Cryptocurrencies Price Prediction: Bitcoin, Uniswap and Dogecoin – European Wrap 26 February

Grayscale on selling spree as Bitcoin correlation to equities market deepens

Grayscale gigantic Bitcoin trust is falling at a rate faster than the recent drop in the price of the leading cryptocurrency. Grayscale Bitcoin trust has plunged roughly 20% in less than a week compared to a 13% dip in BTC. On the other hand, the cryptocurrency correlation with the equity market is hitting new levels. With the equities market on a downward spiral, Bitcoin may continue with the dip to $38,000. Read more...

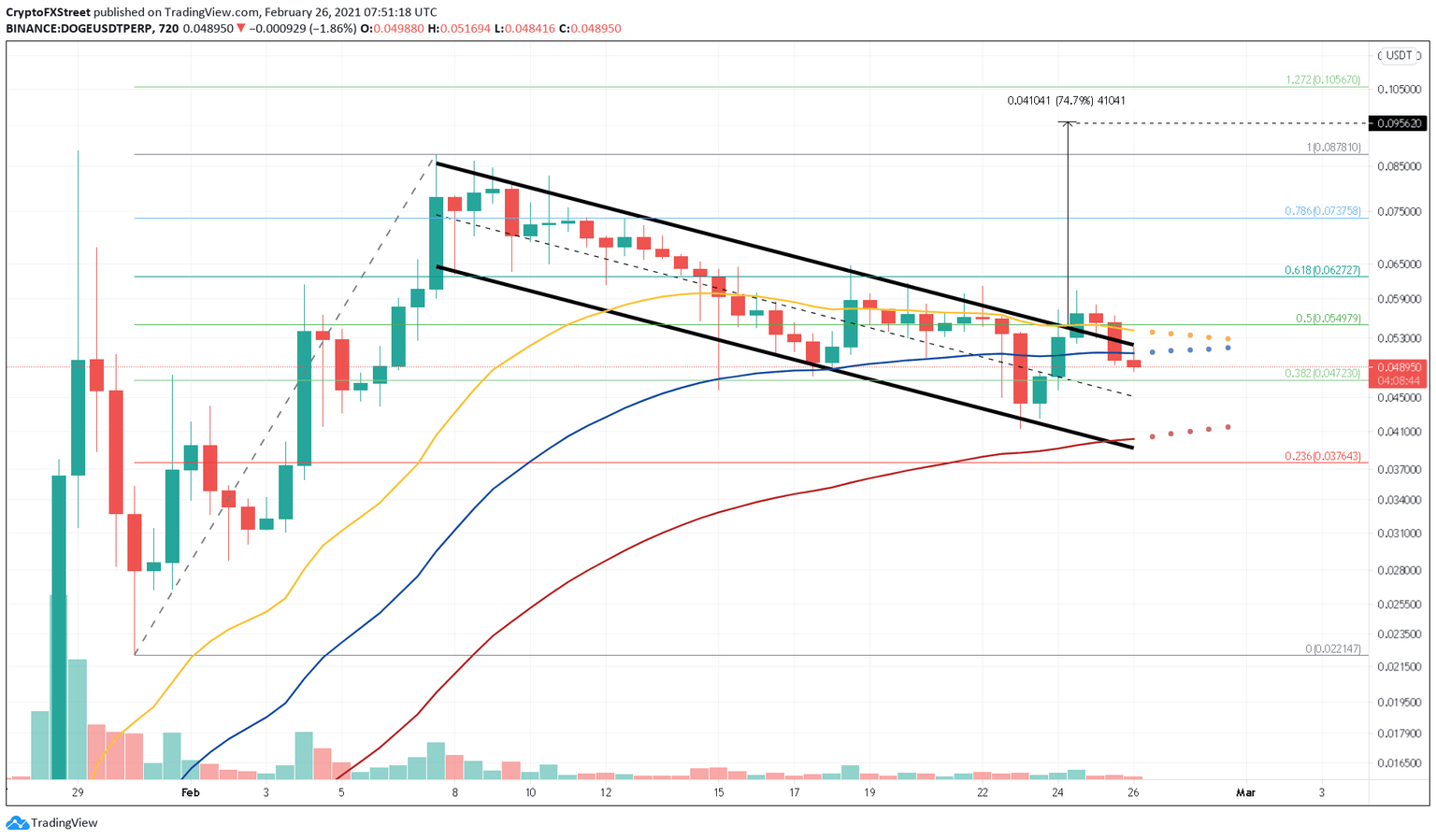

DOGE bullish failure could cause a 20%-to-40% correction

Dogecoin price shows a failure to hold above the bull flag’s breakout point at $0.055. This lack of buying pressure has caused a pullback into the consolidation zone. Now, DOGE faces a bearish outlook that could result in a steep correction. Read more...

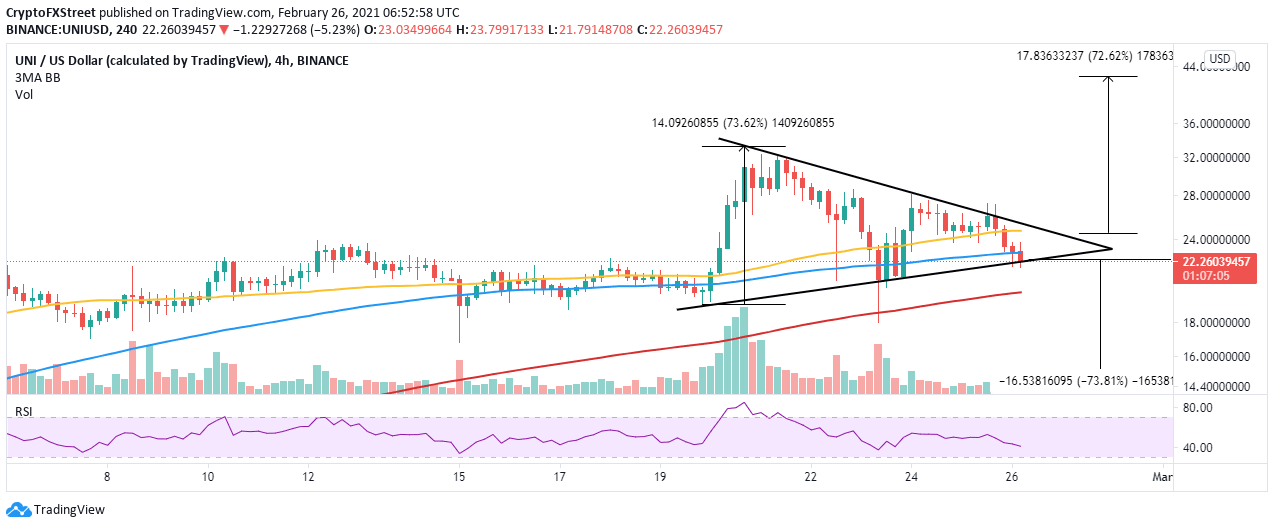

UNI whales major exodus ahead of 74% downswing

Uniswap has hit another barrier at $28, cutting short the recovery staged from $18. The mission to gain ground to the all-time high of around $34 has been abandoned, with losses extending toward $20. UNI is trading at $22 after losing a couple of key support zones, likely to flip into intense seller congestion areas. Read more...

Author

FXStreet Team

FXStreet

%2520-%25202021-02-26T135711.783-637499348795415454.png&w=1536&q=95)