Cryptocurrencies Price Prediction: VeChain, ChainLink & Axie Infinity — Asian Wrap 20 Aug

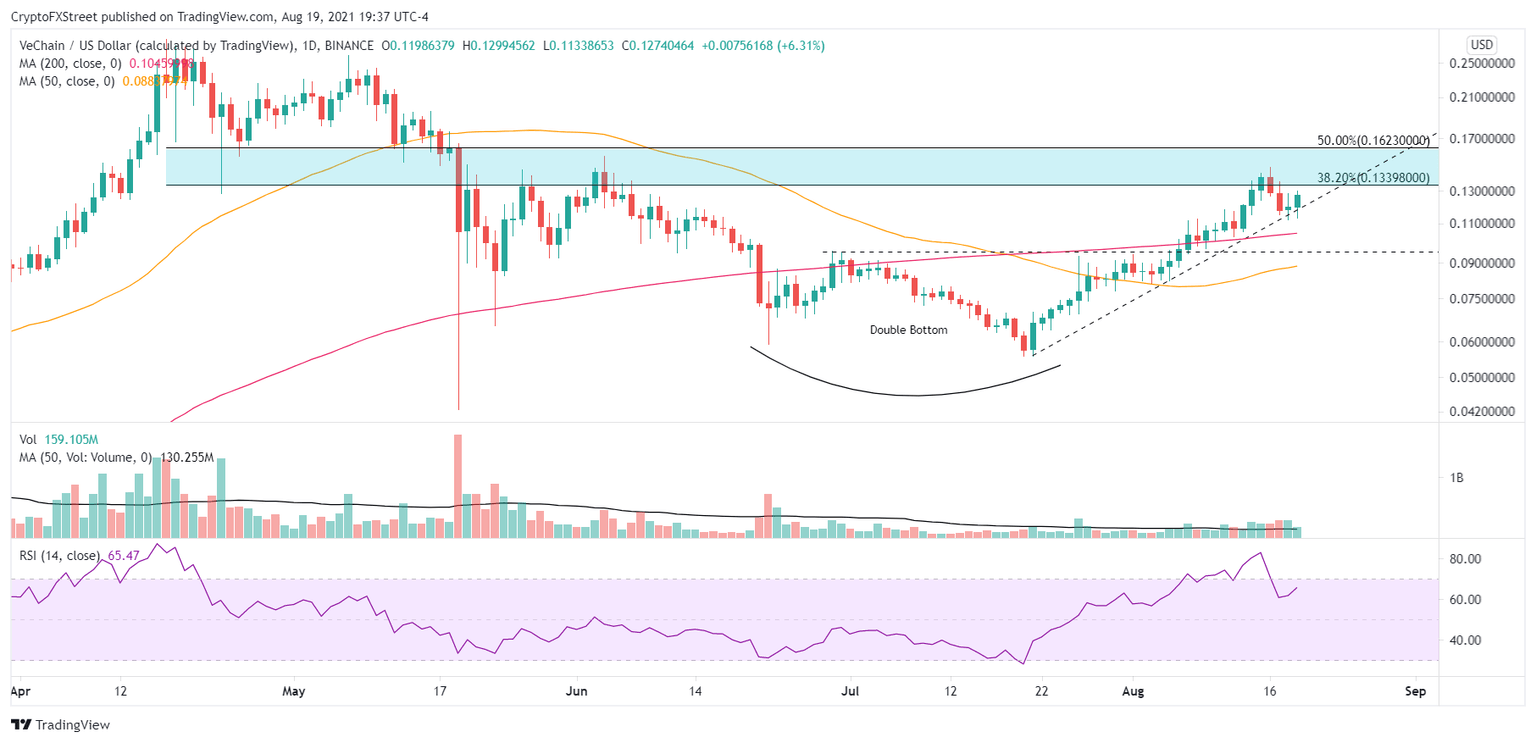

VeChain Price Prediction: VET strikes important resistance, may creep lower

VeChain price is now holding the July ascending trend line after finding stiff resistance at the 38.2% retracement level and the double bottom measured move target of $0.135. The VET pullback is set to continue, possibly testing the 200-day simple moving average (SMA) at $0.104 before engineering the next leg higher for the rally.

