Dogecoin price eyes 18% upswing if DOGE can close above this key level

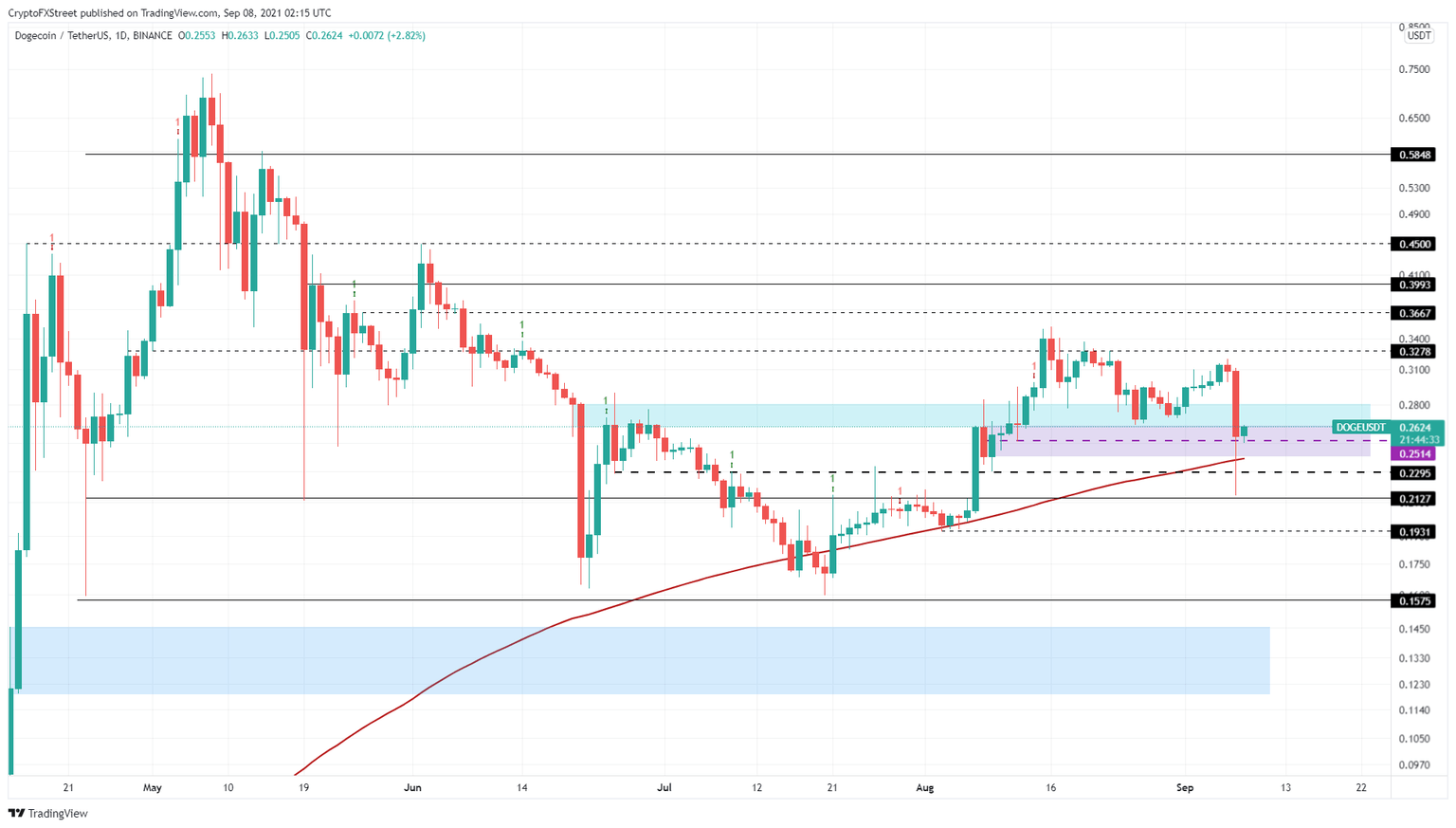

- Dogecoin price dipped below the demand zone ranging from $0.262 to $0.281 during the September 7 flash crash.

- A recovery above $0.281 will promote an 18% upswing to $0.328.

- If DOGE closes below the $0.24 support barrier, it will invalidate the bullish thesis.

Dogecoin price was due for a massive upswing but failed to manifest it quickly. The market crash on September 7 undid most of the gains and will continue to do so unless DOGE recovers quickly.

Dogecoin price awaits a move above critical levels

Dogecoin price was bouncing off the demand zone extending from $0.262 to $0.281 on August 31 and had rallied 18% with hopes of continuing this uptrend. However, on September 6, the climb seemingly stopped and crashed 31% on the next day, only to close a little higher.

The September 7 daily close was below the lower limit of the demand zone mentioned above, which suggested a bearish development. Regardless, DOGE has another support area, ranging from $0.262 to $0.240, likely to prevent minor downswings.

If Dogecoin price needs to flip bullish, it has to produce a daily close above $0.281. Doing so will open up the path to an 18% upswing to $0.328. If the bullish momentum persists, the 18% climb could extend to a 30% ascent to the $0.367 resistance barrier.

DOGE/USDT 1-day chart

On the other hand, if Dogecoin price slices through the subsequent support level at $0.240, it will invalidate the bullish outlook. This move will confirm that a downswing is around the corner.

In such a case, DOGE will revisit the $0.230 support level, followed by $0.213. Therefore, investors need to keep a close eye on the $0.240 foothold as it could exacerbate the September 7 sell-off.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.