Dogecoin price on the verge of a pullback to $0.06 as indicator flashes sell signals

- Dogecoin price had another significant surge in the past 24 hours towards $0.08.

- The digital asset faces a strong selling pressure in the short-term.

- A crucial indicator has just presented two significant sell signals for DOGE.

The best performing ‘meme’ cryptocurrency, Dogecoin, has surged again in the past 24 hours touching $0.084 and potentially forming a double top in the short-term. It seems that the digital asset is poised for a short-term correction before another potential leg up.

Dogecoin price could fall to $0.06 as indicator presents sell signals

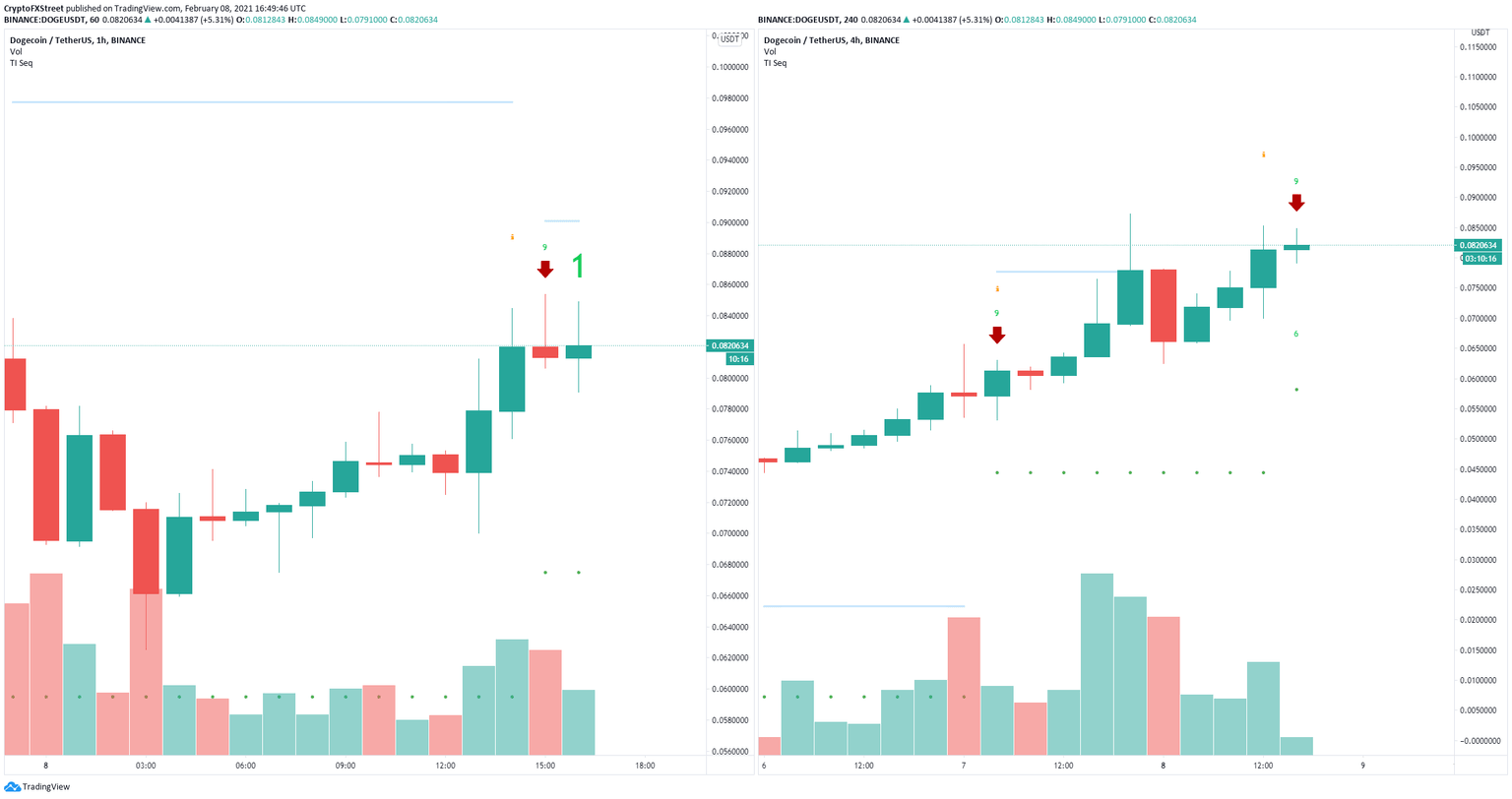

On the 1-hour and 4-hour charts, the TD Sequential indicator has just presented two sell signals which add a lot of credence to the bears. Additionally, Dogecoin price has topped out at around $0.084 again which is a critical resistance barrier.

