Elrond Price Prediction: EGLD aims for a 30% rebound amind market’s recovery

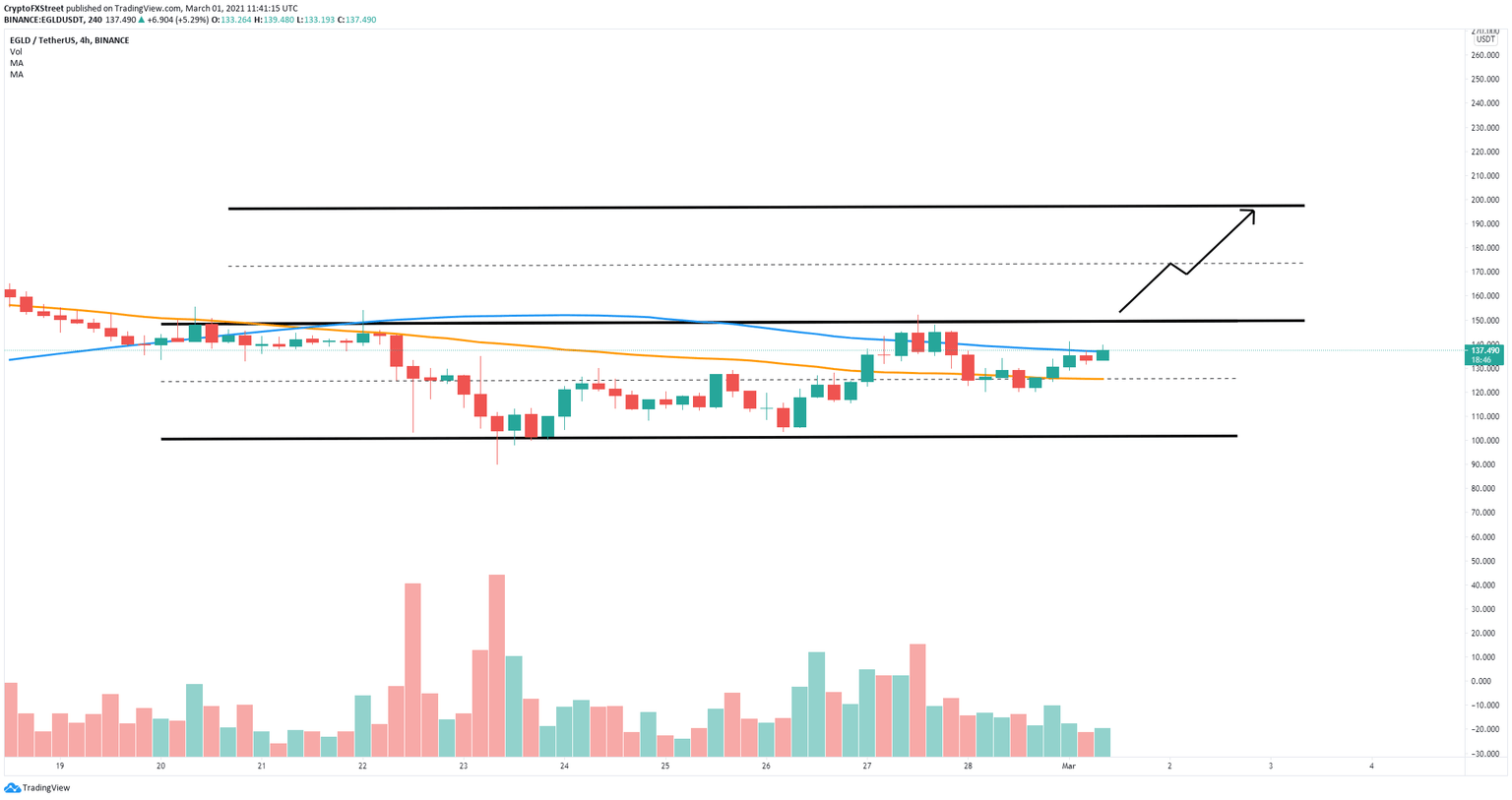

- Elrond price is contained inside a parallel channel on the 4-hour chart.

- The cryptocurrency market has experienced a significant rebound in the past 24 hours.

- The digital asset faces only one critical resistance level before a 30% breakout.

The cryptocurrency market had a significant recovery in the past 24 hours gaining $150 billion in market capitalization. Elrond price climbed from a low of $120 up to a current price of $138 and aims for more in the short-term.

Only this key level separates Elrond price from hitting $200 again

On the 4-hour chart, Elrond has established a parallel channel that favors the bulls as they have confirmed an uptrend. The key resistance trendline is established at $150 but EGLD also needs to see a candlestick close above the 100-SMA at $137.

EGLD/USD 4-hour chart

A breakout above the critical resistance point of $150 should push Elrond price towards $170 initially, but up to $200 in the longer-term as there isn’t a lot of resistance to the upside.

On the other hand, a candlestick close below the 100-SMA would be a bearish sign in the short-term which could drive Elrond price down to the middle of the channel at $126, coinciding with the 50-SMA. Losing this support level would push EGLD down to $100.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.