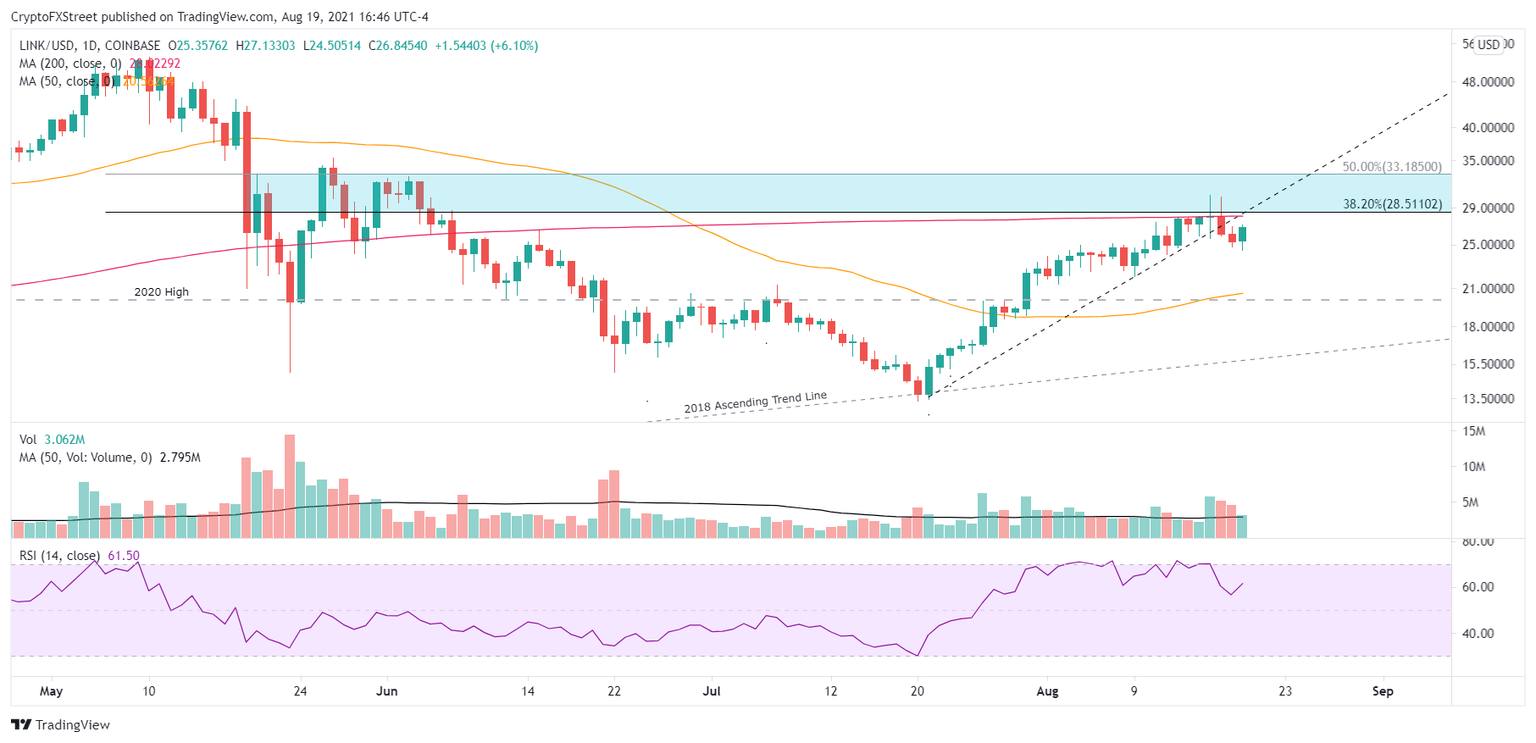

Chainlink Price Forecast: LINK confronts a new reality, easy money has been made

Chainlink price registered a 100% gain from July 21 to August 13, gaining traction on the widespread interest in DeFi tokens and making it the best 24-day gain since January. The impressive rally met heavy resistance at the 200-day SMA and has been trending at or below the moving average over the last six sessions, busting the July ascending trend line on August 17.

