Dogecoin price outperforms LTC and BCH as Bitcoin’s $100K rally drives Proof-of-Work sector to $2B

- Dogecoin price surges 14% on Thursday, as Bitcoin’s rally above $100,000 sparked interest across the Proof-of-Work sector.

- Aggregate Proof-of-Work sector valuation grew 5.7%, according to Coingecko data, outpacing the overall crypto market.

- Litecoin, Bitcoin Cash, and Ethereum Classic also posted double-digit gains.

Dogecoin price surges 14% on Thursday, as Bitcoin’s rally above $100,000 sparked interest across the Proof-of-Work sector.

Dogecoin (DOGE) price grazes $0.20 as Bitcoin’s $100K rally sparks demand across the Proof-of-Work sector.

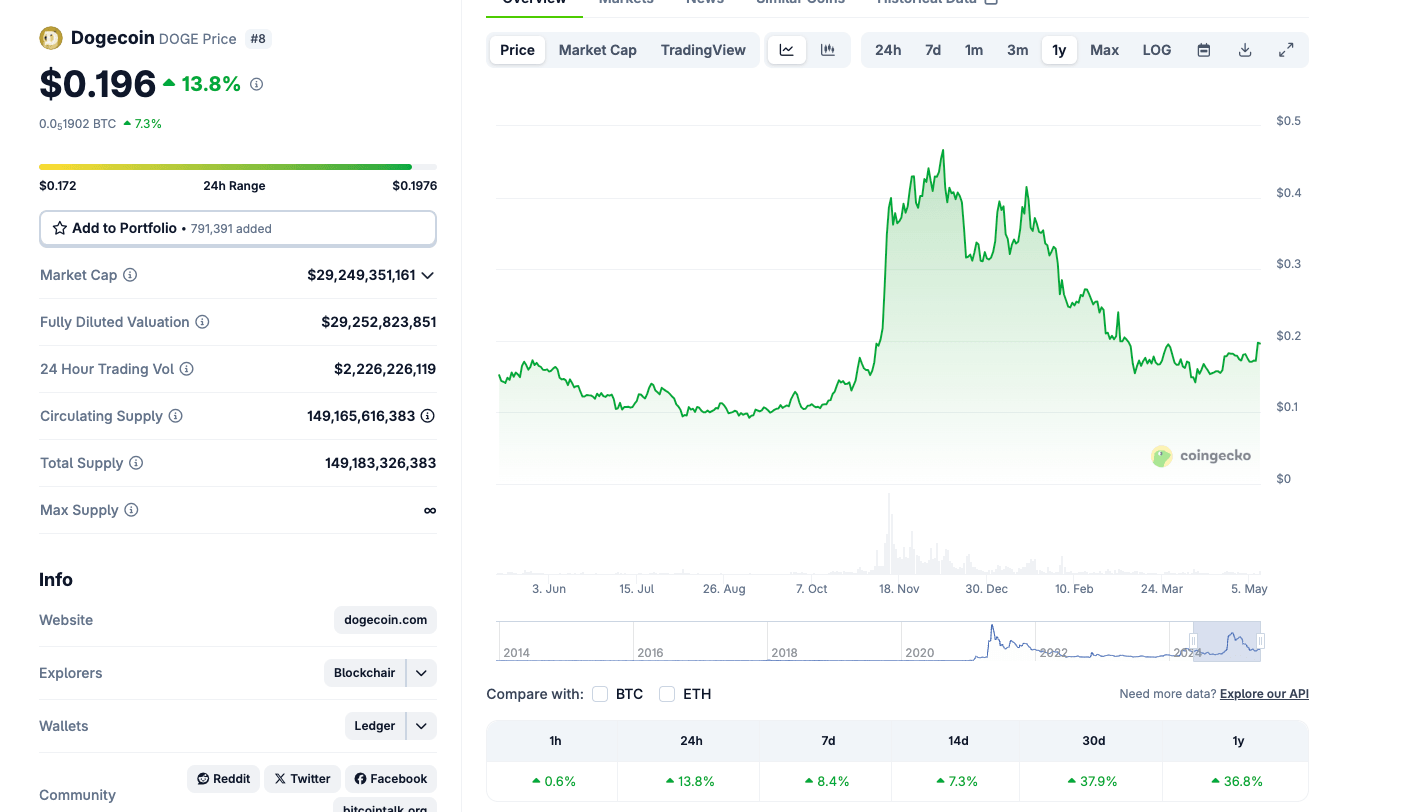

Dogecoin (DOGE) price surges 14% to hit $0.19 at press time, emerging as one of the standout performers on Thursday.

