El Salvador rushes in new Bitcoin law to comply with IMF deal: Report

El Salvador’s Congress has reportedly swiftly approved legislation to amend its Bitcoin laws to comply with a deal struck with the International Monetary Fund to adjust its exposure to crypto.

The bill was ratified by the country’s Legislative Assembly just minutes after President Nayib Bukele sent it the legislation, Reuters reported on Jan. 29

El Salvador struck a $1.4 billion loan deal with the IMF in December, with the agency requiring the Bukele’s government to scale back its involvement in Bitcoin BTC $105,254 and make BTC optional and voluntary for private sector merchants.

The reform was passed with 55 votes in favor and only two against. Previously, it was a legal requirement for businesses to accept Bitcoin as payment.

Ruling party lawmaker Elisa Rosales said the amendment was needed to guarantee Bitcoin’s “permanence as legal tender” while facilitating its “practical implementation.”

El Salvador has continued its accumulation of Bitcoin, purchasing an additional 12 BTC for the country’s strategic reserves.

An El Salvador Bitcoin Office spokesperson told Cointelegraph last month that the country intends to keep buying Bitcoin, with plans to “intensify in 2025.”

“We have achieved not only the greatest rebrand in history, but we are now an actual case study for a winning country strategy,” the spokesperson said.

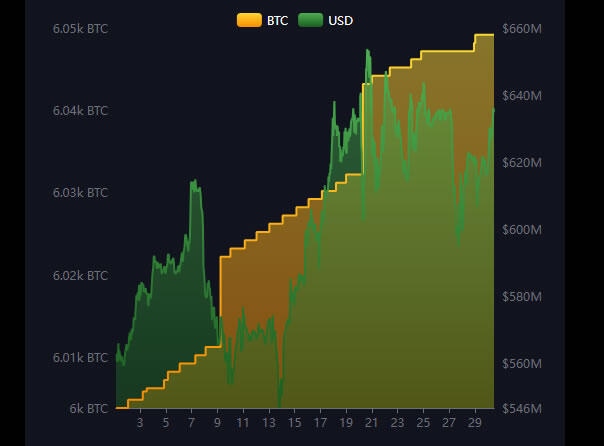

El Salvador currently holds 6,049 BTC worth around $633 million, according to the Bitcoin Office official tracker. The portfolio has made a 127% profit with an average purchase price of $46,000 per Bitcoin.

El Salvador BTC purchases over time. Source: Bitcoin Office

El Salvador became the first country to make Bitcoin legal tender in 2021. Meanwhile, former US Senator Bob Menendez, who fought against El Salvador adopting Bitcoin, was sentenced to 11 years in prison for taking bribes in gold and cash on Jan. 29, according to the Associated Press.

FBI agents who searched his house found $480,000 in cash and gold bars worth an estimated $150,000, the report added.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.