Dogecoin Price Prediction: DOGE interest dwindles as buyers unable to prevent 14% decline

- Dogecoin price may not be able to prevent a 14% decline as the token is sealed in a downtrend.

- DOGE is testing its last line of defense at $0.120 before the token drops toward $0.104.

- In order to invalidate the bearish chart pattern, Dogecoin will need to slice above $0.156.

Dogecoin price is preparing for a further decline as the prevailing chart pattern suggests that DOGE is headed in a downward direction. The canine-themed token could tag the lower boundary of the governing technical pattern as it searches for support.

Dogecoin price locked in downtrend

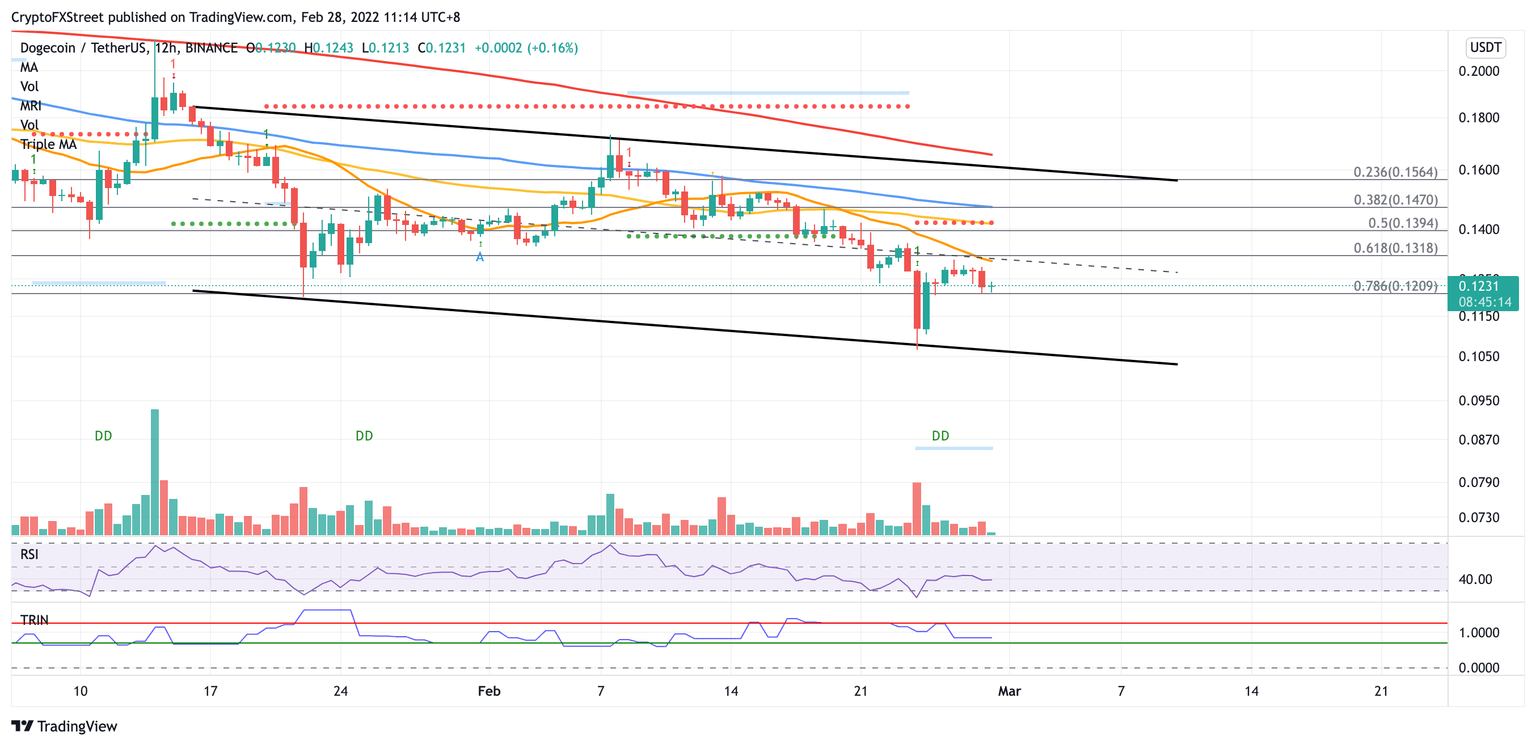

Dogecoin price has been sealed within a descending parallel channel on the 12-hour chart, indicating that the momentum has shifted to the downside.

Dogecoin price could soon tag the lower boundary of the prevailing chart pattern at $0.104, resulting in a 14% fall if DOGE slices below the 78.6% Fibonacci retracement level at $0.120 before dropping toward the pessimistic target.

An additional spike in sell orders may push Dogecoin price even further toward the April 13 high at $0.096, then toward the April 11 high at $0.080.

However, if the bulls manage to reverse the period of underperformance, Dogecoin price may target the middle boundary of the governing technical pattern at $0.131, which coincides with the 21 twelve-hour Simple Moving Average (SMA) and 61.8% Fibonacci retracement level.

DOGE/USDT 12-hour chart

A further increase in bearish sentiment may incentivize Dogecoin price to reach the resistance line given by the Momentum Reversal Indicator (MRI) at $0.141, coinciding with the 50 twelve-hour SMA.

If a spike in buy orders occurs, Dogecoin price will aim for the 100 twelve-hour SMA at $0.147 next, before attempting to tag the upper boundary of the descending parallel channel at $0.156.

Investors should note that if Dogecoin price manages to slice above the topside trend line of the prevailing chart pattern, the prevailing downtrend may be invalidated.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.