Cryptocurrency Market News: Bitcoin confirms $9,600 support as Ethereum and Ripple consolidate

Here is what you need to know on Wednesday

Markets:

BTC/USD is still dealing with selling activities under $10,000 for the third day this week. Advances made to the critical level have ended up in rejections. Interestingly, Bitcoin bulls have had the opportunity to confirm the support at $9,600.

Before the European session begins, Bitcoin is exchanging hands at $9,714. The largest cryptoasset has lost a subtle 0.41% of its value from $9,783 (opening value). On the downside, $9,700 is the short term intraday support while $9,800 is the immediate resistance. The prevailing bullish trend means that buyers in control but due to the low volatility, their effort is limited.

ETH/USD is in consolidation under $215 after the rejection at $216 on Monday. On the downside, Ethereum has embraced short term support at $210. Like Bitcoin, the crypto has a bullish biased but low trading volume which is hindering rapid price action. ETH/USD is doddering at $213.40 following a 0.5% loss on the day.

XRP/USD is extending the consolidation above $0.20. Movements towards $0.21 have been capped at $0.2055. At the time of writing, Ripple price is flirting with $0.2046. The main goal for the bulls is to hold above $0.20 and capitalize on the consolidation to create fresh demand before pushing for a breakout above $0.21.

Among the top 100 cryptocurrencies, the best-performing include DeviantCoin (up 631%), THETA (up 16.74%), OmiseGo (up 20%), Nano (up 17.93%), Advanced Internet Blocks (up 50.65%) and Steem (up 18%).

Chart Of The Day: BTC/USD daily

-637255518360955978.png&w=1536&q=95)

Market

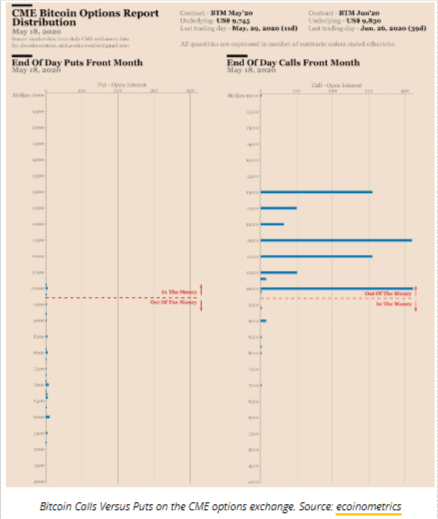

The Bitcoin options market data, mainly dominated by exchanges such as Deribit and CME suggests that the trend is leaning to the bullish side. Bitcoin has a tendency to start rallying six to eight months after halving a parameter options traders are cautious about, especially in the medium term. However, traders on CME and Deribit are optimistic that Bitcoin price will continue growing in value in the short term.

Data by ecoinmetrics indicates that for every 22 people who purchased Bitcoin, only one person sold. This means that buyers are massively overwhelming sellers in the near term hence improving sentiments around BTC.

Industry

Bakkt, the Intercontinental Exchange (ICE)-owned Bitcoin futures platform has signed a partnership with Marsh, an insurance broker for a $500 million cryptocurrency custody insurance coverage. The news was revealed in a blog post written by Bakkt CEO Adam White.

Bakkt already has a $125 million insurance running but the new deal is to increase the scope of the coverage. According to White, the firm has improved the structure of its custody services with the integration of examinations conducted by KPMG and PricewaterhouseCoopers. The blog states in part:

These audited procedures and controls are essential to our institutional customers and led Tagomi, one of the most popular crypto prime brokers, to select Bakkt as their preferred bitcoin custodian.

Regulation

According to a research conducted by the Bank of Korea, the research into central bank digital currencies (CBDCs) has been greatly supported by the advancement in various technologies, particularly the distributed ledger technology (DLT). The research was conducted across 14 central banks around the world. It also found that central banks in regions like Hong Kong, Japan and Canada are already applying DLT in their specific CBDC projects. The research released on May 18 states in part:

Most countries are investigating whether new future-oriented technologies can be applied beyond the centralized ledger management and account-based transactions that are currently applied to payment and settlement systems. There is no clear market dominant technology yet.

Quote of the day

"To the degree banks and credit unions increase their reliance on closed network payment systems for sending remittance transfers and other cross-border money transfers, the Bureau notes that this could result in greater standardization and ease by which sending institutions can know exact covered third-party fees and exchange rates."

@United States Consumer Financial Protection Bureau (CFPB) while highlighting Ripple's XRP as a cross-border payments solution.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren