Cryptocurrencies Struggle to Regain Upward Impulse

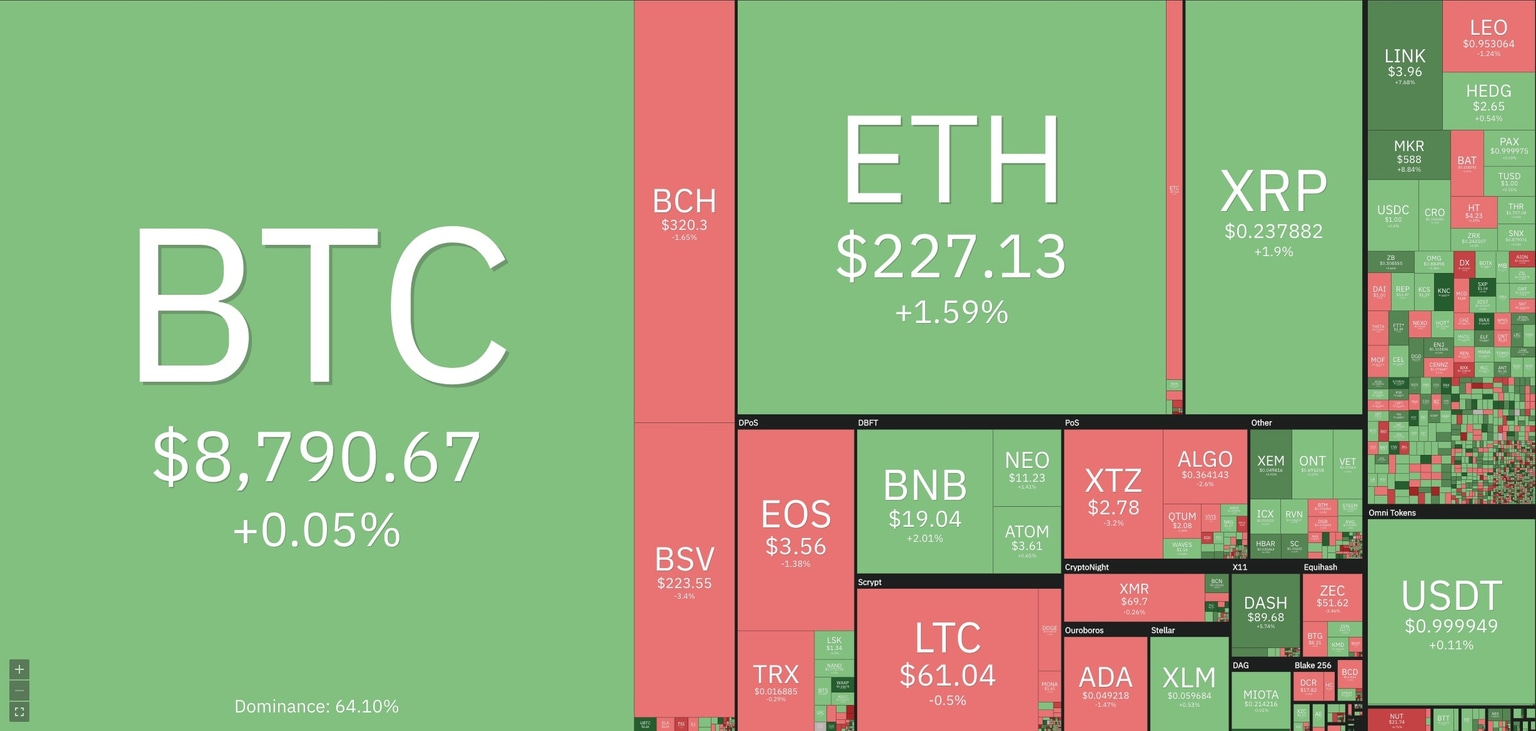

Yesterday, cryptocurrencies had a modest bounce driven by Ethereum (+1.58%) and Ripple (+1.92%). Part of it has been lost this early morning, as Bitcoin (+0.05%) could manage to move beyond $8,800. The most bullish in the last 24H cycle were XEM (+5.5%) and DASH(+5.36%). Also, Ethereum-based tokens such as Link(+7.01%) and MKT(+9.38%) bounced sharply.

