Cryptocurrencies Price Prediction: Coin, Aave & Bonk Inu – European Wrap 29 December

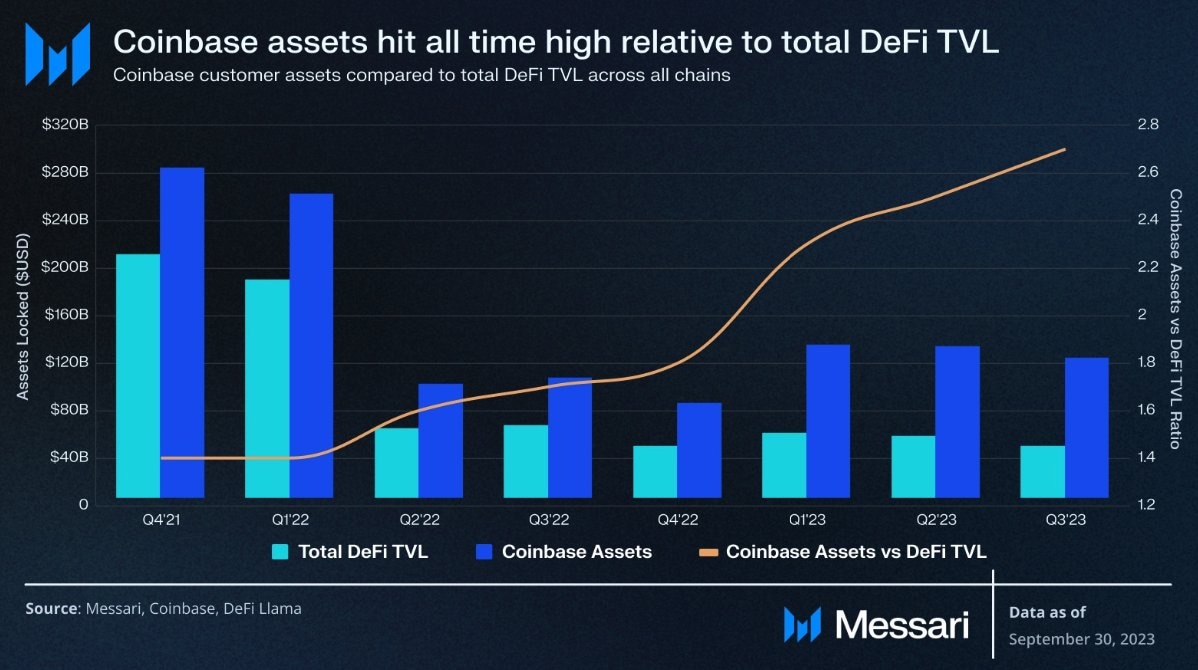

Coinbase outshines the entire DeFi market, holding 80% more assets in custody; COIN price hits new high

Coinbase is known for being the second biggest cryptocurrency exchange in the world, but the company also seems to be in competition with the entire Decentralized Finance (DeFi) market.

Coinbase, at the time of writing, holds about $114 billion worth of assets under its management, which is slightly lower than the total value locked in the DeFi market, coming up at about $117 billion. However, when comparing the quarterly performance, Coinbase leaps ahead.

Aave price edges closer to 40% rally due to Ethereum

Aave (AAVE) price shows no signs of slowing down as it approaches a key weekly hurdle. If AAVE holders push the altcoin to flip this barrier into a support floor, they could be in for massive gains.

With the full-blown start of the bull run, altcoins have generated massive returns for holders. Ethereum remained a slugger for quite some time but decided to rally a week ago as Bitcoin slipped into consolidation.

