Cryptocurrencies Price Prediction: Ethereum, Bitcoin & Cronos – European Wrap 27 August

Crypto Today: Bitcoin eyes key support amid weak on-chain demand, as Ethereum, XRP trade choppy

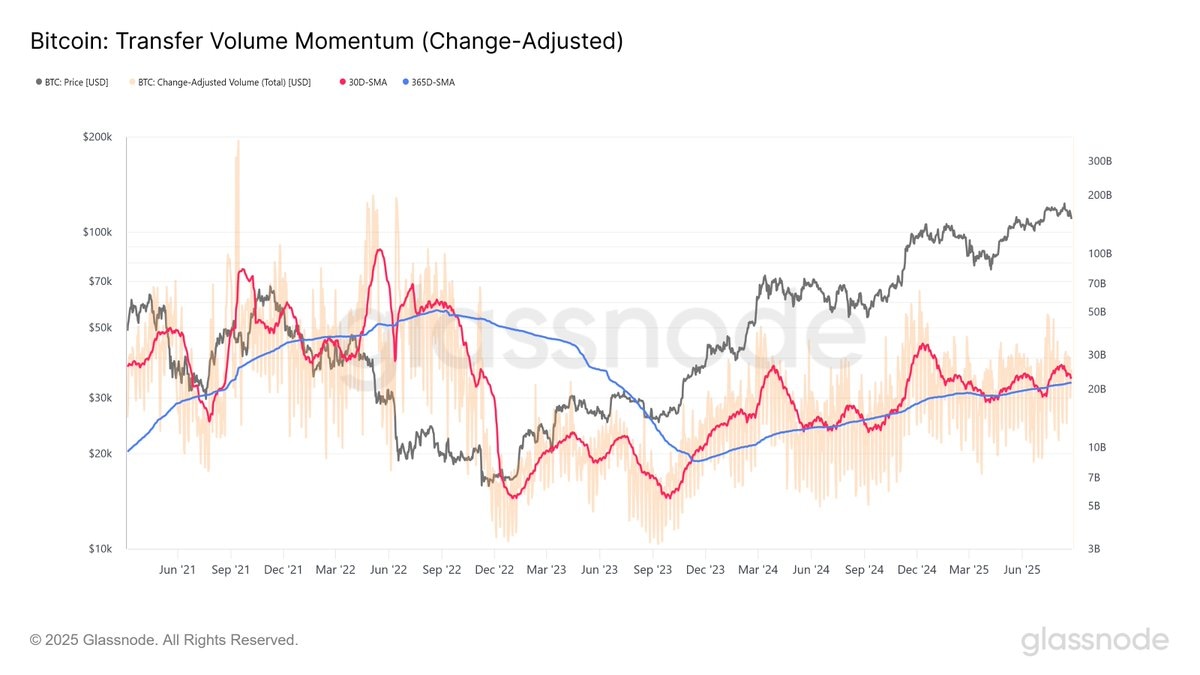

Bitcoin (BTC) extends price fluctuation trading above $110,000 on Wednesday, mirroring widespread uncertainty in the broader cryptocurrency market. Altcoins led by Ethereum (ETH) and Ripple (XRP) remain choppy at the time of writing.

Extended recovery remains uncertain due to prevailing market conditions, prompting caution among traders who have shifted their attention to the Federal Reserve (Fed) and its likely interest rate cuts in September, which would provide direction for risk assets like Bitcoin and cryptocurrencies.

Bitcoin Price Forecast: BTC stabilizes as Fed Cook vows lawsuit over termination by President Trump

Bitcoin (BTC) is holding steady midweek around $110,700 on Wednesday, after recovering slightly the previous day. Market participants digest the latest headlines surrounding the escalating feud between United States (US) President Donald Trump and the Federal Reserve (Fed). Meanwhile, mixed sentiment hovers over BTC as US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded $88 million in inflows on Tuesday, amid growing risks from high leverage.

Bitcoin correction paused after a sharp 12% pullback from its record high of $124,474 on August 14 to a low of $108,666 on Tuesday. At the time of writing on Wednesday, BTC stabilizes at around $110,700.

Crypto Gainers Today: Cronos, Numeraire and Hyperliquid rally as bullish news fuels momentum

Cronos (CRO), Numeraire (NMR), and Hyperliquid (HYPE) emerged as the top crypto gainers on Wednesday, rallying strongly on the back of bullish news and market momentum. Cronos price surges to a new yearly high following Trump Media's plans for a CRO treasury company. At the same time, Numeraire soared after securing a massive $500 million commitment from JPMorgan Asset Management. Meanwhile, Hyperliquid (HYPE) extended its upward run, breaking past its record high and entering price discovery mode.

Trump Media Group announced on Tuesday that it has agreed with Crypto.com to establish a CRO treasury company. The companies will jointly establish Trump Media Group CRO Strategy Inc., with an expected funding of $6.42 billion at launch. The initial investment will comprise $1 billion in CRO (approximately 6.3 billion CRO), $200 million in cash, $220 million in warrants, and an additional $5 billion line of credit from an affiliate of Yorkville.

Author

FXStreet Team

FXStreet