Fig 1 - 24H Crypto Sector Heat Map

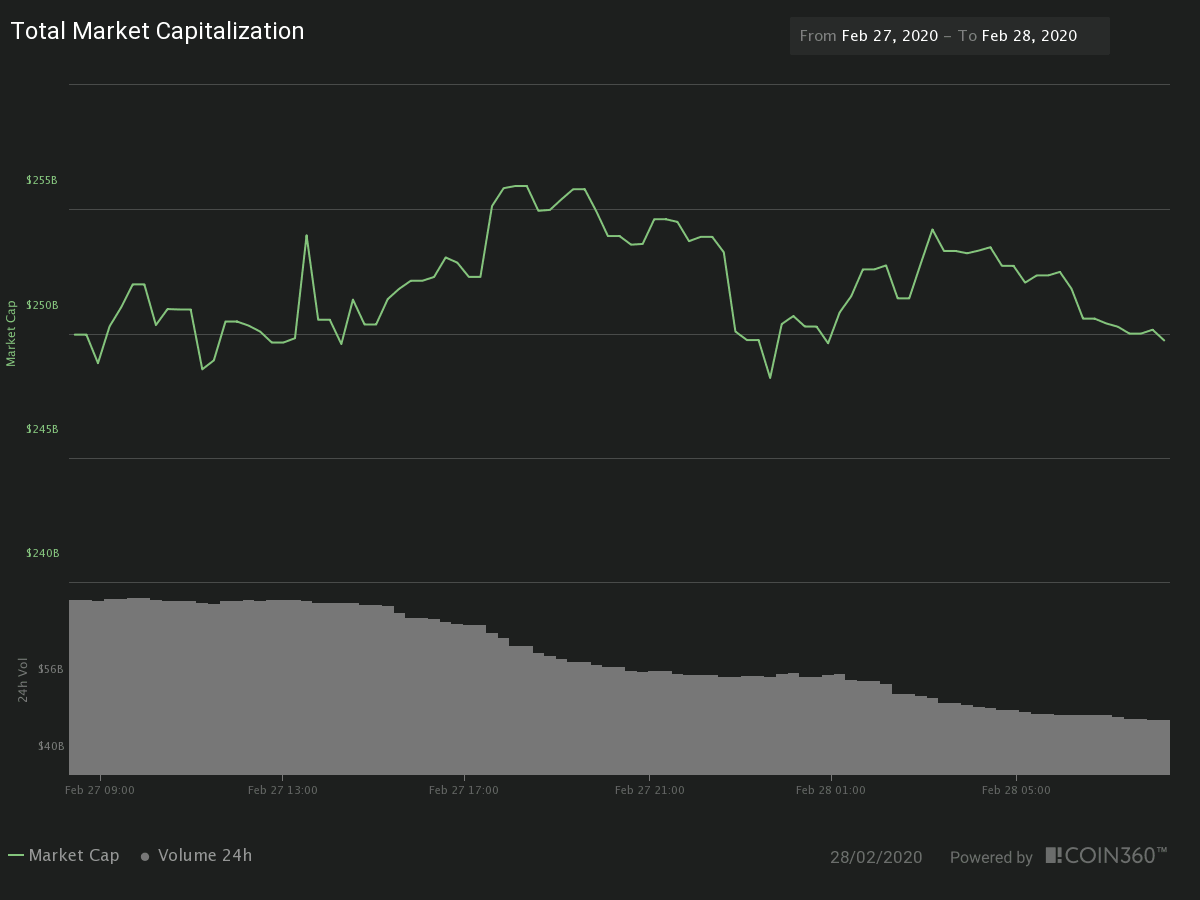

The market cap of the sector is slightly down by 0.24 percent and is now valued at $249.720 billion. That was done on a 24H traded volume of $51.645 billion, which is down almost 30% from its previous value. That shows the prices are moving in a consolidation range, and traders are waiting for a confirmation of the next direction. Bitcoin dominance remains near 64 percent.

Fig 2 - 24H Crypto Market Cap and Traded Volume

Hot News

The Committee on Small Business will hold a hearing that take place at the US House of Representatives focused on the impact of Blockchain technologies on small businesses. The hearing is scheduled to take place on March 4, 2020 at 11:30 A.M. "This hearing will explore how innovators and entrepreneurs are using blockchain technology to help small businesses boost productivity, increase security, open new markets, and change the way business is done." (Source: smallbusinss.house.gov)

On Feb 27, Ethereum Classic Labs published a note announcing its collaboration with Chainlink to bring decentralized oracles to Ethereum Classic. Decentalized oracles solve the problem of communication between different blockchains and also between blockchains and the outside world.