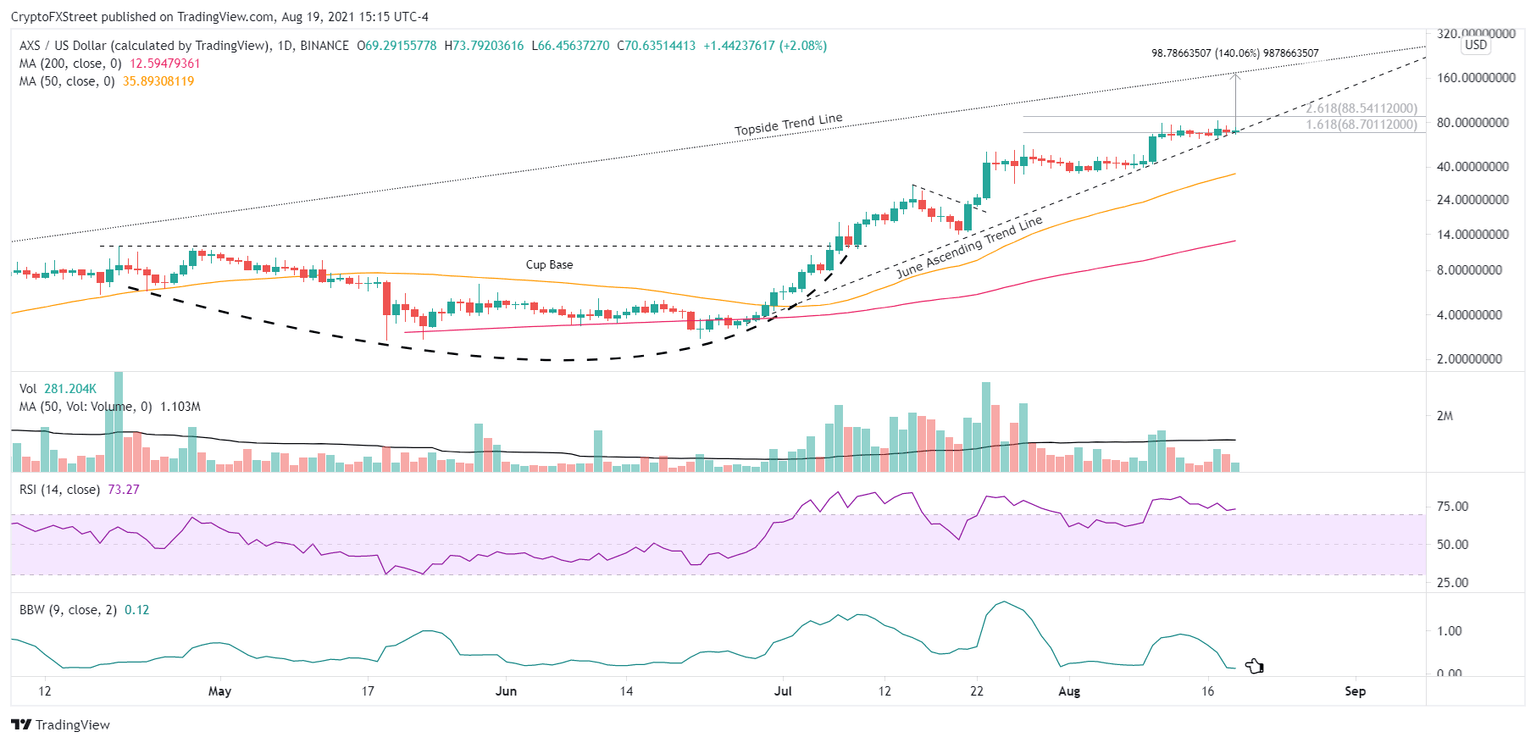

Axie Infinity price waits for no one, as AXS prepares for launch

Axie Infinity price has been transacting in a very tight range since the August 10 spike higher of 47.59%, squeezing the Bollinger Bands to the tightest reading since trading began in 2020. The price compression combined with the June ascending trend line and no hint of distribution suggests that AXS is on the cusp of another sharp move.

Author

FXStreet Team

FXStreet