Dogecoin Price Prediction: DOGE bulls can stay hopeful above these levels

- DOGE/USD fades upside break of short-term resistance line, now support.

- Sustained trading beyond key SMA confluence, three-week-old rising trend line favor bulls.

- Friday’s low adds to the downside filters, bulls seek fresh monthly top.

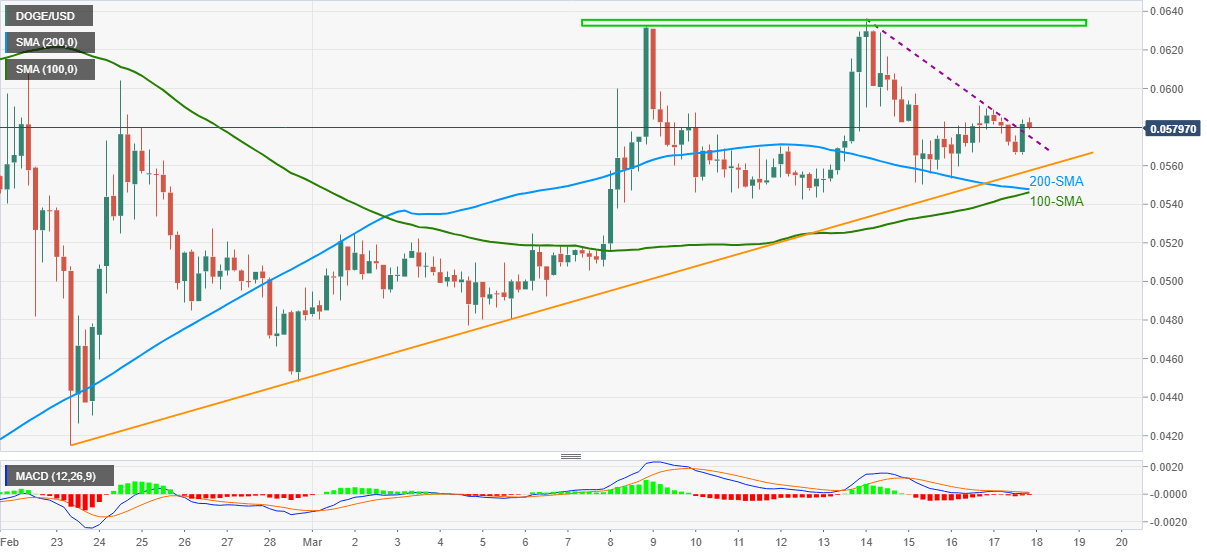

DOGE/USD fizzles the latest run-up beyond short-term resistance while easing to $0.0580 during early Thursday. Even so, the meme-coin keeps trend line breakout amid receding bearish MACD bias, not to forget trading above the key support lines and SMA confluence.

It should, however, be noted that the current pullback eyes re-test of the previous resistance line, at $0.0575, a break of which will eye for short-term support line from late February, at $0.0557 now.

If at all the DOGE/USD sellers manage to conquer the key support line, they won’t be able to retake the throne as a convergence of 100 and 200-SMA precedes Friday low, respectively around $0.0545 and $0.0540, challenge the quote’s further downside.

Meanwhile, recovery moves the $0.0600 threshold as an immediate target ahead of confronting the “double top” around $0.0635.

In a case where DOGE/USD bulls cross the key hurdle around $0.0635, the $0.0700 round-figure and the previous month’s record high around $0.880 should be the key to watch.

DOGE/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.