CYBER trolled after liquidity proposal rejection, users decry manipulation

- CyberConnect released an emergency proposal to provide liquidity for cross-chain bridges.

- The proposal was rejected, with the network citing a misprint that misled community members.

- The network is now the talk on social media, with users calling it out for manipulation.

CyberConnect released an emergency proposal, suggesting the use of CYBER tokens that remain locked in the network’s treasury to provide liquidity for cross-chain bridges. The proposal was rejected, with the crypto community calling out the network for possible pump-and-dump.

Short Pays Long maybe they shorted their own coin then now buying again to pump it for their Long Position.. Lets Go!

— CustomGameMaster (@CustomGMaster) September 2, 2023

CyberConnect had introduced “Multichain Liquidity Balancing” strategies to achieve price discovery for CYBER. This would make it more efficient across networks.

Its native token, CYBER, deployed on Ethereum CYBER-ETH), Optimism (CYBER-OP), and BNB Chain (CYBER-BSC). Noteworthy, these three deployments are all the same native token to CyberConnect, meaning they can be freely bridged across networks with sufficient liquidity for demands from all networks.

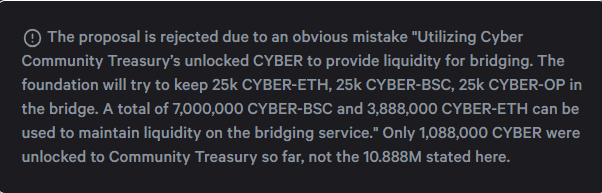

The emergency proposal, dubbed CP-1, has been rejected. The network has cited a typing error.

There was a mistake in the snapshot proposal CP-1 and so it was rejected. The intended usage of Community Treasury for providing liquidity was 1,088,000 CYBER which was unlocked already.

Further, the CyberConnect has explained the mistake, saying:

The intended usage of Community Treasury was 1,088,000 CYBER, which was unlocked already but mistyped to a much bigger number.

The update is that only 1,088,000 CYBER were unlocked to the community treasury, not the 10,888,000 million indicted in the misprint or typo.

Earlier reports pointed to Korean traders possibly pumping the token, considering its massive surge on the South Korean exchange Upbit.

Also Read: CYBER token open interest hits $200 million as Korean traders pump CyberConnect price

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.