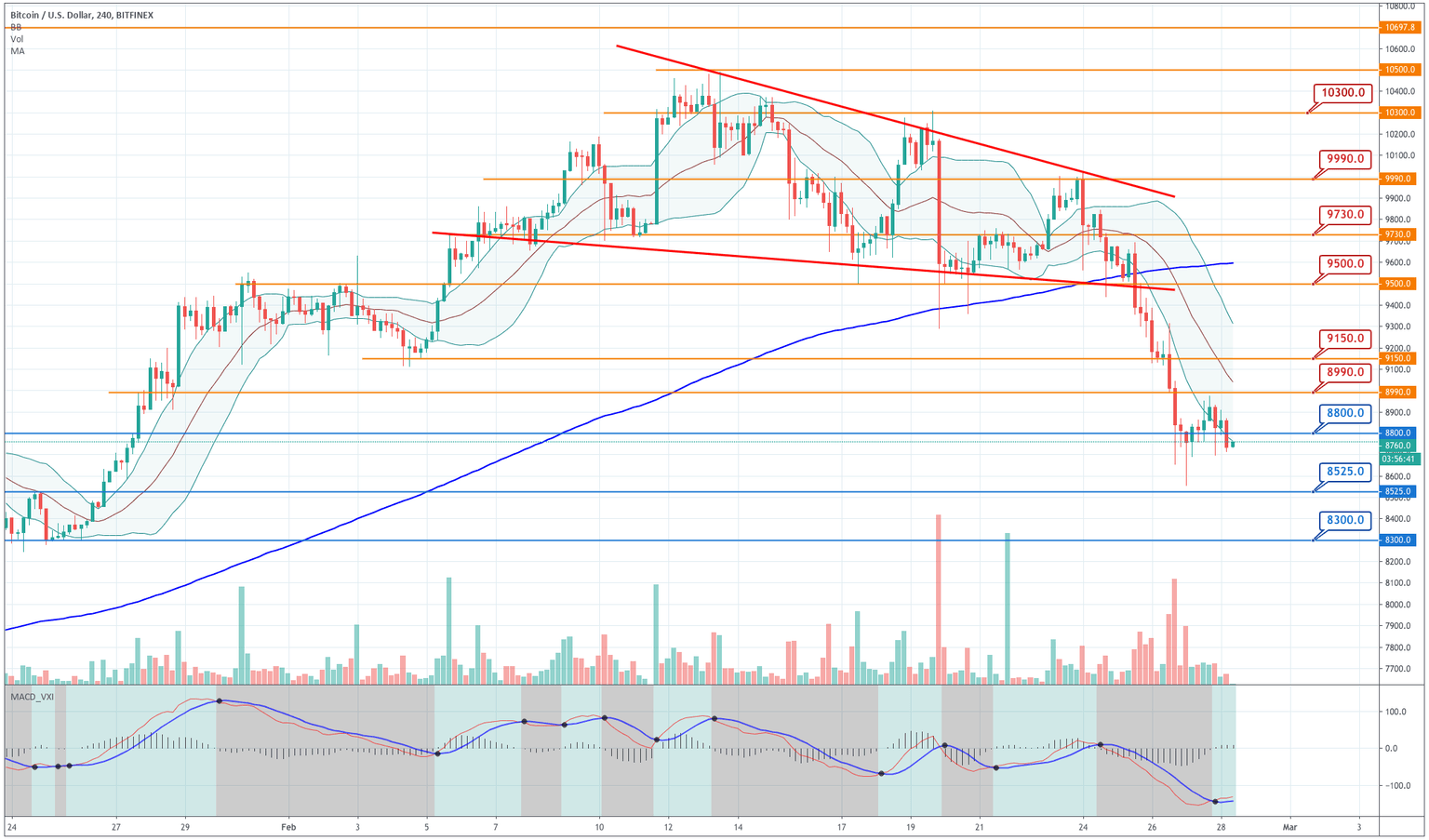

Technical Analysis - Bitcoin

Chart 1 - Bitcoin 4H Chart

Bitcoin began the day with an increase in its bearish movements. The price went below the $8,800 level and is menacing to continue below the $8,700 and visit the $8,300 lows made on Jan 24 and 25. The price moves following the -1SD line, a situation prone to more downward movements. The volume is thin; thus, the movement could be reversed easily. The MACD has made a bullish crossover; thus, hinting to the continuation of the sideways action.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

