Cryptocurrencies Price Prediction: Polkadot, Algorand & DogeCoin — Asian Wrap 01 Apr

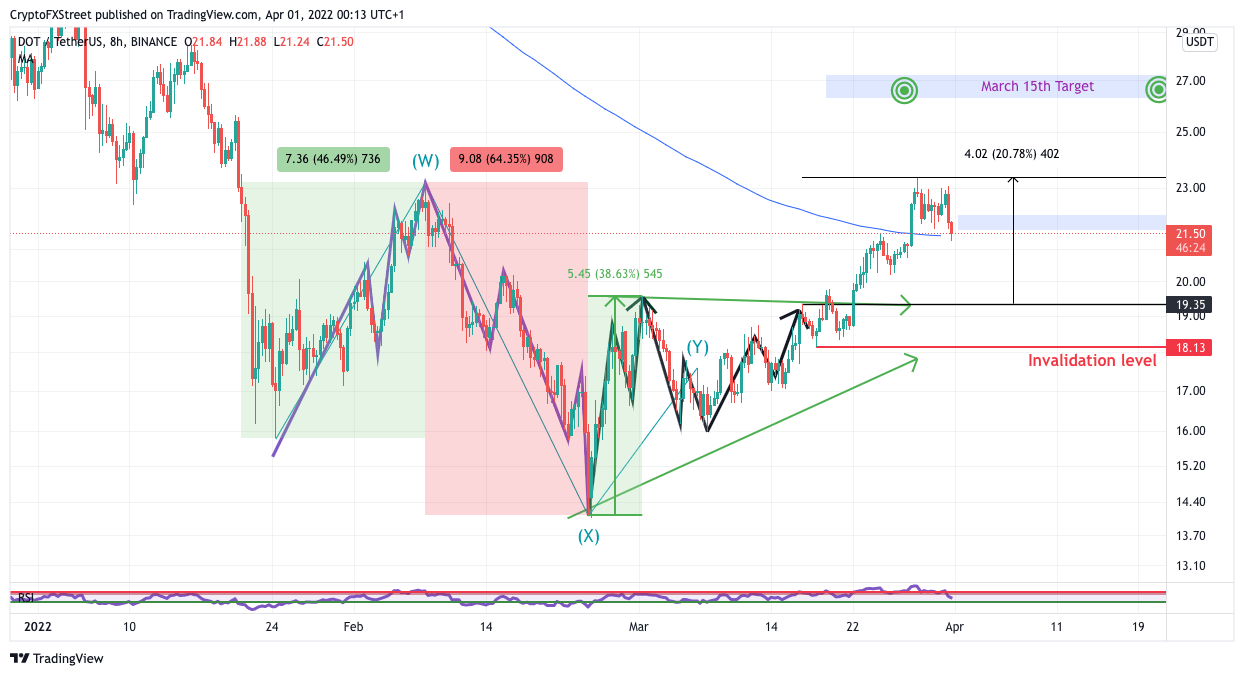

Polkadot price has a bullish target at $26, here’s what to expect next

Polkadot price has rallied 20% in the last two weeks, establishing a new swing high at $23.33. It was forecasted on March 15 that a triangle formation could project a 38% rally for the Polkadot price. Now that the DOT price has halfway validated the corrective WXY pattern, the bulls are experiencing downside pressure from the bears.