Coingecko data shows DOGE delivering double-digit gains alongside prominent Proof-of-Work coins, including Bitcoin Cash (BCH) and Litecoin (LTC).

Dogecoin Price Action, May 9, 2025 | Source: Coingecko

While Bitcoin’s rally above $100,000 for the first time since February dominated media headlines, investors flocked towards DOGE and other coins with narratives adjacent to BTC.

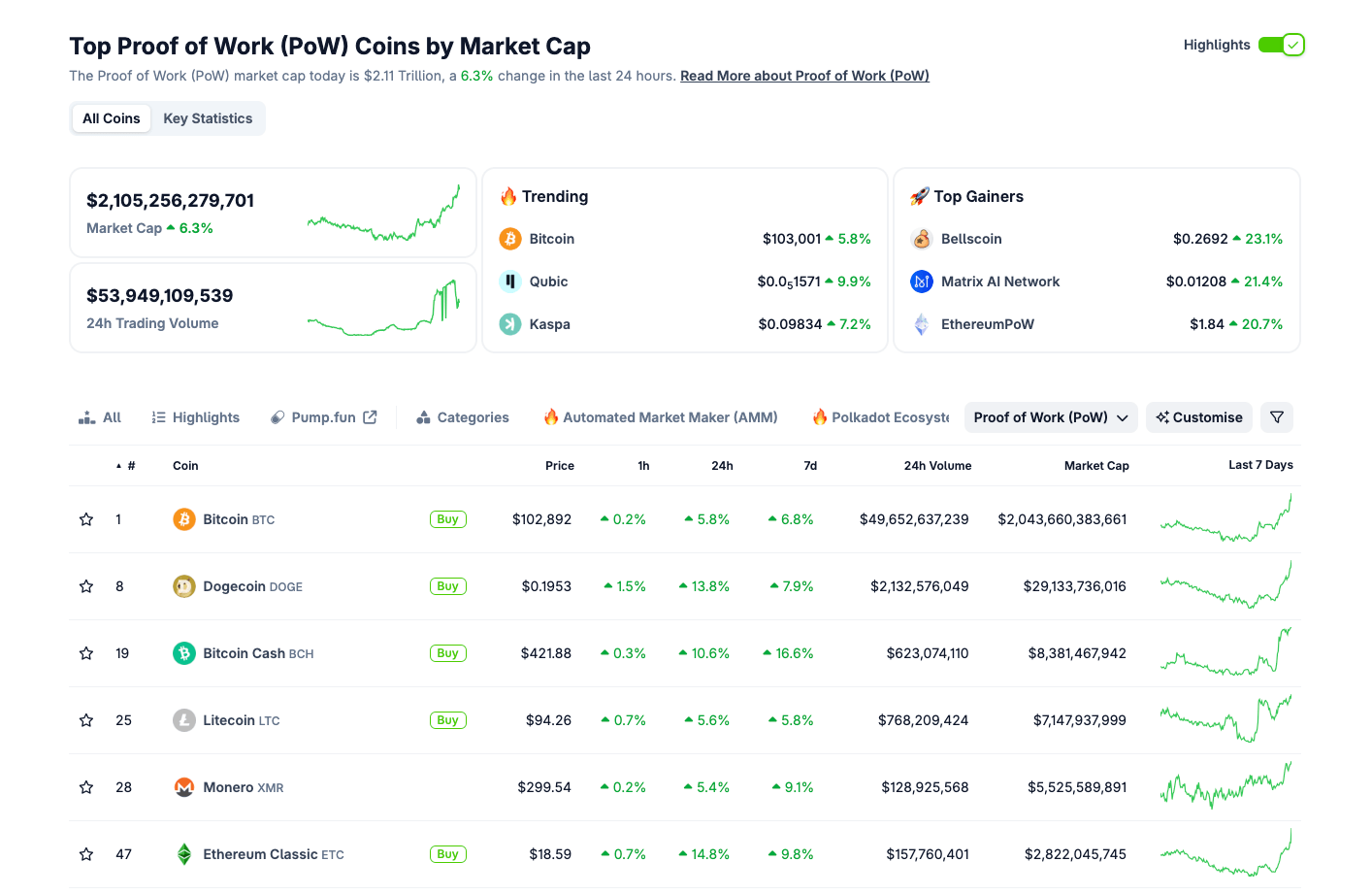

Validating this stance, the Coingecko chart below shows how the aggregate valuation of the Proof-of-Work (PoW) sector grew 5.7% on Thursday, outpacing the broader crypto market growth of 3% over the last 24 hours.

DOGE price outperforming Proof-of-Work rivals

The PoW sector encapsulates cryptocurrency projects that deploy the Bitcoin-pioneered mathematical cryptography consensus to validate transactions and control supply issuance.

At press time, the sector is valued at $2.12 trillion, with the 6.3% gains indicating $123 billion in inflows within the last 24 hours alone.

Currently trading at $103,000 per coin, Bitcoin’s 5.8% price uptick and $2.04 trillion market cap,at press time, means that BTC absorbed, $118 billion of the fresh inflows into the PoW sector on Thursday.

Proof-of-Work Sector Performance, May 9, 2025 | Source: Coingecko

The remaining $5 billion PoW inflows from the market rally on Thursday is split between other top altcoins including Dogecoin (DOGE), Bitcoin Cash (BCH), Litecoin (LTC), and Ethereum Classic (ETC).

A closer look at the chart shows that DOGE outperforms each of these mega-cap altcoin.

As seen above, Dogecoin’s 14% price rally from Thursday has seen its market cap cross the $29.2 billion mark as it floats near $0.20 at press time.

This reflects that DOGE’s meme coin valuation grew by $4.2 billion, leaving only $800 million in gains accruing to the likes of Litecoin and Bitcoin Cash on the day.

What’s Next? $4.2B DOGE inflows signal high-risk appetite and early bull-cycle rotation