8,525 |

8,800 |

8,990 |

|

8,300 |

9,150 | |

|

8,100 |

9,500 |

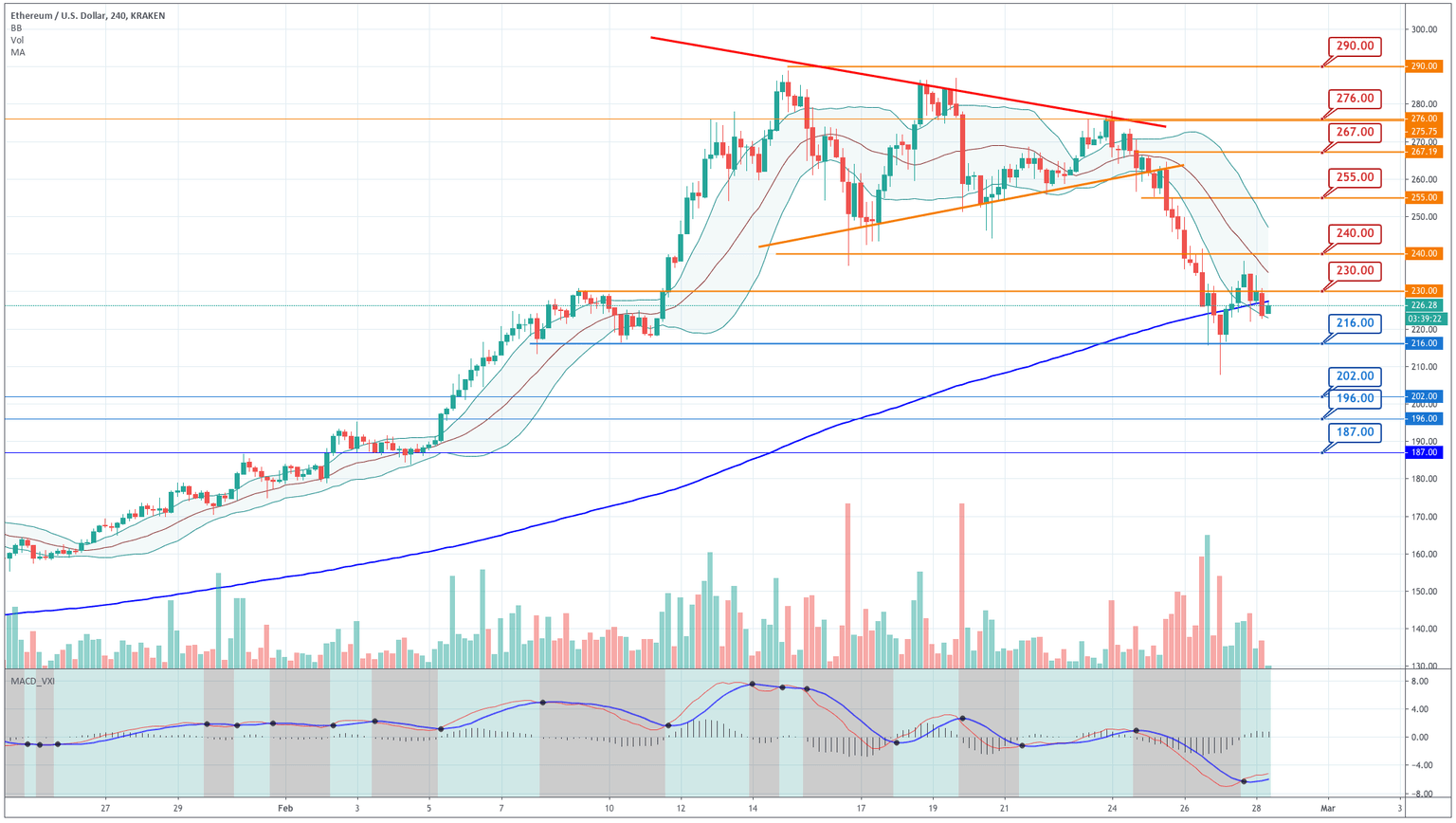

Ethereum

Chart 2 - Ethereum 4H Chart

Ethereum had a nice 3 percent bounce yesterday, but today it has faded most of it and show signs that hint for a rest of the $216 support. Currently, the price moves near the -1SD Bollinger line, although the MACD made a bullish crossover, as in the Bitcoin case. This may lead to a directionless move. From a trader's perspective, a break of the 216 level would increase its bearishness, and a movement above $240 would indicate that buyers are still present.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

