Dogecoin Price Forecast: Further rally likely, fueled by Elon Musk's endorsement

- Dogecoin price rises for a third consecutive day after bouncing from $0.128, Friday's low.

- Elon Musk's promotion of the meme coin has reignited interest in Dogecoin.

- A daily candlestick close below $0.126 would invalidate the bullish thesis.

Dogecoin (DOGE) extended its gains on Monday and during the weekend after successfully retesting a key support level on Friday. The bullish price action since broadly mid-October has been bolstered by Elon Musk's promotion of the meme coin, reigniting interest among traders and suggesting a potential rally ahead.

Dogecoin support level holds strong

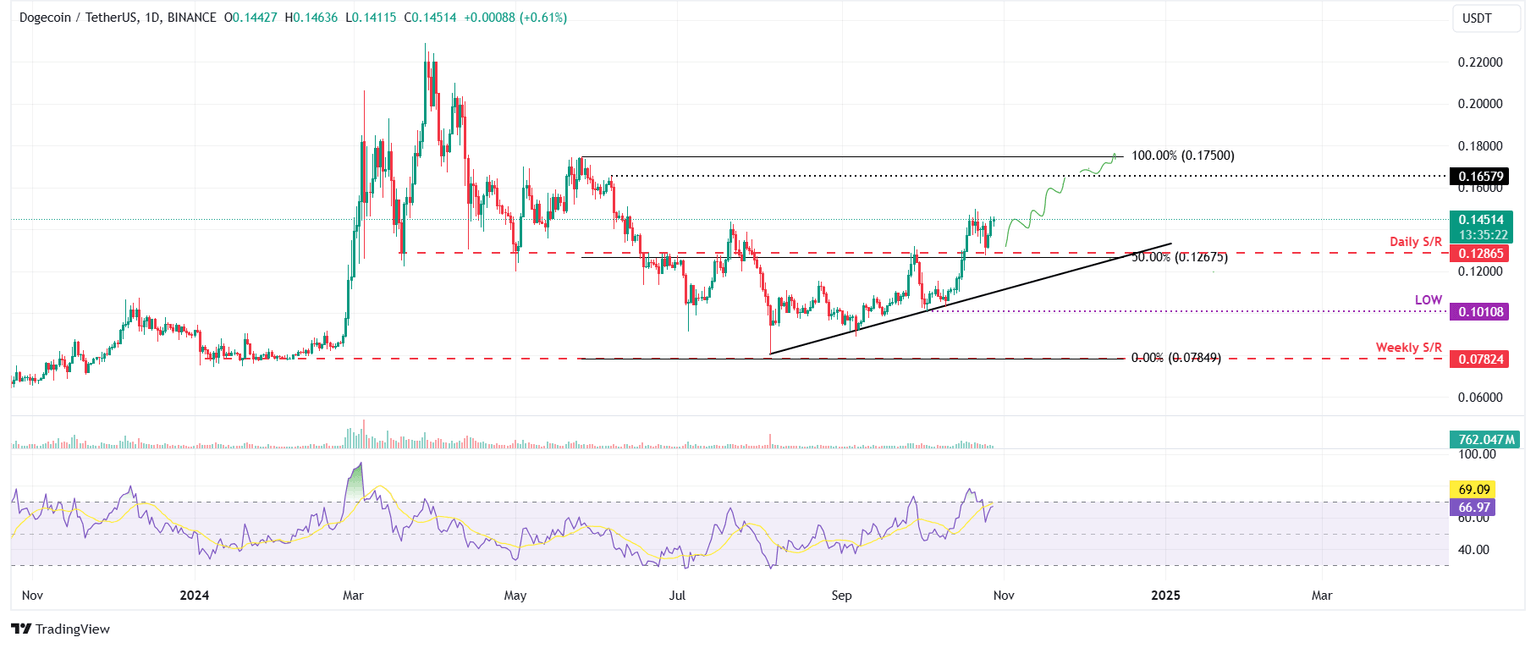

Dogecoin retested and bounced from the daily level of $0.128 on Friday and rallied 9.6% in the next two days. The daily support at $0.128 roughly coincides with the 50% price retracement level at $0.126 (drawn from the June high of $0.175 to the August low of $0.078), making it a key support zone. At the time of writing on Monday, DOGE trades slightly higher at around $0.145.

If the $0.128 level continues to hold as support, DOGE could rally 14% from its current price of $0.145 to retest its June 6 high of $0.165.

The Relative Strength Index (RSI) currently reads at 66 and is nearing the overbought level of 70, showing strong bullish momentum. However, if it enters the zone on a closing basis, traders will be advised not to add to their long positions as the chances of a price pullback would increase. Another option is that the rally continues, and the RSI climbs further up into overbought and remains there.