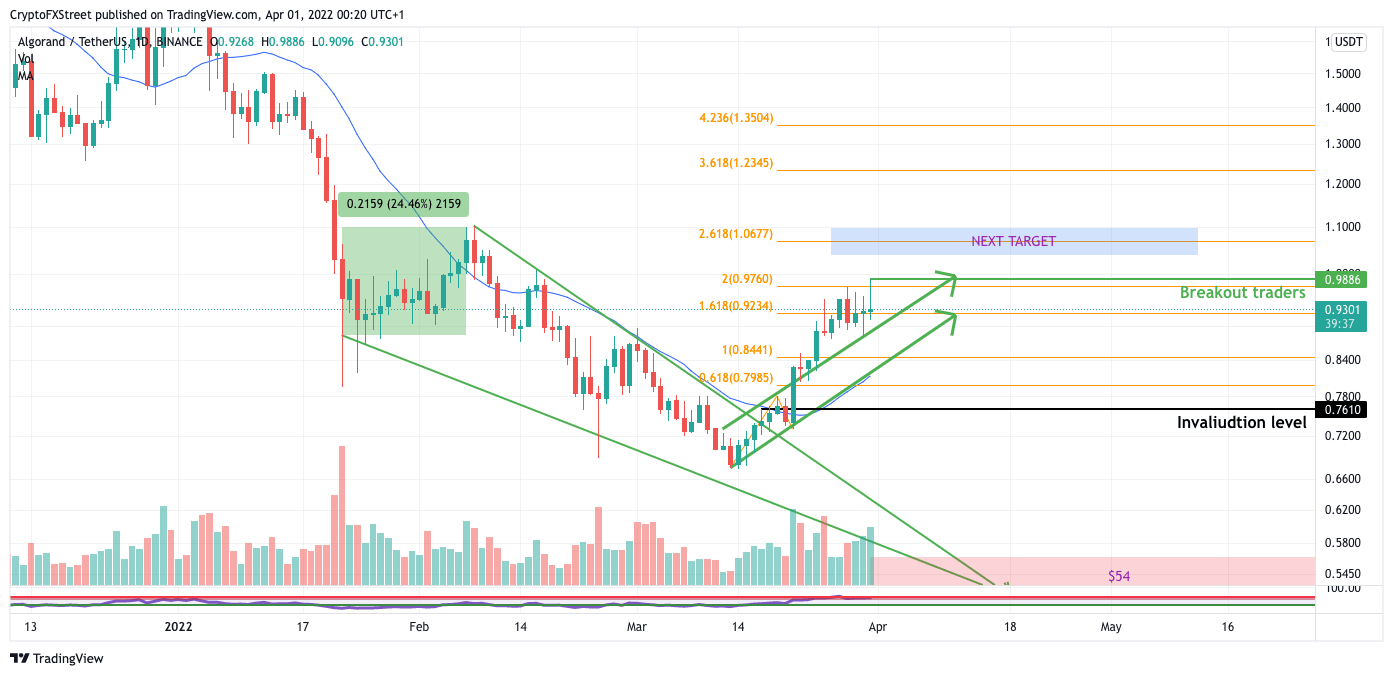

Algorand price could rally to $1.06 if the bulls maintain support

Algorand price has consolidated all week as the digital asset currently hovers at $0.92. It was mentioned in last week's thesis that the bulls would likely be trailing up stops as the first target for the March 16th trade setup was successfully reached at $0.87.

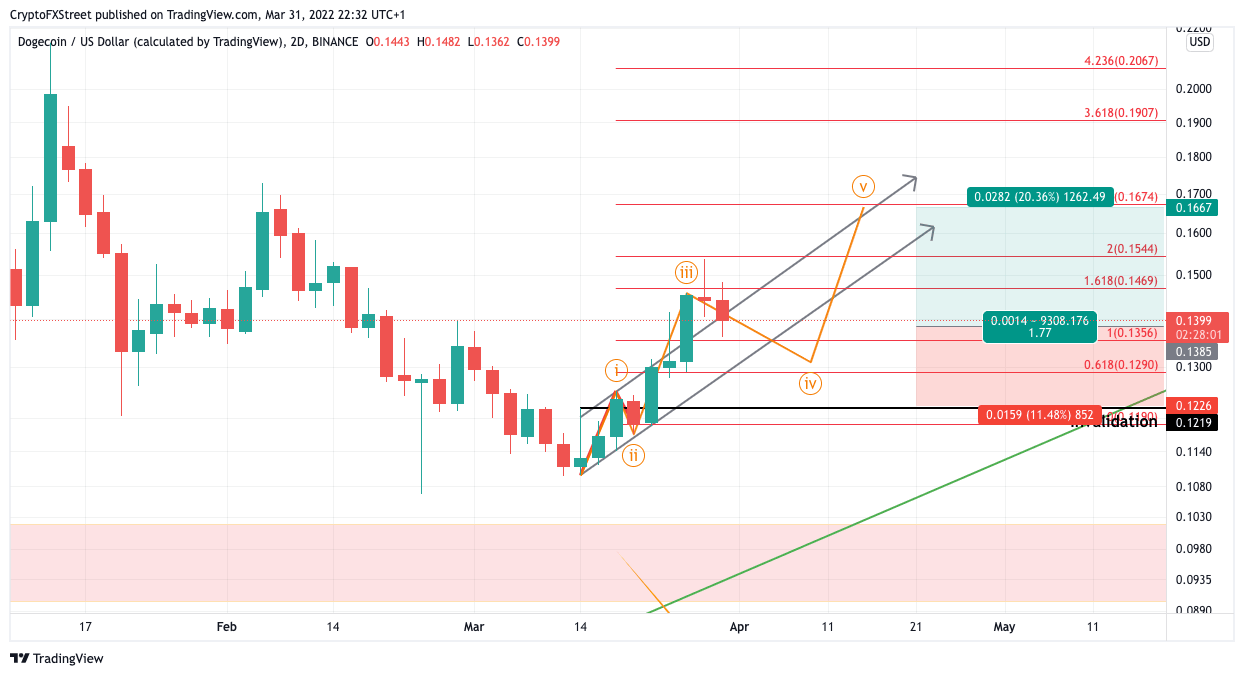

DogeCoin price has weak hands losing sight of a future 20% bull rally targeting $0.16

DogeCoin price fooled traders this week as price impulsively blew past pullback zones. DogeCoin price has rallied since last week's thesis, establishing a new swing high at $0.1544. When analyzing the rally on the 2-day Chart, the popular meme coin seems to have breached the parallel trend channel, which fits standard Wave 3 criteria.

Author

FXStreet Team

FXStreet