216.00 |

223.00 |

230.00 |

|

202.00 |

240.00 | |

|

187.00 |

255.00 |

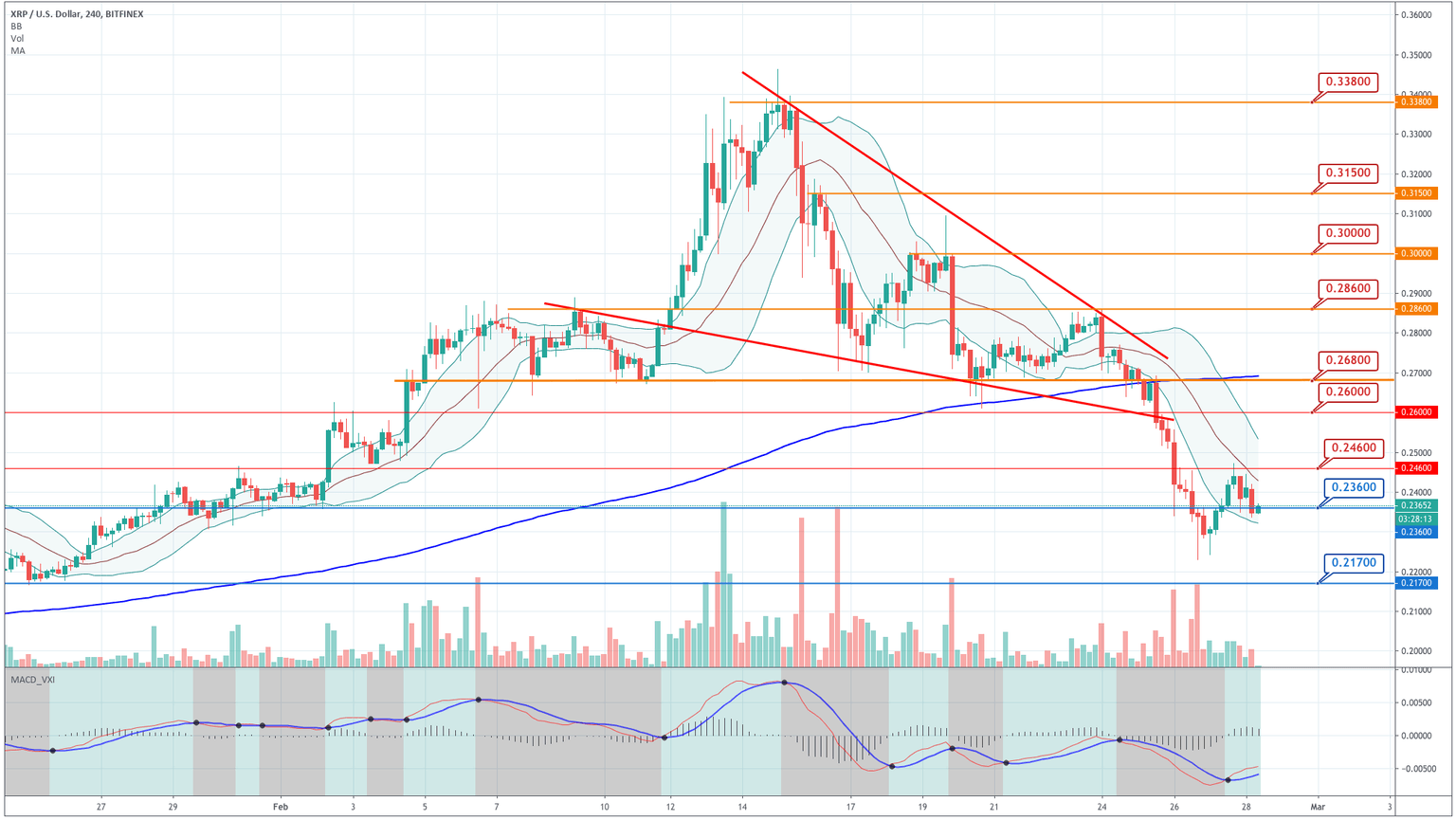

Ripple

Chart 3 - Ripple $H Chart

Ripple is following the overall movements of the sector. Thus, yesterday it experienced a good bounce to the level of 0.246, to drop almost half of it in the early morning. The price touched the mid-Bollinger band and bounced off from there. Now it is trying to hold at the 0.236 level, as the MACD starts a new bullish phase. As it happens with Bitcoin and Ethereum, we think today's action will be sideways, with a slightly downward bias.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2290 |

