Dogecoin Price Forecast: DOGE set to hit a low-hanging fruit target of $1.00 as more upside doubtful

- Dogecoin price jumped 4% on Sunday trading as traders gear up for a bullish week.

- DOGE sees tailwinds coming in from Fed silence and a weaker US Dollar on Monday.

- Traders must be aware of DOGE lagging in the rally against the top 3 cryptos.

Dogecoin (DOGE) price is set to get another boost as markets are entering an area with good trading conditions that are granting some upside. Do not expect Dogecoin price to become an outperformer, but rather see it as a granted profitable trade with limited nearby price targets. As Fed speakers enter the blackout period and some lighter economic data comes out this week, the conditions look fine for a nice 13% gain.

Dogecoin price to be traded as it is

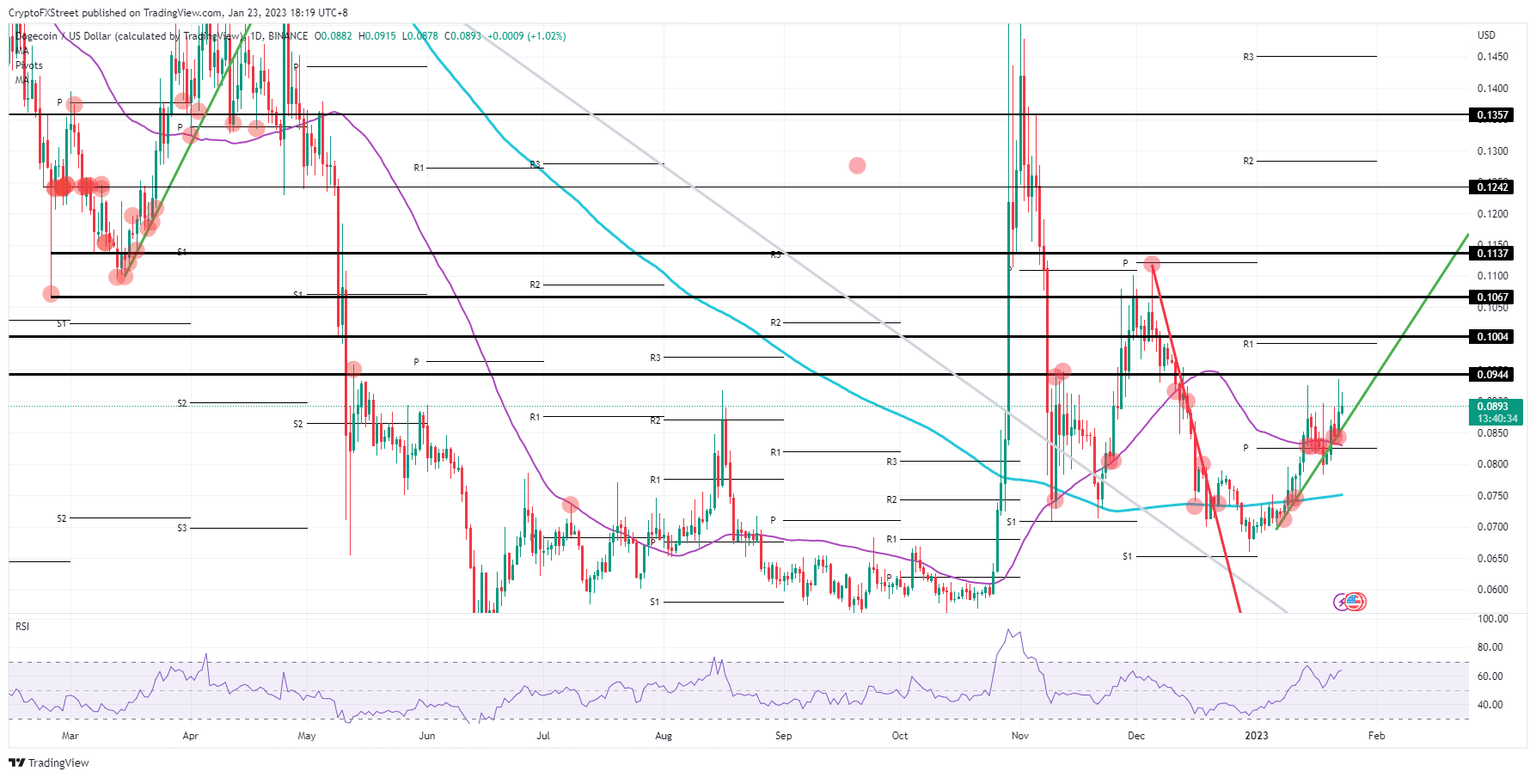

Dogecoin price is set up for some nice upside after market conditions opened up in favor of the bulls last week following some very volatile price action. The biggest element to take away is that the green ascending trendline on Dogecoin’s chart held and withstood the market turmoil. Expect to see a grind and push higher in this bullish triangle formation with the green ascending trend line as the sloping side in the triangle, thus making it key to deciding if the trade can continue or if the rally has been broken.

DOGE traders who enter for a long trade must remain realistic in their price projections on when to book profits. Where Bitcoin price, for example, is set to go forward roughly 25%, Dogecoin price traders will need to settle for 10% instead, which is still not bad. The level to watch is $0.1004, with the monthly R1 not far away, making it a tough nut to crack.

DOGE/USD daily chart

The big inflection point on the chart is at $0.0830, where quite a few forces are currently underpinning the price action, including the monthly pivot, the 55-day Simple Moving Average and the green ascending trendline all clustered together. Should that level break, expect a full unwind of the rally. That means DOGE could trade back to $0.0650 and look for support at the start of the rally and the monthly S1 support level nearby.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.