DOGE Sell Signals

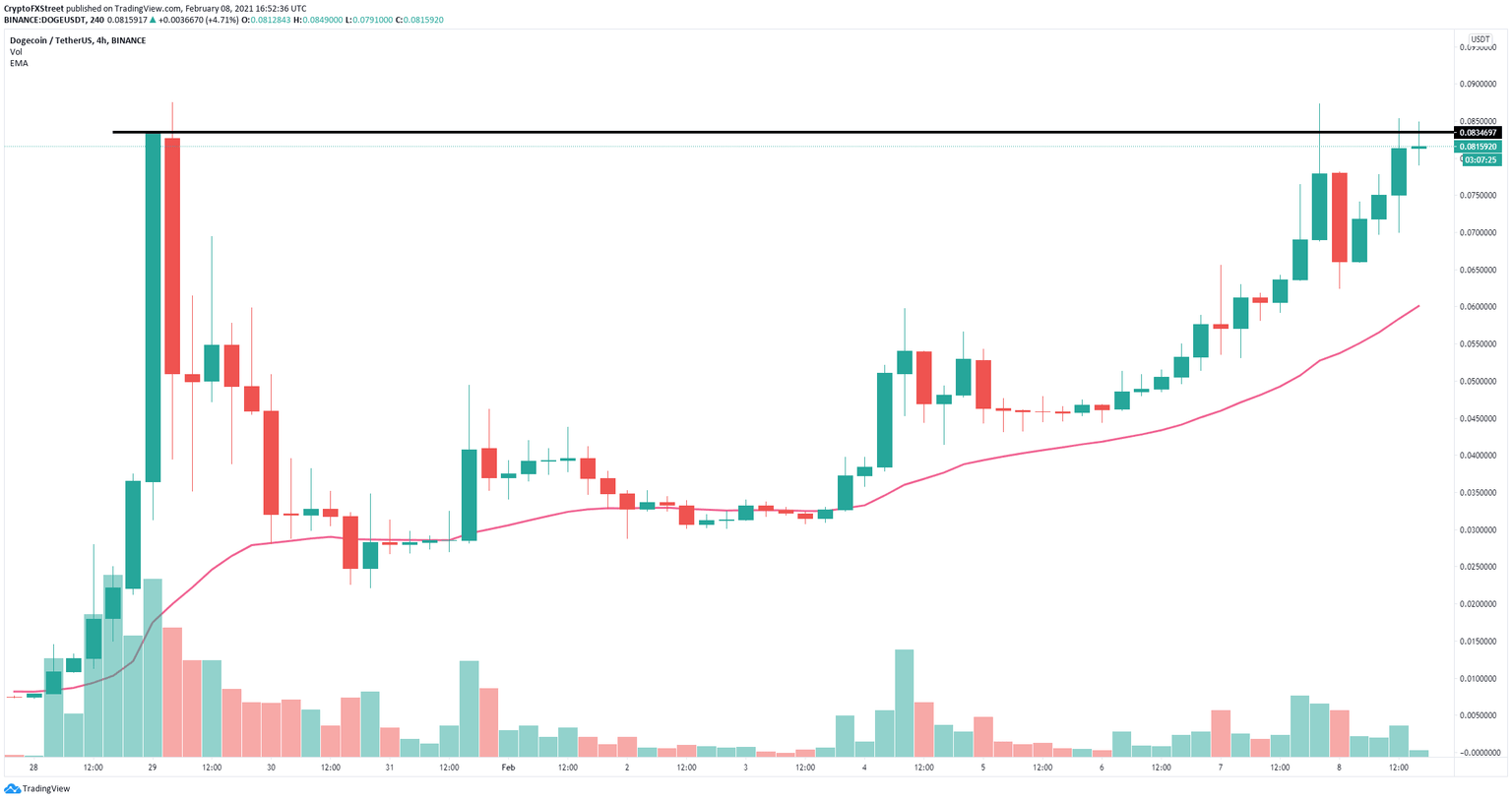

On the 4-hour chart, DOGE got rejected several times in the past 24 hours from the resistance level at $0.084 and can easily dive towards $0.06 which is the 26-EMA support level.

DOGE/USD 4-hour chart

The social volume of Dogecoin is spiking again which is usually a good indicator of upcoming corrections. This adds even more credence to the bearish outlook.

