Cryptocurrencies Price Prediction: Bitcoin, Hyperliquid & Bitcoin – European Wrap 1 May

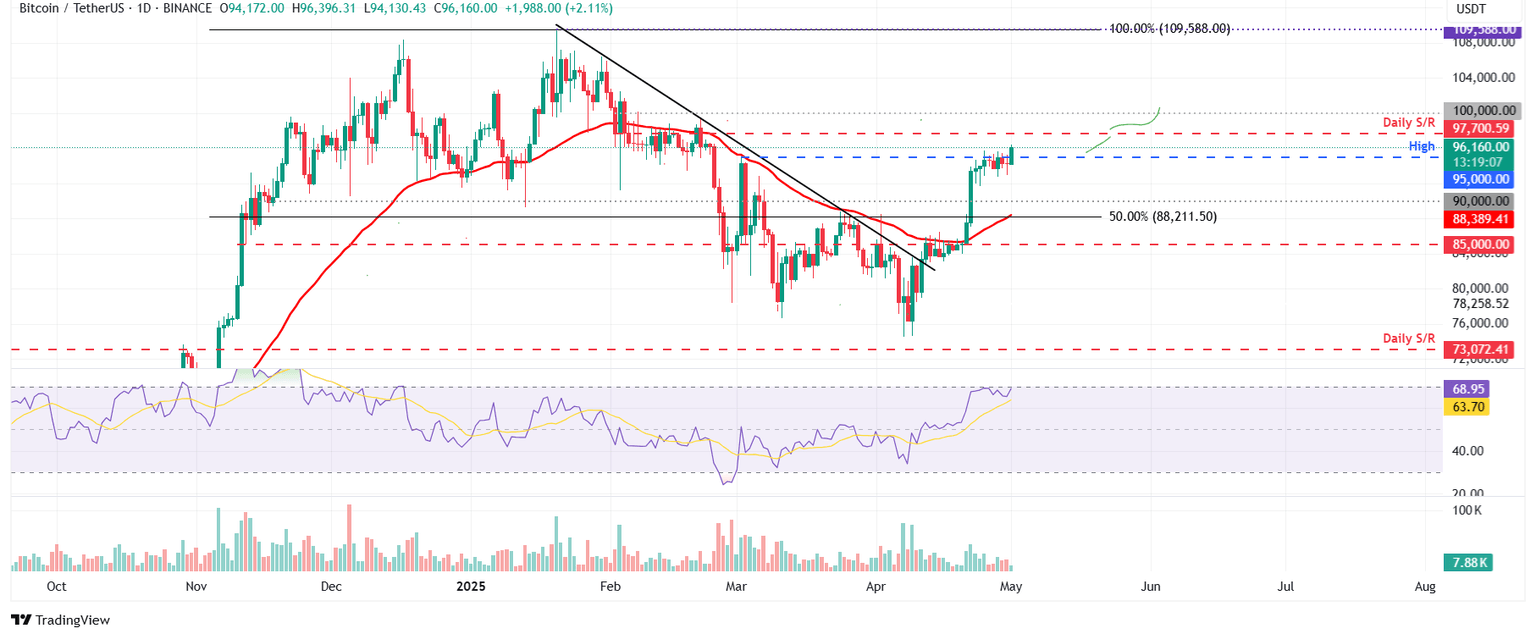

Bitcoin Price Forecast: BTC reaches $96,000 after slight pullback following US GDP contraction

Bitcoin (BTC) price is breaking above its key resistance level, trading above $96,000 at the time of writing on Thursday, following a mild pullback the previous day. The decline came as US GDP data showed a contraction of 0.3% in Q1, spurring recession fears, but BTC’s price fall proved to be short-lived.

Bitcoin price rebounds to reclaim the $96,000 level, recovering from a brief pullback on Tuesday. This mild correction in Bitcoin's price was primarily caused by the US GDP data released on Tuesday, which showed an unexpected contraction of 0.3% annualized pace, missing the expected 0.4% growth, indicating stronger chances of entering a stage of stagflation – when the economy is characterized by stagnant growth and high inflation.

