EIP-4844 catalyzes ARB, SNX, OP, and VELO as Layer-2 season proliferates

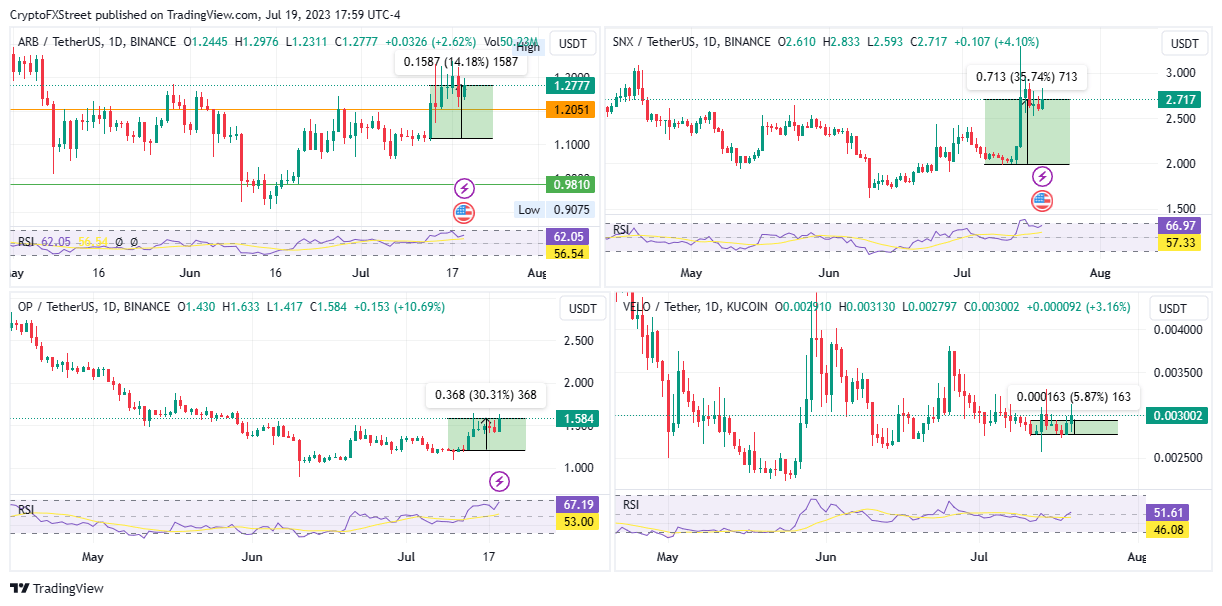

- Arbitrum, Synthetix, Optimism, and Velo prices have rallied 15%, 35%, 30%, and 5%, respectively, over the week.

- The four tokens ride the Layer-2 season with the Ethereum Improvement Proposal, EIP-4844, providing hind winds.

- The rally comes as traders draw toward reduced gas fees, a break from the long-standing challenge for the ETH blockchain.

EIP-4844, an Ethereum Improvement Proposal, has been a strong theme this week by acting as a catalyst for Layer-2 (L2) tokens. As a result, cryptocurrencies within the L2 category have recorded massive gains on both daily and weekly timescales, with Arbitrum, Synthetix, Optimism, and Velo taking the front-row seats.

Also Read: Why Ethereum's EIP-4844 could kickstart bull run for Optimism (OP), Arbitrum (ARB), Polygon (MATIC)

EIP-4844 catalyzes Layer-2 season

EIP-4844 defines an improvement proposal for the Ethereum network, an upgrade that comes with reduced gas fees. Notably, gas fees, and therefore transaction cost, has been a long-standing concern for the Ethereum network.

EIP-4844, christened proto-Danksharding, increases the speed of transactions on the Ethereum (ETH) blockchain while reducing the transaction cost while keeping everything decentralized. To do this, the network presents a special type of " forward-compatible " transaction by accepting data blobs.

The upgrade has boded well for L2 tokens as traders side with cost efficiency and increased throughput within a secure ecosystem that is Ethereum.

Current narratives :

— VIKTOR (@thedefivillain) July 19, 2023

- The Ripple news propelled $XRP (+70% in one week) and $XLM (+45%) and they are performing well today

- L2 season and EIP-4844 catalyst : $OP is strong (+20%), $VELO too as levered OP bet, $SNX too (+ Infinex perp dex announced). Also $ARB is up 10% this…

The upgrade also increases the competitiveness of the Ethereum network within the crypto playing field, making it the go-to ecosystem for global transactions.

EIP-4844 working mechanics

For the layperson, the upgrade will enable the Ethereum network to handle the capacity for a global network of transactions. This comes as Ethereum developers strive to identify and implement solutions to address its ever-growing user base and spare them the hassle of expensive fees.

The upgrade offers network users the voice to suggest new features and solutions to the Ethereum protocol.

ARB, SNX, OP, and VELO rally on the back of the EIP-4844 upgrade

Arbitrum (ARB), Synthetix (SNX) Optimism (OP), and Velo (VELO) tokens are up 15%, 35%, 30%, and 5%, respectively, over the week, as indicated in the daily charts below.

ARB/USDT 1-Day Chart, SNX/USD 1-Day Chart, OP/USDT 1-Day Chart, VELO/USDT 1-Day Chart

With the EIP-4844 upgrade providing tailwinds, the four L2 tokens appear poised for a continued uptrend. The Relative Strength Index (RSI) is sloping upwards, suggesting rising momentum. This adds credence to the bullish thesis.

On the daily timeframes, Arbitrum, Synthetix, Optimism, and Velo are up 2%, 5%, 10%, and 7%, respectively, with surging investor interest indicated by their respective 24-hour trading volumes. These show that traders are actively interacting with the four L2 chains.

Read Further: Ethereum Improvement Proposal EIP-4844 turns experts bullish, will ETH price rally?

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.