0.2360 |

0.2460 |

|

0.2170 |

0.2600 | |

|

0.2030 |

0.2720 |

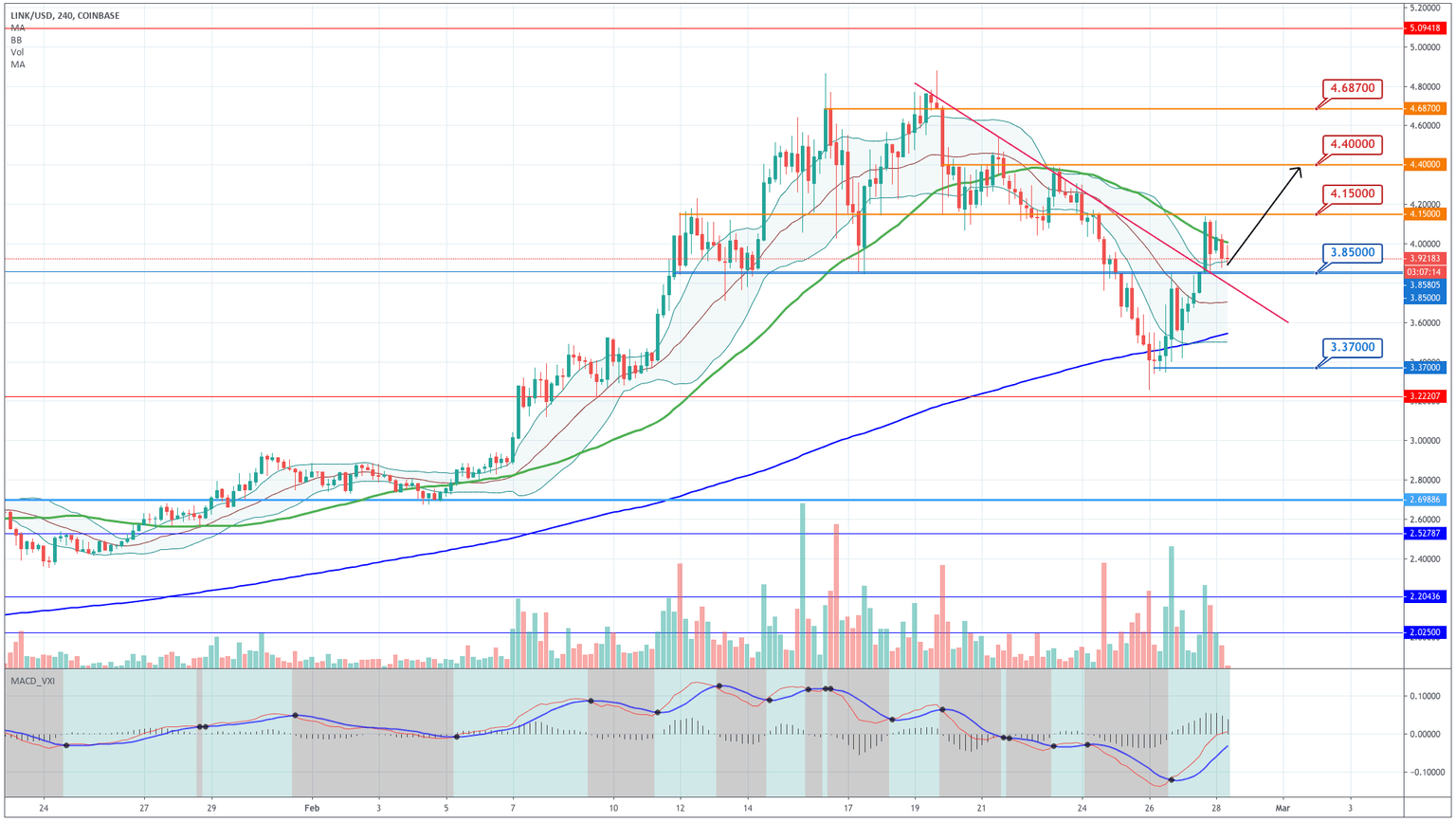

Chainlink

Chainlink 4h Chart

Chainlink, is emerging as one of the most promising tokens in the industry. Its Oracles product is key to connecting blockchains to the rest of the financial world.

The latest bullish trend drove Chainlink to new highs of $4,88. On the last market bearish correction Chainlink had a considerable drop, but it bounced sharply yesterday and is near the $4 mark. Currently the price is moving near the +1SD range and the MACD shows a bullish phase. Thus, we think Link could continue moving to the upside, as its main trend is bullish.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

3.53 |

3.85 |

4.15 |

|

3.37 |

4.40 | |

|

3.11 |

4.69 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and