Dogecoin price remains poised to test $0.45 as dip-buying to lift DOGE

- Dogecoin price clings to 200-DMA as DOGE bulls gather strength.

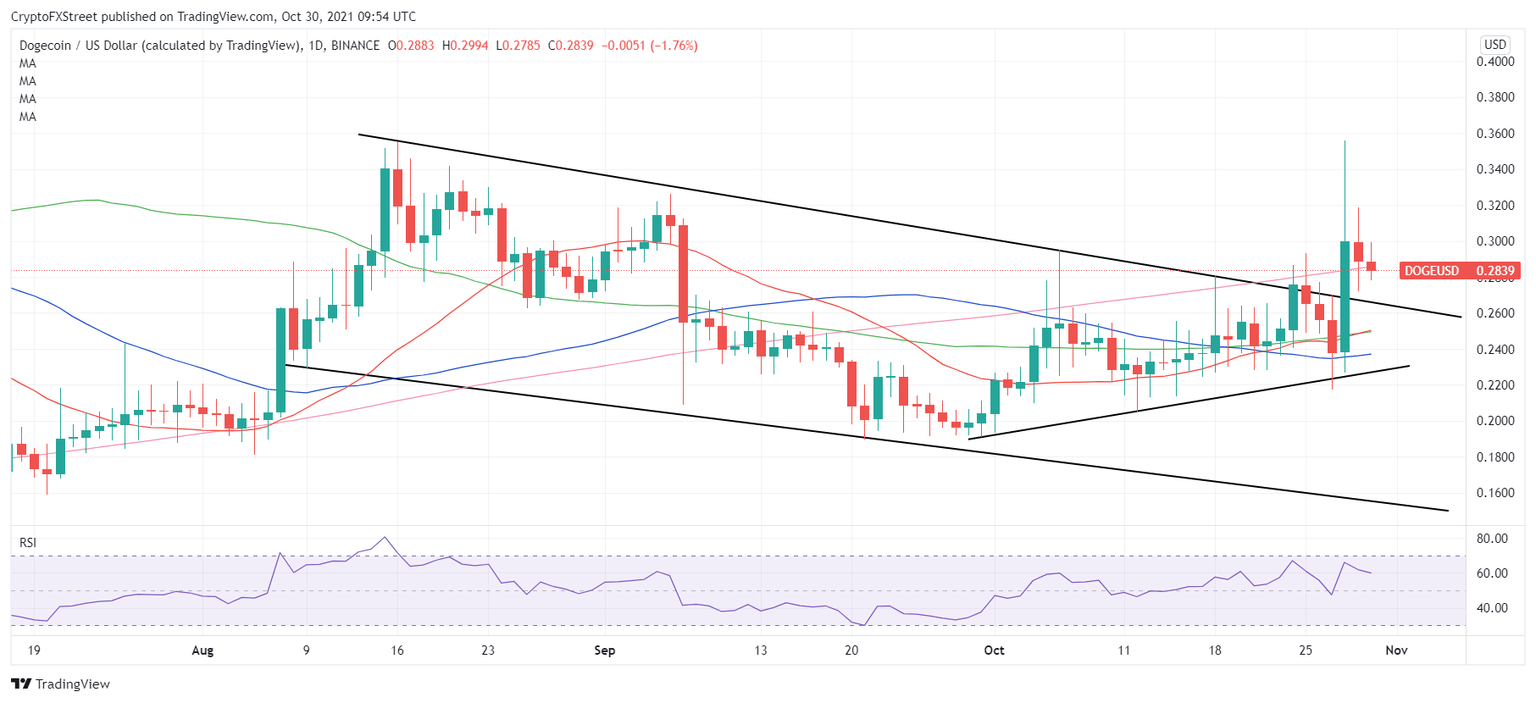

- Falling channel breakout on the 1D chart calls for a test of $0.45.

- RSI turns south but holds well above 50.00, supporting DOGE buyers.

With the rotation of investors’ capital from Bitcoin, Ethereum and Ripple into the canine-themed coins over the past week, Dogecoin wasn’t left behind, as it is looking to end the week with 16% gains.

Despite this week’s solid performance, DOGE bulls seem to have taken a breather over the last 36 hours, as the price enters an upside consolidative mode after Thursday’s massive surge to four-month tops of $0.3556.

In doing so, DOGE price surpassed the mid-August highs of $0.3552, from where the preceding downtrend had kicked in.

The tenth most widely is trading marginally lower on the day, unable to find footing above the $0.29 mark for the second straight day this Saturday.

Dogecoin price eyes additional upside despite the recent pullback

As observed in Dogecoin’s daily chart, DOGE price is trying hard to defend the critical 200-Daily Moving Average (DMA) at $0.2861, as it extends the corrective pullback from two-month highs on Saturday.

However, DOGE price continues to waver within Friday’s trading range, as the bulls bide time before a convincing extension of the renewed upswing.

On Thursday, the canine-inspired coin soared 27%, extending the upside breakout from a two-month-long falling channel confirmed last Sunday. The channel breakout materialized after DOGE price closed above the falling trendline resistance, then at $0.272.

DOGE bulls recaptured the upward-pointing 200-DMA on the massive upswing and have managed to close above the latter, thus far.

The latest move lower in Dogecoin can be attributed to the sharp downtick in the Relative Strength Index (RSI) indicator. The pullback appears shallow and could be seen as a good dip-buying opportunity for DOGE optimists, as the RSI continues to hold above the midline.

If the bulls fight back control, then DOGE price could swing back towards the multi-month highs above $0.3550.

The next upside barrier for DOGE bull is placed at pattern target measured at $0.4432.

DOGE/USD: Daily chart

On the downside, DOGE price could meet initial demand at the channel resistance now support at $0.2649 should the correction picks up steam and knocks down the 200-DMA on a daily closing basis.

Further south, $0.2490 will limit additional losses in Dogecoin. At that level, the 21-DMA meets the 100-DMA.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.