Dogecoin upside is limited to $0.20 as DOGE continues to coil up

- Dogecoin price coils up under a declining trend line, suggesting a dearth of volatility.

- A breakout from this barrier is likely to propel DOGE to $0.163, constituting a 23% run-up.

- A daily candlestick close below $0.127 will invalidate the bullish thesis for DOGE.

Dogecoin price is stuck producing lower highs and equal lows between two crucial barriers. As this price action progress, DOGE becomes increasingly coiled up. A breakout from this consolidation is likely to pop, leading to a quick run-up.

Dogecoin price to launch soon

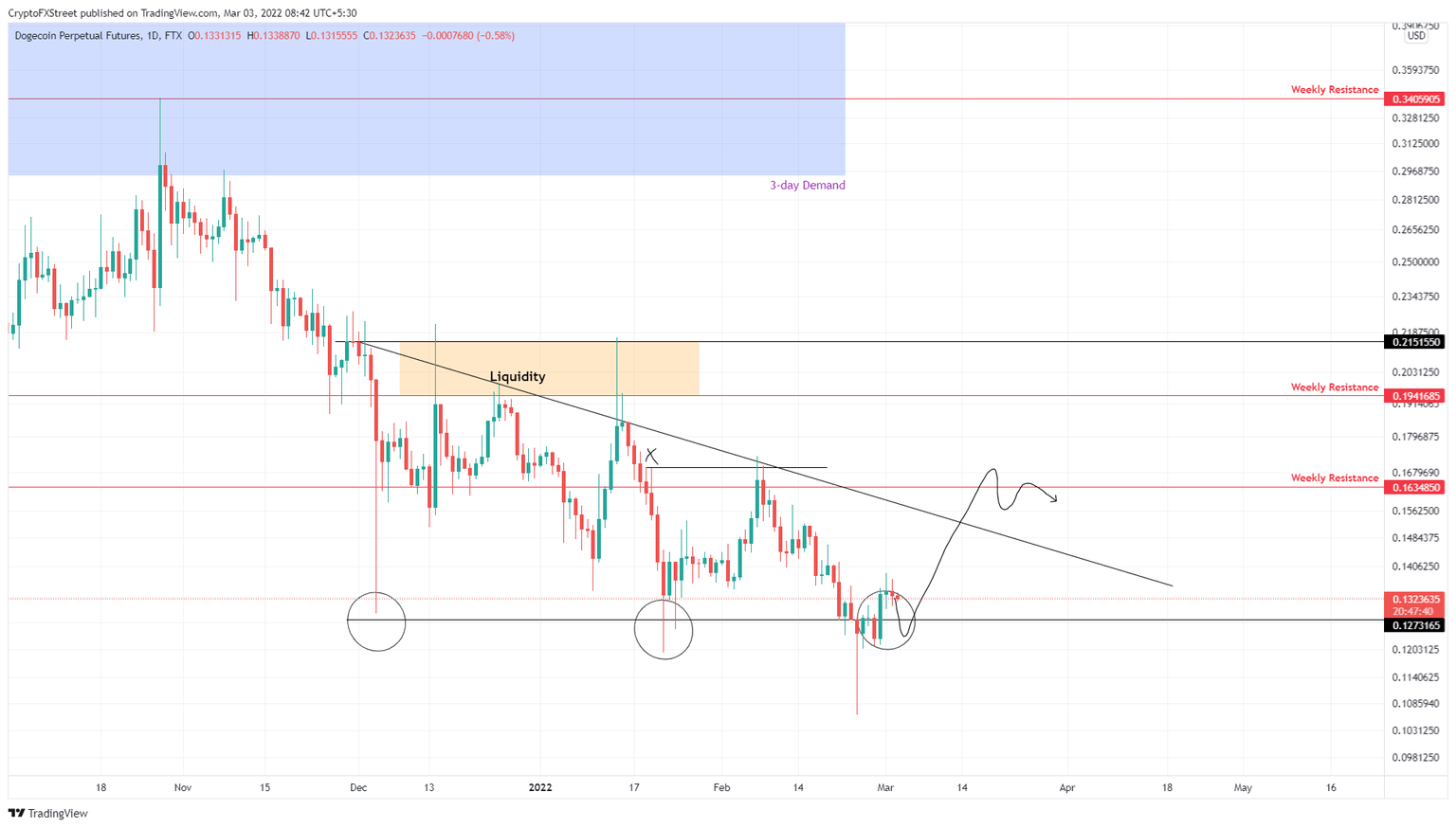

Dogecoin price has set four lower highs and three equal lows since November 2021. A trend line drawn rough along the candlesticks of these swing highs shows a declining resistance barrier.

As DOGE gets squeezed between the aforementioned trend line and the $0.127 support level, it signals a breakout will be explosive. Dogecoin price is currently bouncing off the horizontal barrier and will make a 15% run for the declining trend line.

A decisive close above this hurdle will open the path for DOGE to retest the weekly resistance barrier at $0.163. This move would represent a 23% ascent from the current position - $0.132. There is a good chance for DOGE to form a local top around $0.163, but a resurgence of buying pressure combined with market makers’ intent to collect liquidity might propel the meme coin to retest the $0.194 hurdle and sweep above it.

This extension would bring the total gain from 23% to 47% for the Dogecoin price.

DOGE/USDT 1-day chart

While things are looking exceptionally optimistic for Dogecoin price, a failure to move past the declining trend line will indicate a weakness on buyers’ part. However, if DOGE produces a daily candlestick close below $0.127, it will create a lower low and invalidate the bullish thesis.

In this scenario, Dogecoin price could crash 41% and revisit the $0.0746 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.