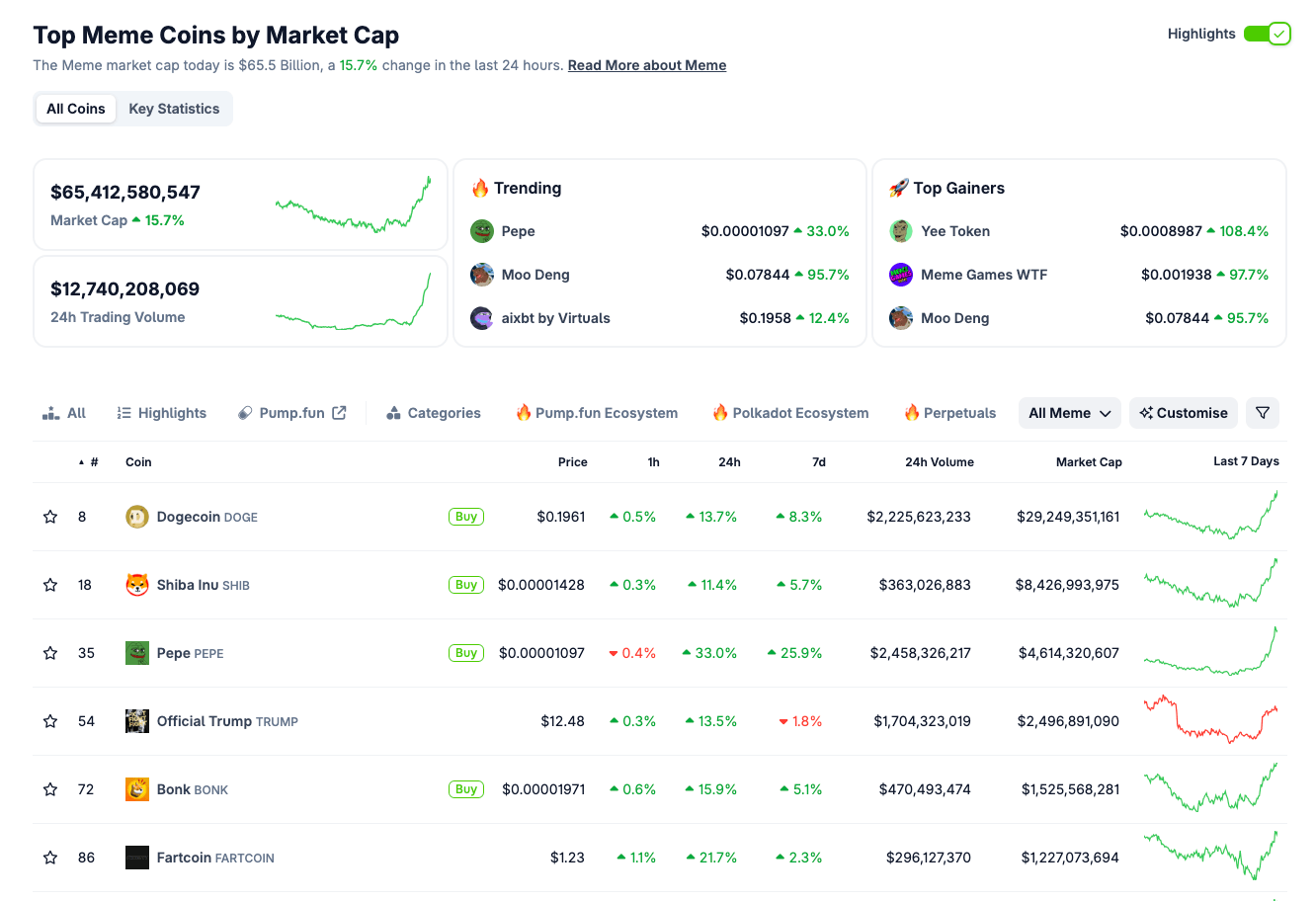

Dogecoin’s $4.2 billion inflow on Thursday marks a significant upbeat in investor appetite towards higher-risk, sentiment-driven assets.

Rather than opt for relatively safer altcoins like Litecoin or Bitcoin Cash, with stronger utility depth and dominant peer-to-peer payment use cases, crypto traders clearly chased DOGE for its high-volatility potential and community driven sentiment.

This may explain why DOGE’s 14% rally surpassed BCH and LTC, which rose 10.5% and 5.3%, respectively. Further validating this narrative, other non-PoW memecoins like PEPE and Fartcoin also posted 34% and 18.2% gains, respectively, far exceeding Dogecoin’s 14.5% growth performance.

Market outlook:

If memecoins continue to dominate inflows trickling down from Bitcoin’s ascent towards new all-time highs, traders may continue to place more aggressive upside bets across the altcoin markets in the coming sessions.

This pattern reinforces the notion that in bull cycles driven by risk-on macro events, such as Bitcoin’s $100K breakout, Trump’s trade deals, and growing expectations of Fed rate cuts, short-term traders often gravitate toward assets most sensitive to positive market sentiment.

Hence, DOGE’s sharp move higher, in contrast to LTC and BCH’s more modest gains, is a classic signal of risk-on conditions and an early bull-cycle rotation pattern.

Global Memecoin Market Performance, May 9, 2025 | Source: Coingecko

Conversely, to foreshadow potential market reversals, strategic traders may look out for sessions where major memecoins like DOGE, PEPE, and Fartcoin record synchronized double-digit retracements.

As the memecoin narrative heats up again, memecoin may continue to serves barometer for investor risk appetite within the global cryptocurrency markets.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.