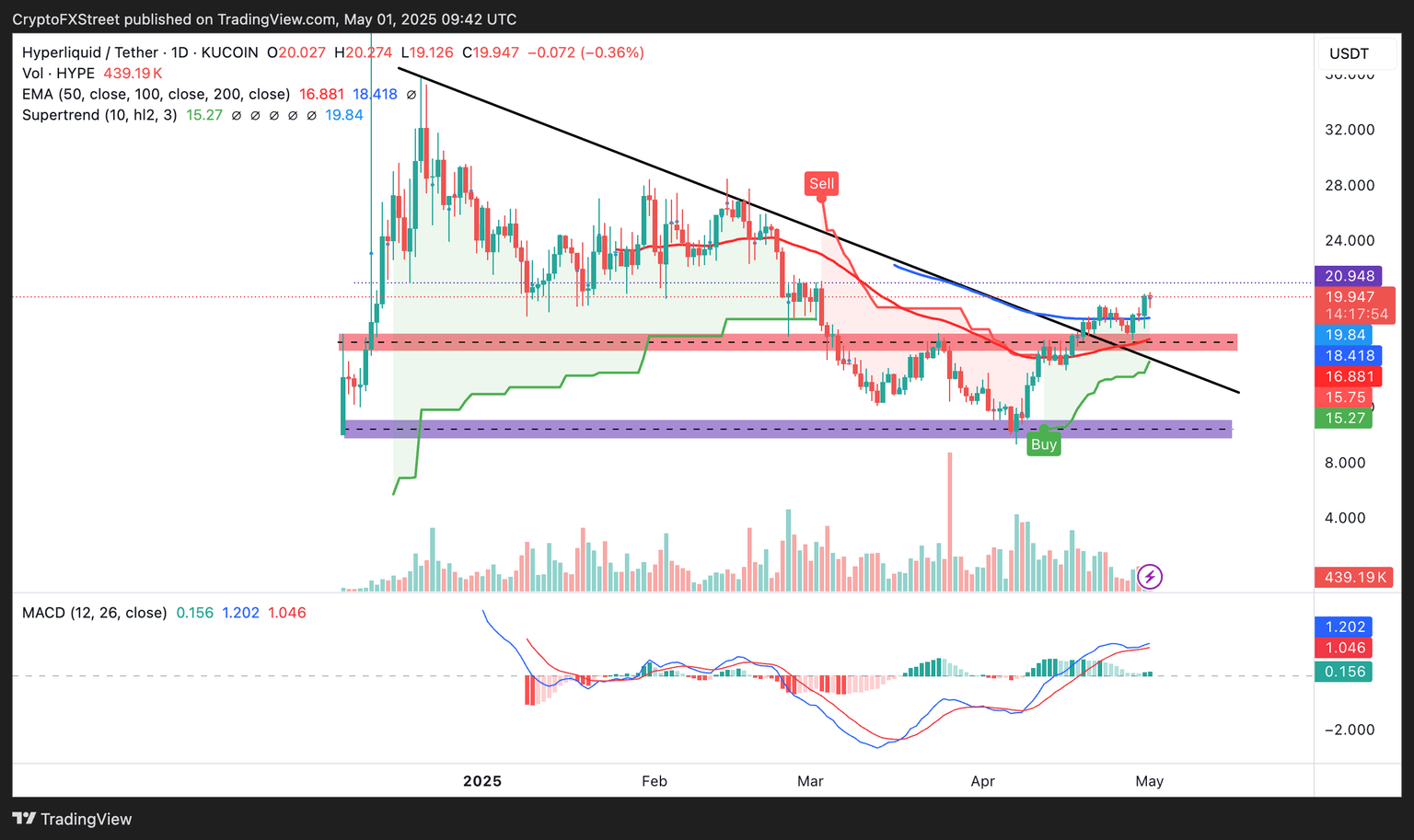

Hyperliquid price targets breakout above $20 resistance as open interest soars

Hyperliquid (HYPE) price remains stable, holding onto recently accrued gains, while trading at $19.85 at the time of writing on Thursday. The layer-1 blockchain token tested but failed to break through resistance at $20.00 on Wednesday, forcing bulls to step back and strategize their next attempt at accelerating the uptrend.

Hyperliquid's price holds above the 100-day Exponential Moving Average (EMA) at $18.41, as bulls focus on stabilizing the uptrend following a recent break above a descending trendline, as illustrated on the daily chart below. The 50-day EMA at $16.88 is trending upward and aligns with a strong support zone (marked in red), which bolsters HYPE's bullish outlook.