DOGE Social Volume

However, since Tesla announced the purchase of $1.5 billion worth of Bitcoin and potentially other digital assets in the future, DOGE bulls have a lot of momentum.

DOGE/USD 4-hour chart

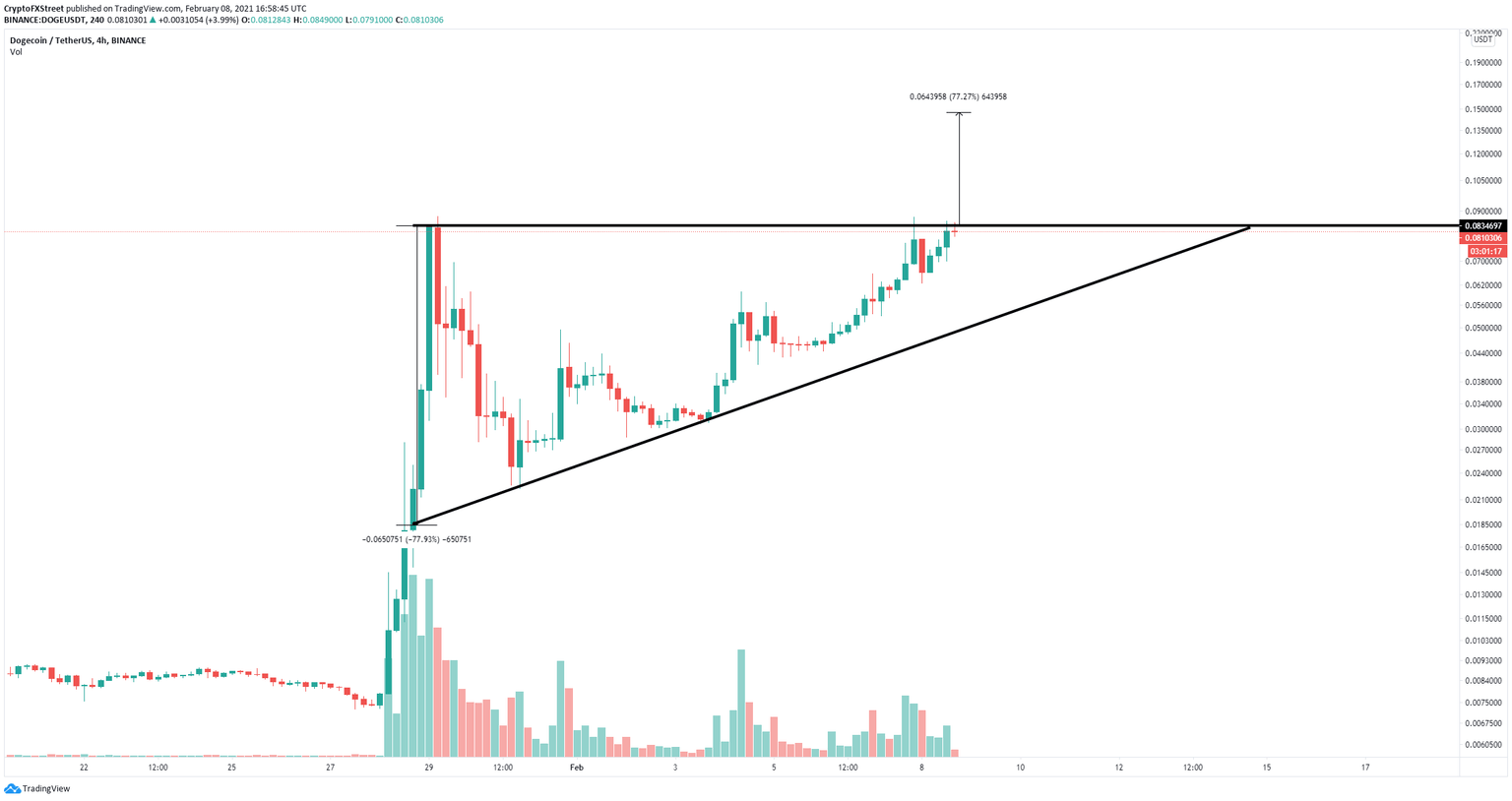

Climbing above the resistance level at $0.084 would be a massive breakout from an ascending triangle on the 4-hour chart with a price target of $0.147.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.55.13%2C%252008%2520Feb%2C%25202021%5D-637484004385656646.png&w=1536&q=95)