Dogecoin Price Prediction: DOGE coils up for 30% breakout

- After a composed liquidity sweep, Dogecoin price is leading the sector with a recovery rally.

- DOGE could make a 30% move north if Bitcoin price strength sustains.

- A break and close below $0.1255 would invalidate the bullish thesis.

Dogecoin (DOGE) price has recorded heightened volatility this month, amid soaring correlation with Bitcoin. As the pioneer cryptocurrency navigated FOMO, capital flows due to the spot ETF market and recently the Fed meeting, DOGE price fluctuated by association.

Also Read: Dogecoin Price Prediction: DOGE refuses to let WIF have all the fun

Dogecoin could rally 30%

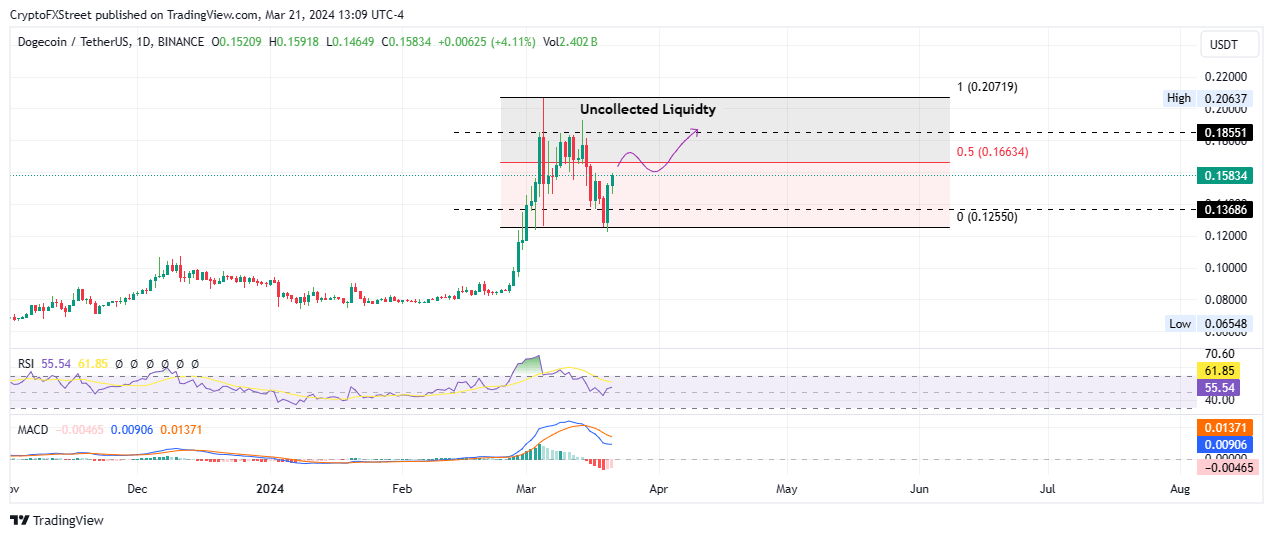

When Bitcoin price slumped to the $62,000 range in the aftermath of capital outflows from the ETF market, Dogecoin price plummeted to an intraday low of $0.1252 on Wednesday. The move saw DOGE price collect liquidity that resided in the sub-$0.1255 level.

With BTC now showing strength, Dogecoin price is on a recovery rally and could confront resistance due to the midrange of the market’s price action, marked by the 50% Fibonacci placeholder at $0.1663. A decisive candlestick close above this level could see DOGE price extend to the resistance at $0.1855.

The Relative Strength Index (RSI) reinforces the case for the bulls, bouncing atop the 50 level as part of a fluke rally. Increased buyer momentum could see Dogecoin price clear the stiff resistance at $0.1855, before a continuation to record a higher high above the March 5 peak of $0.2071.

DOGE/USDT 1-day chart

Conversely, early profit booking could see Dogecoin price drop to test the $0.1368 support. In a dire case, where this level fails to hold as support, the price could extend to the foot of the market range at $0.1255 before a potential recovery. A break and close below this level would invalidate the bullish thesis.

Also Read: Dogecoin soars nearly 20% after Coinbase announces listing of DOGE derivatives

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.