DOGE/USDT daily chart

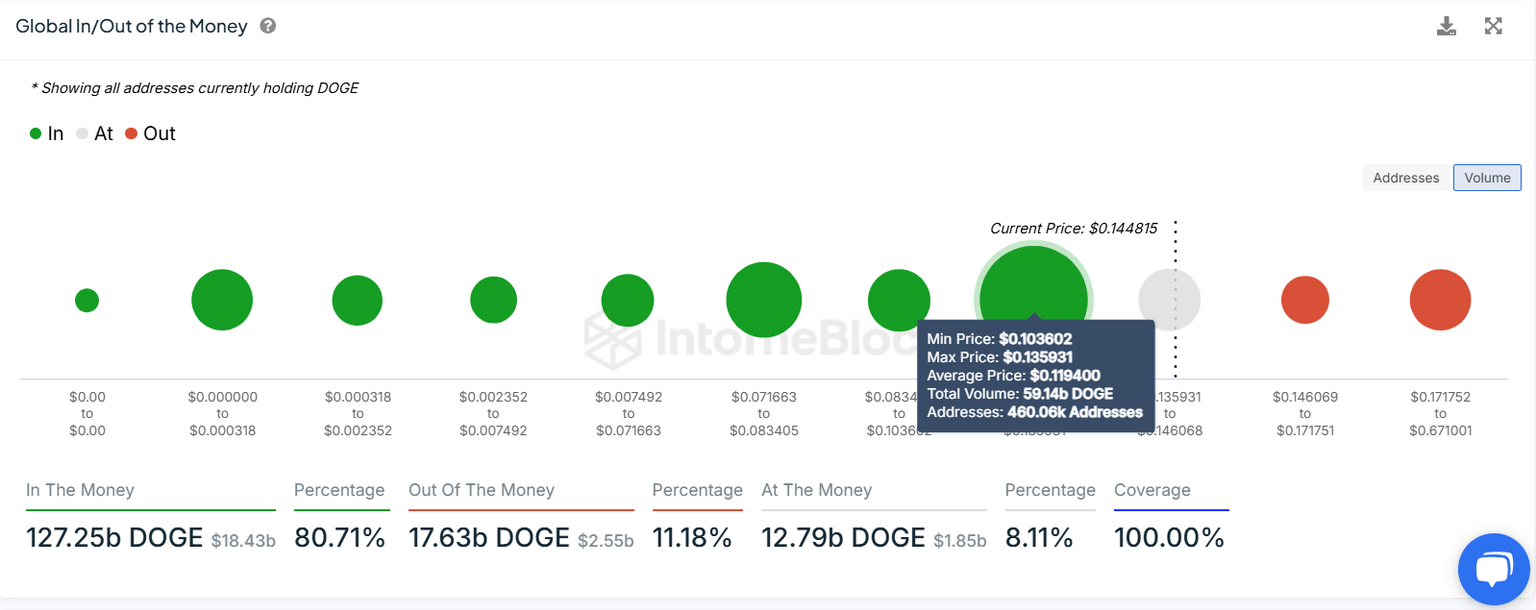

Based on IntoTheBlock's Global In/Out of the Money (GIOM), nearly 460,060 addresses accumulated 59.14 billion DOGE tokens at an average price of $0.119. These addresses bought the dog-based meme token between $0.103 and $0.135, which makes it a key support zone.

Interestingly, the zone mentioned from a technical analysis perspective, the $0.119 level, coincides with the GIOM findings, making this zone a key reversal area to watch.

DOGE GIOM chart. Source: IntoTheBlock

Elon Musk's support for Dogecoin

Elon Musk's involvement has reignited interest in Dogecoin, particularly following his co-founding of the "Department of Government Efficiency" (DOGE), a concept aimed at streamlining US government operations and reducing waste.

During a New York campaign rally for former President Donald Trump on Sunday, he claimed this initiative could save the United States $2 trillion in tax spending, asserting and reducing costs.

"Your money is being wasted, and the Department of Government Efficiency is going to fix that," Musk said.

The initiative's initials, DOGE, align with the Dogecoin ticker, fueling discussions and speculation on social media about the token's future and enhancing bullish sentiment for the meme coin.

— Elon Musk (@elonmusk) October 28, 2024

DOGE’s bullish trend would be invalidated if the token breaks below the daily support at $0.128 and closes below $0.126. This scenario could lead to a decline in Dogecoin price to retest its October 3 low of $0.101.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.