Cryptocurrency Market News: The start of Bitcoin rollercoaster rides

Here is what you need to know on Wednesday, June 3, 2020.

Markets:

Bitcoin price is in shambles after the unsuccessful attempt to hold above $10,000. As reported on Tuesday, BTC/USD traded above this key resistance zone for the first time since the first week of May. It is, however, clear that the breakout to $10,410 was not fundamentally nor technically supported. Due to that, a reversal under $9,000 occurred during the American session on Tuesday. BTC/USD is trading at $9,446 following a 1.3% loss on the day. The ongoing retracement is likely to continue if support at $9,400 fails to hold.

Ethereum, on the other hand, has retreated from highs above $240 but managed to hold above $230. The price is teetering at $236 after sinking 0.45% on the day. With the trend being bullish, it shows that buying pressure is still present. The shrinking volatility talks of dwindling trading volume, which means that rapid price movement to the north is unlikely.

Ripple has surprisingly held above $0.20 despite the general retracement in the market. A loss of 0.14% has been encountered on the day. XRP is trading at $0.2029 at the time of writing. On the upside, an intraday high has been reached at $0.2034 while the focus is still on sustaining gains above $0.21 and $0.22.

Bitcoin may seem to be the most affected cryptocurrency in the market by the ongoing bearish wave but some of the worst-hit coins among the top 100 include Nexo (-22.74%), MadiSafeCoin (-10.83), Loopring (-5.39%), HyperCash (-5.49%), and IOST (-7.35%).

Chart of the day: BTC/USD daily

Market:

According to one of the most significant cryptocurrency pioneers in the world, Blockstream’s Adam Back, Bitcoin is set to explode into massive gains backed by the ongoing financial disaster. In his opinion, the ongoing printing of paper money for economic stimulation will push retail investors to Bitcoin. For this reason, Bitcoin is pointing towards $300,000 in the next five years.

It might not require additional institutional adoption because the current environment is causing more individuals to think about hedging,” Back said. “And retaining value when there’s a lot of money printing in the world.

Industry:

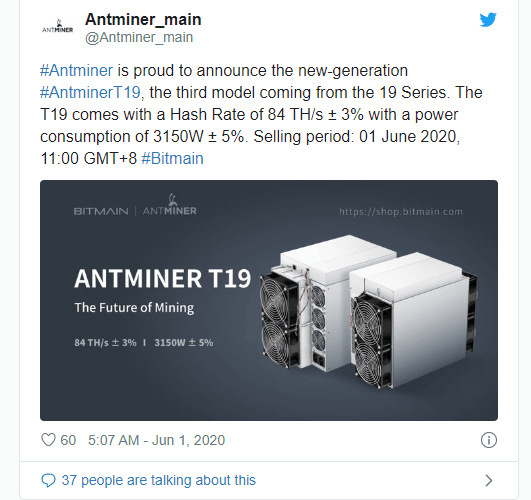

Bitmain, a leading cryptocurrency mining equipment manufacturer has this week launched a new T19 mining rig. The new rig boasts of improved software and efficiency. The move is as though to counter the negative publicity when miners claimed in May that the company was producing defective rigs with malfunctioning hardware. Miners said that the defective rigs were leading to great losses and negative user experience. The new Antiminer T19 started selling on June 21 while delivery will be made between now and early July.

Regulation:

Regulation experts are envisioning tougher times ahead for Bitcoin ATMs. The strict measures are likely to come into effect in a bid to eradicate money laundering. A report published by CipherTrace found that over 74% of Bitcoin ATM transactions from the United States made it to overseas cryptocurrency exchanges. The volume of these transactions has grown immensely since 2017. CipherTrace’s CTO John Jeffries while in an interview with Law360 said that tougher regulations will call for uniform regulatory requirements across countries.

Quote of the day:

“Bitcoin itself is primarily a financial tool. Ethereum is explicitly less financial in nature, but even there it remains a fact that a large fraction of applications that a blockchain legitimately makes better involve handling coins/tokens/money of some form.”(Ethereum co-founder Vitalik Buterin).

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637267641184466764.png&w=1536&q=95)