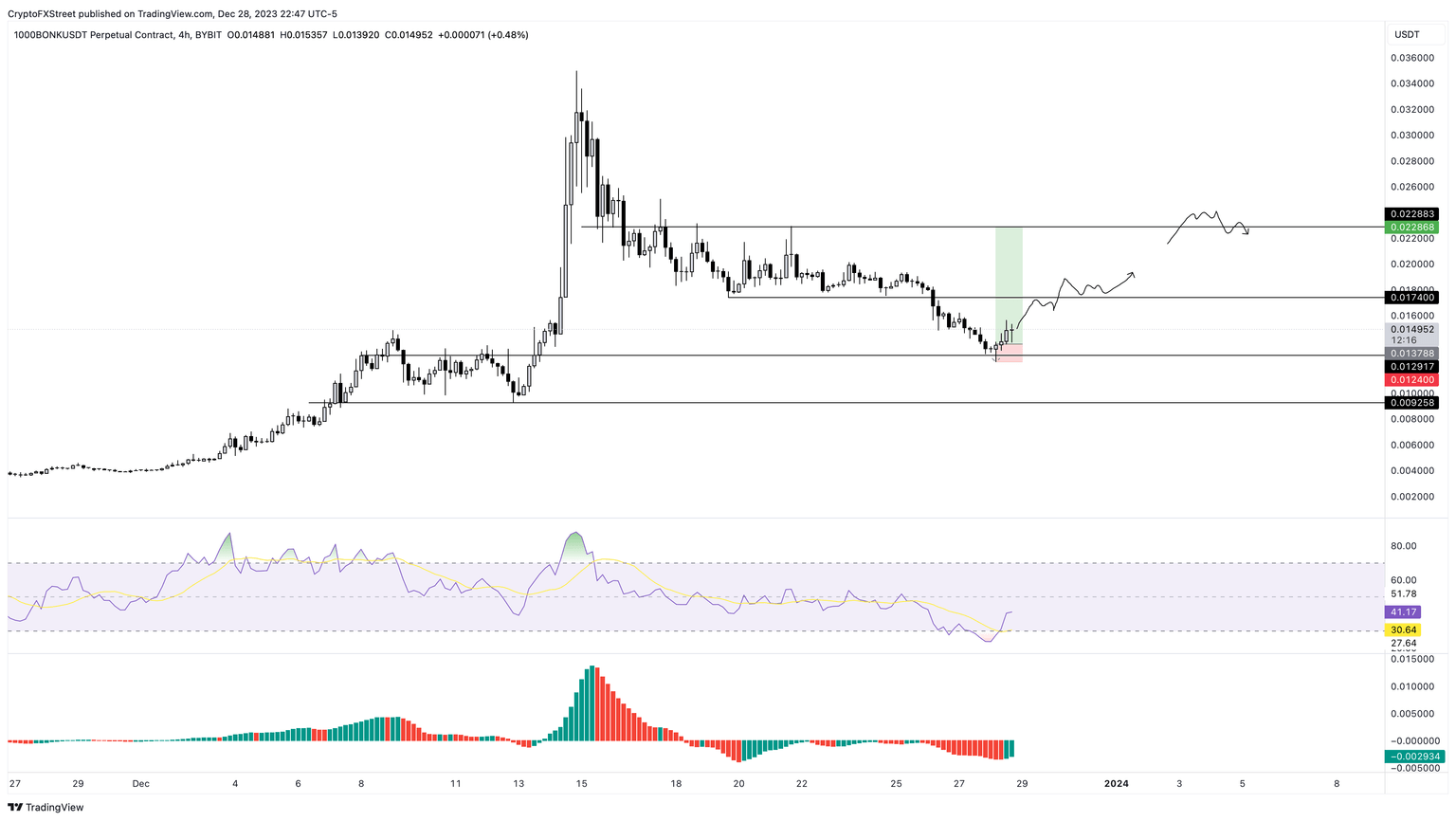

Why Bonk Inu price could rally 55% here

Bonk Inu (BONK) price has been moving down only since it was listed on major exchanges in mid-December. As a result of this sell-only mentality from investors, it has caused the dog-themed crypto BONK to be oversold. But things could change quickly for the meme coin as buy signals emerge.

Bonk Inu price shed 64% between December 14 and 28, which is resembles a bear market-type correction that typically takes a few years. Due to the volatile nature of meme coins, BONK is close to triggering a reversal.

Author

FXStreet Team

FXStreet