Dogecoin Price Forecast: DOGE bulls approach last line of defense

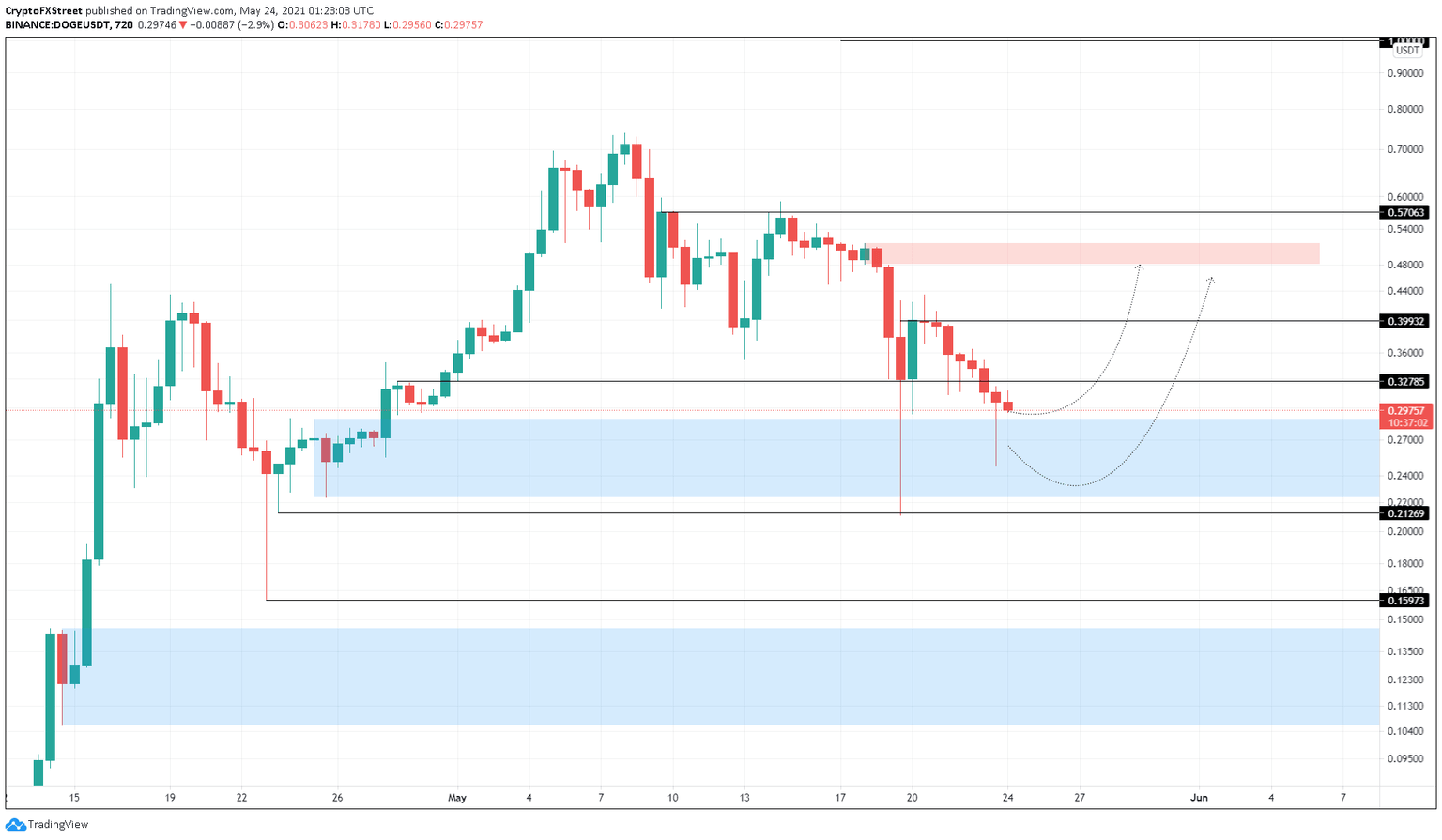

- Dogecoin price is trading above a demand zone, extending from $0.224 to $0.289.

- If the bid orders pile up, DOGE could rally 37% to tag $0.40.

- A decisive close below $0.212 will invalidate the upswing narrative and kick-start a sell-off.

Dogecoin price is fast approaching a critical demand zone that will decide the meme coin’s fate for the foreseeable future. A bounce from this pivotal area will allow buyers a chance to push DOGE to pre-crash levels and higher, but a failure will take it to lows last seen in mid-April.

Dogecoin price at crossroads

Dogecoin price has dropped roughly 32% since May 20. The crash on May 19 seems to have taken a massive toll on altcoins, which have plummeted between 50% and 70%, undoing almost all of the gains accrued over the past year.

After the recent downfall, DOGE is currently hovering above a support area that stretches from $0.224 to $0.289. This demand zone is a perfect setup for the buyers to make a comeback. A potential spike in buying pressure that causes Dogecoin price to bounce from the aforementioned floor might trigger a 37% upswing to $0.40.

If the bullish momentum persists after hitting this point, investors could see the meme-themed cryptocurrency rally another 21% to tag the lower boundary of the supply area ranging from $0.481 to $0.515.

DOGE/USDT 12-hour chart

The upswing narrative detailed above depends on the assumption that the buyers manage to pull their act together and bounce from the demand zone, extending from $0.224 to $0.289. If the bulls fall short or fail to produce enough momentum to trigger an upswing, a sell-off will likely ensue.

While a breakdown of the $0.224 level will extinguish the bulls’ hope of a rally, a decisive 12-hour candlestick below the support floor at $0.212 will invalidate the bullish thesis.

In such a case, market participants could see Dogecoin price fall 25% to tag the first meaningful demand level at $0.159, a breakdown of which will result in a brutal crash to the support area ranging from $0.106 to $0.145, formed during mid-April.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.