Dogecoin Price Forecast: DOGE on the cusp of a massive 85% explosion

- Dogecoin price is on the verge of a breakout from a bull flag established on the daily chart.

- The digital asset only faces one critical resistance level before a potential breakout to new all-time highs.

- Another key pattern formed on the 4-hour chart, will be decisive in the short-term momentum of DOGE.

Dogecoin price had another surge in the last three days jumping toward $0.348. The digital asset still aims for new all-time highs and it’s only facing one critical resistance level at $0.32.

Dogecoin price must overcome this barrier for new all-time highs

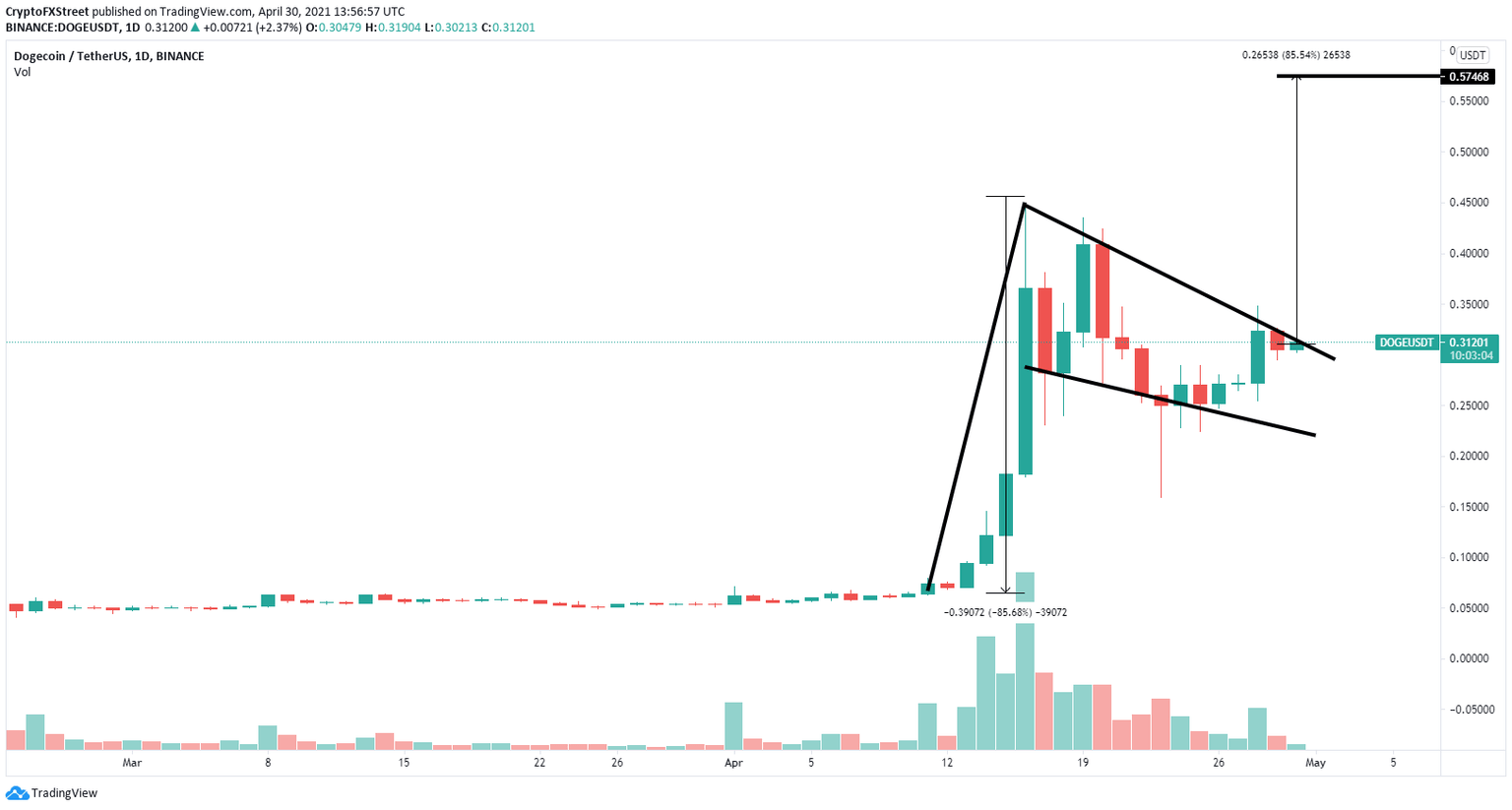

On the daily chart, Dogecoin price formed a bull flag which could be on the verge of a breakout. The most significant resistance level is formed at around $0.32. A daily candlestick close above this point would confirm a breakout.