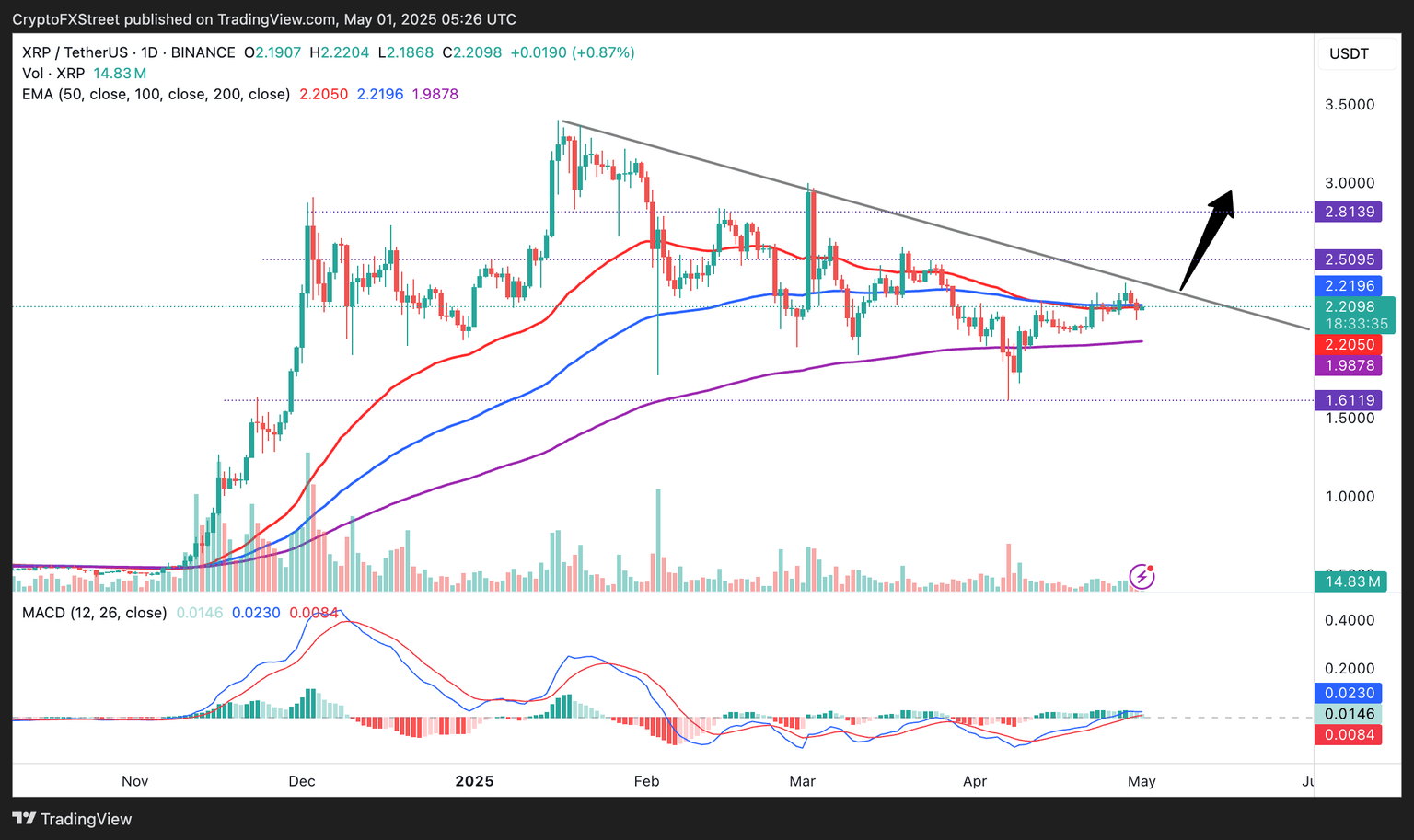

XRP price builds bullish momentum above $2.20

Ripple’s (XRP) price is consolidating at $2.21 at the time of writing on Thursday, reflecting sideways trading in the wider cryptocurrency market. Support anticipate above $2.20, coinciding with the 50- and 100-day Exponential Moving Averages (EMA), could accelerate the uptrend towards $3.00. Meanwhile, Ripple’s $5 billion bid to acquire Circle, the company that issues USDC stablecoin, has caught the industry’s attention. However, Ripple may have been too ambitious, as Circle would rather focus on going public.

Ripple recently made public its bid to acquire Circle, one of the cryptocurrency market’s reputable issuers of stablecoins, for an estimated $4 - 5 billion. Circle is the issuer of USDC, the second-largest stablecoin, with a market capitalization of $61.5 billion.

Author

FXStreet Team

FXStreet