Dogecoin presents buying opportunity before DOGE returns to $0.28

- Dogecoin price falls below rising wedge, enticing new short entries out of bears.

- 5% bounce from yesterday's low extends into today, putting pressure on sellers.

- Point of max pain ahead as a short squeeze-induced rally begins.

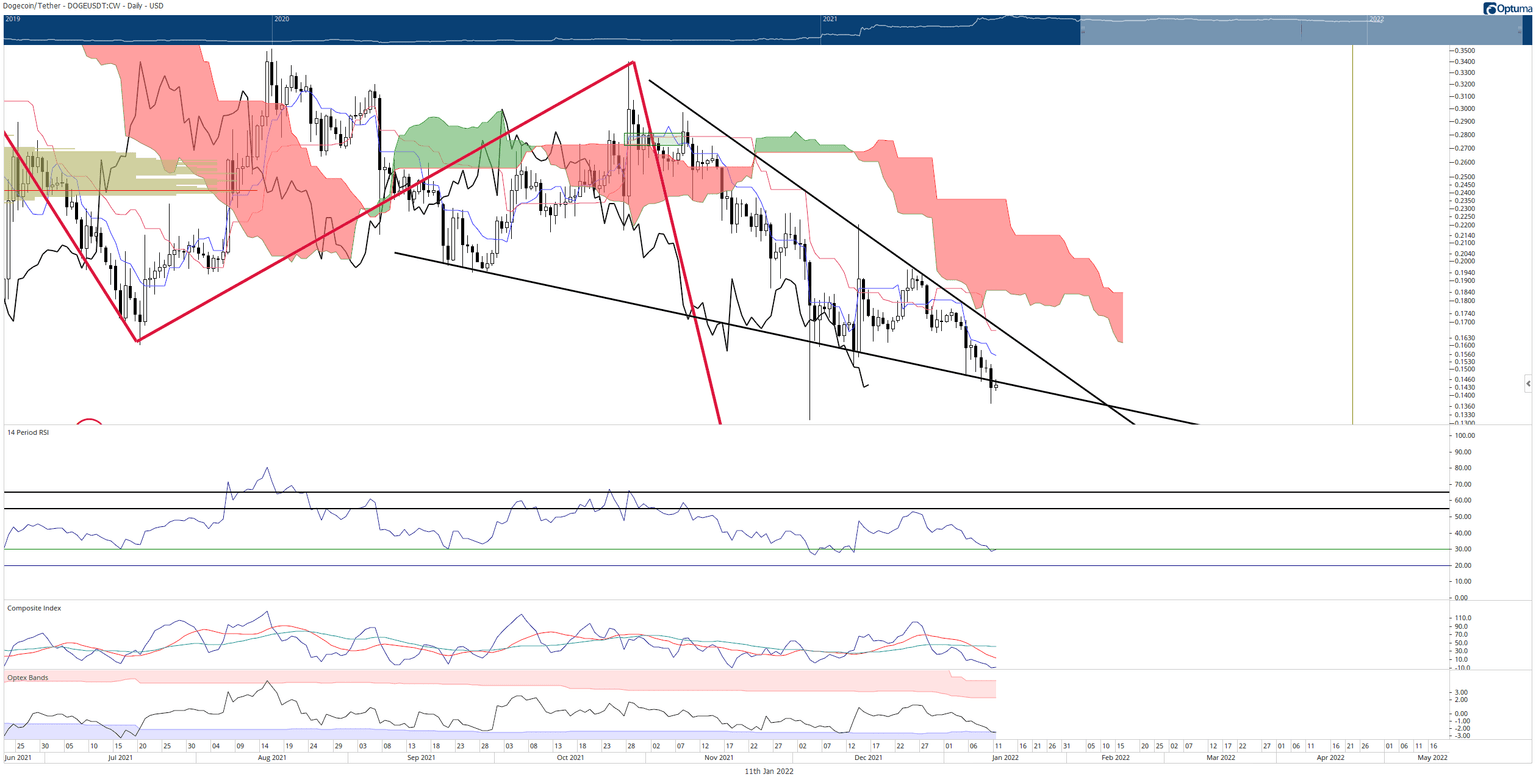

Dogecoin price continued its path lower yesterday, hitting the $0.13 value area - a price level traded in April 2021. It appeared as if Dogecoin might push even lower as it breached the lower trendline of the falling wedge, but buyers stepped in to support DOGE.

Dogecoin price dips below rising wedge and finds buyers, bulls eye a return above the lower trendline

Dogecoin price remains overwhelmingly bearish on its daily Ichimoku chart. The close below the rising wedge on Monday added to fears that a capitulation move for Dogecoin may be coming up. However, recent intraday buying pressure has mitigated some of those fears.

Wedge patterns have some of the highest positive expectancy ratios of chart patterns, often turning into profitable trade setups. Wedge patterns are the definition of an overbought/oversold market and represent excess. The current falling wedge pattern is a warning sign to traders who are short because the falling wedge is a powerful bullish reversal pattern.

Bulls are likely eyeing a daily close that positions Dogecoin price above the lower trendline of the rising wedge as an area to enter long. Given the oversold and extreme lows in all of DOGE's oscillators, a fast spike higher towards $0.25 is very likely.

DOGE/USDT Daily Ichimoku Chart

Traders will want to watch for any sustained move below the falling wedge lower trendline that would result in at least three days of closes below the lower trendline. That would invalidate this analysis's theoretical long setup and bullish outlook.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.