DOGE/USD daily chart

This breakout has a price target of $0.57, which would be a new all-time high. There is only one in-between target at $0.45.

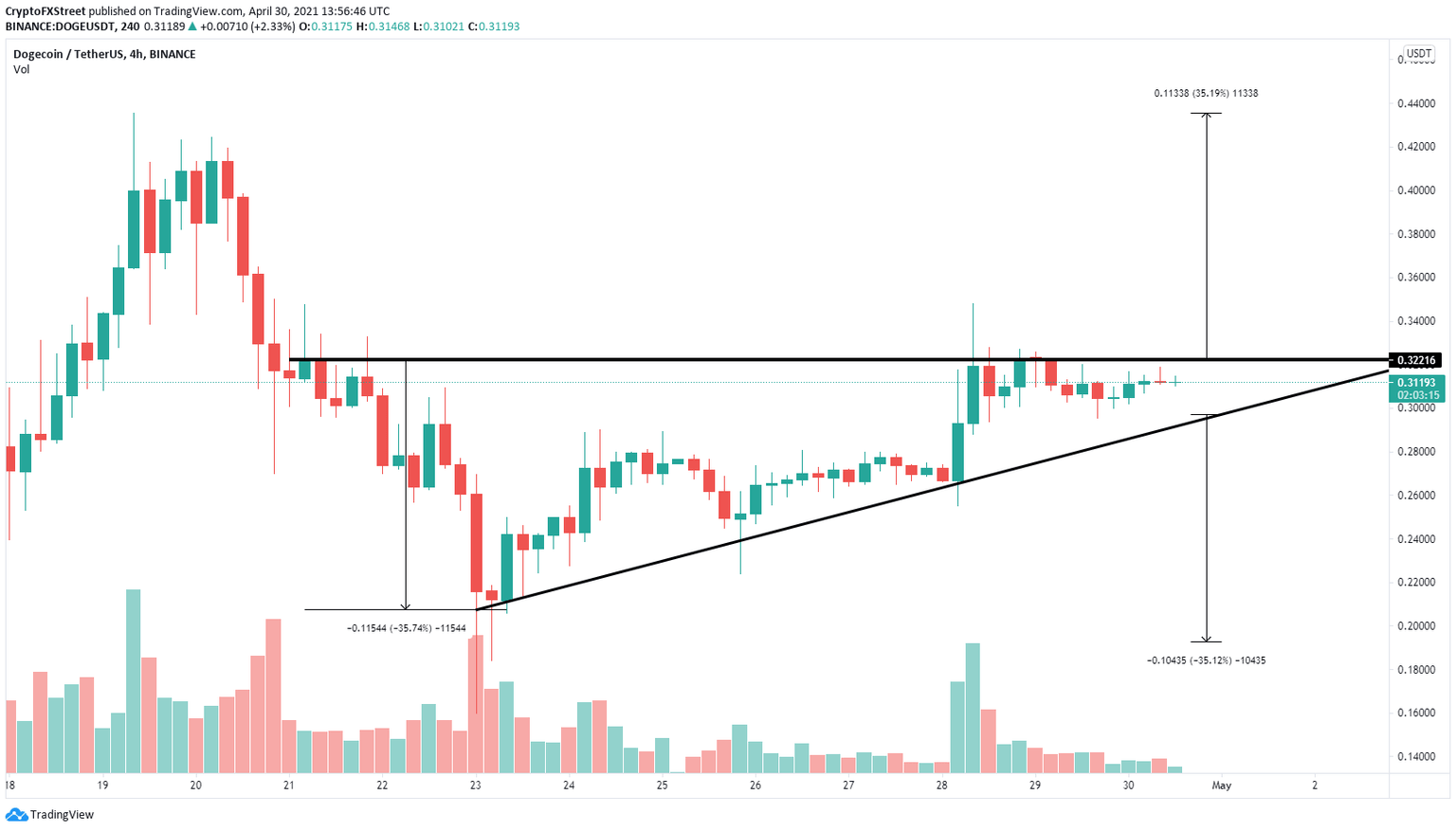

Additionally, on the 4-hour chart, Dogecoin formed an ascending triangle pattern which can be drawn with an upper horizontal trend line and another one connecting the higher lows. The resistance level coincides with the one above at $0.32.

DOGE/USD 4-hour chart

However, if Dogecoin price gets rejected at the top, it can quickly fall toward the lower boundary of the pattern at $0.29. A 4-hour candlestick close below this point would confirm a breakdown with a 35% price target at $0.193.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.