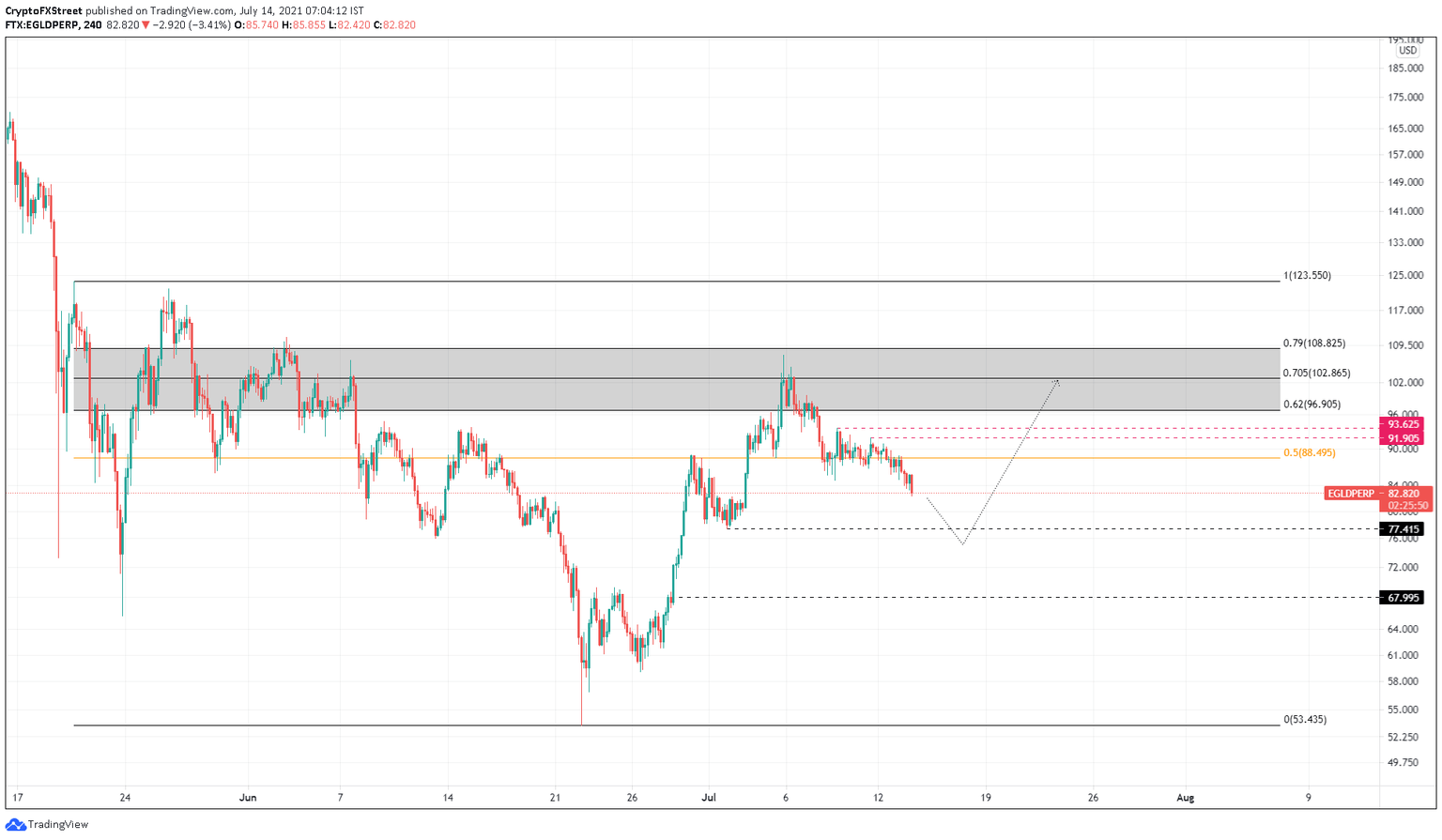

- Elrond price is retracing after getting rejected at $102.87 on July 5.

- An upswing is likely to emerge after the pullback sweeps July 2 swing lows at $77.42.

- A breakdown of the $68 support level will invalidate the bullish thesis.

Elrond price witnessed an impressive upswing between June 26 and July 2, which was followed by a steep downtrend after piercing the high probability reversal zone. The pullback will continue until it finds a suitable support level.

Elrond price looks to restart upswing

Elrond price has retraced roughly 23% over the past week, after an 82% climb between June 26 and July 2. The downswing was inevitable due to the exponential growth in EGLD’s market value and the entry into a high probability reversal zone extending from $96.91 to $108.83.

As Elrond price slices through the trading range’s midpoint at $88.50, investors can expect the correction to continue another 8%. Such a move will sweep the swing lows at $77.42, providing liquidity and serving as a reversal point.

If the buyers come to Elrond’s rescue, it is likely a 15% upswing that tags $88.50 will be seen. If the bullish momentum is enough to break through this barrier, Elrond price will consolidate between $91.91 and $93.63.

In a highly bullish case, EGLD price might tag 62% Fibonacci retracement level at $96.91, which is the starting point of the high probability reversal zone.

EGLD/USDT 4-hour chart

While the reversal at $77.42 seems plausible, investors need to consider the possibility of an extended correction. If the buyers fail to climb above $77.42 after a sweep, Elrond price will likely shed another 12% until it finds the support level at $68.

A breakdown of this barrier will invalidate the bullish thesis and, in some cases, push EGLD down to the June 27 swing low at $61.81.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.