Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

- Dogecoin and Bitcoin Cash failed to register gains on Tuesday, declining by 3% and 8%, respectively.

- The DOGE derivatives market indicates weakness, but spot investors continue their multi-month buy-the-dip strategy.

- Bitcoin Cash funding rates plunged into negative territory after one-year holders stepped up selling pressure.

Dogecoin (DOGE) and Bitcoin Cash (BCH) registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin (BTC), Ether (ETH) and XRP, holding still with slight gains.

Dogecoin derivative and spot markets indicate divergence in investor sentiment

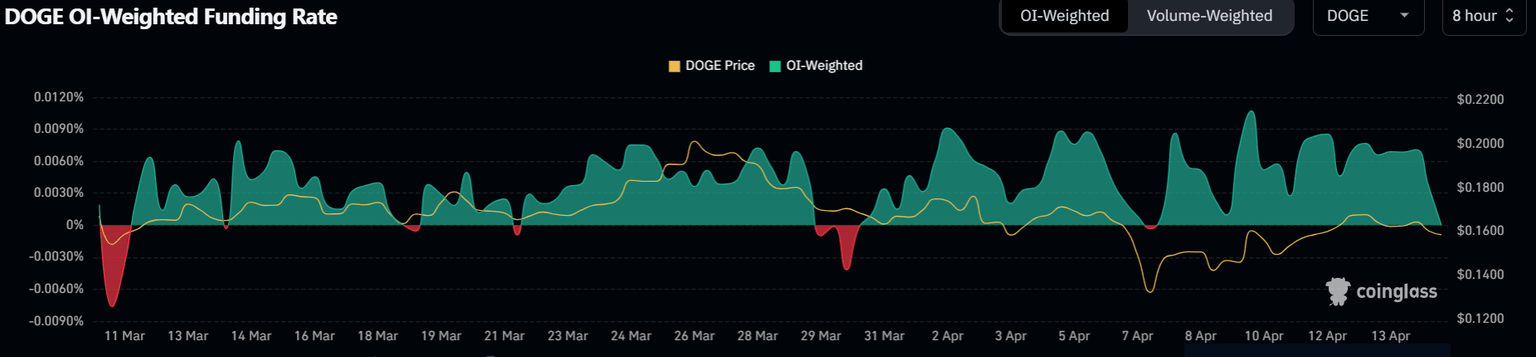

The decline in Dogecoin appears to have stemmed from the derivative market, where its funding rate is on the verge of flipping negative.

Funding rates are periodic payments between buyers and sellers in a derivatives market that keep the prices of futures contracts closely tied to the underlying assets' spot price. A negative funding rate indicates that most traders are becoming bearish, potentially causing prices to decline.

DOGE funding rates. Source: Coinglass

Additionally, DOGE's open interest has remained flat since the beginning of February, indicating reduced interest among leveraged traders. If DOGE's funding rates continue declining with its flat open interest, its price risks an extended downtrend.

However, buying activity from spot investors could cushion the losses and help its price stay afloat. DOGE has consistently registered exchange net outflows since the crypto market began its decline in late January, indicating dominant buying pressure from spot investors. The top meme coin has only recorded 10 days of exchange net inflows in the past three months.

DOGE exchange netflow. Source: Coinglass

On the technical side, DOGE is forming its second multi-month descending triangle following its downtrend since the beginning of December. DOGE has to stay above the $0.1428 support level to prevent another major downtrend. A decline below $0.1428 could see DOGE finding support near $0.0906 if buyers quickly step in.

DOGE/USDT daily chart

The Relative Strength Index (RSI) is below its neutral level, while the Stochastic Oscillator is above mid-level but trending downward, signaling a slight increase in bearish momentum.

A firm move above the descending triangle's resistance could invalidate the thesis and send DOGE toward $0.287.

Bitcoin Cash one-year holders show fear amid weakness in BCH futures

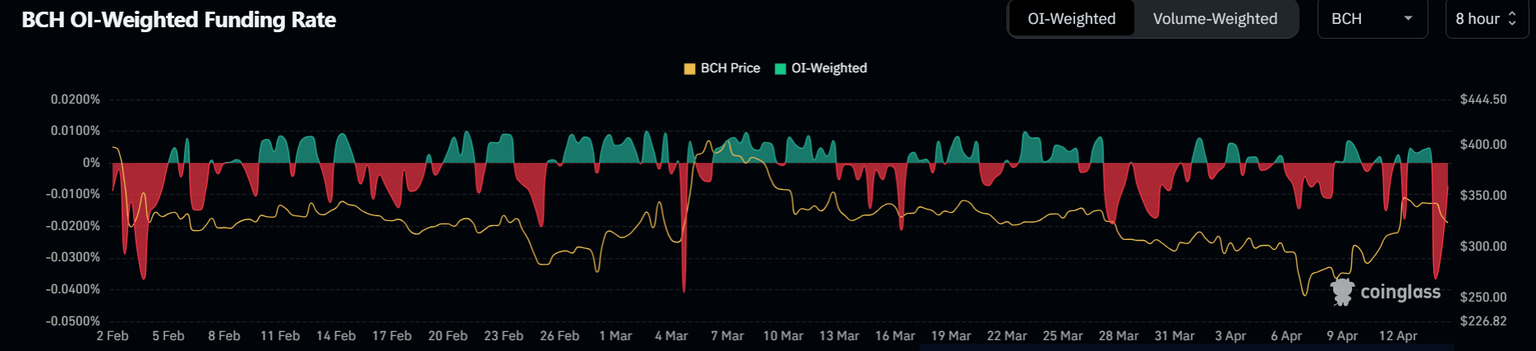

Bitcoin Cash's funding rates plunged negative on Monday, declining to its lowest level since the beginning of March after its price dropped by 8% in the past 24 hours. This indicates increased bearish momentum among BCH derivatives traders. However, it could also prove a buy-the-dip opportunity, as price reversal sometimes follows a sharp decline in funding rates.

BCH funding rates. Source: Coinglass

BCH’s open interest has also remained at low levels, declining by 50% in the past year. Its OI even failed to pick up during the post-election crypto rally, indicating reduced interest in the cryptocurrency.

On the spot market side, BCH's exchange net flows show an increase in selling pressure among investors in the past seven days — with the only outflow coming on Monday from buy-the-dip investors, per Coinglass data.

Santiment's Dormant Circulation and Spent Coins Age Band metrics reveal that most of the recent selling pressure stems from investors who have held BCH for just over one year. These investors may be looking to quickly cut losses or book profits, considering prices fell toward their cost basis last week.

%20%5B05-1744692657338.27.41%2C%2015%20Apr%2C%202025%5D.png&w=1536&q=95)

Dormant Circulation (365D) and Spent Coins Age Band (365D to 2Y). Source: Santiment

Meanwhile, a descending triangle is also forming on the Bitcoin Cash daily chart, with its price consistently seeing a rejection near the triangle's resistance. If BCH breaks the support range between $255 to $222, it could accelerate its decline.

BCH/USDT daily chart

The RSI and Stoch are above their neutral levels but slightly trending downwards, indicating a modest weakness in bullish momentum.

However, a firm move above the triangle's resistance will invalidate the thesis and potentially send BCH toward $428.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi